Exhibit 99.2

MIND MEDICINE (MINDMED) INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE QUARTER ENDED SEPTEMBER 30, 2021

Dated: November 11, 2021

http://mindmed.co

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

ABOUT THIS MANAGEMENT’S DISCUSSION AND ANALYSIS

All references in this management’s discussion and analysis, or MD&A, to the “Company”, “MindMed”, “we”, “us”, or “our” refer to Mind Medicine (MindMed) Inc., unless otherwise indicated or the context requires otherwise. The following MD&A is prepared as of November 11, 2021 for MindMed for the three and nine months ended September 30, 2021 and should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2020 (the “Financial Statements”), which have been prepared by management in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

Our IFRS accounting policies are referred to in note 3 of the Financial Statements. All amounts are in United States dollars, unless otherwise indicated. References to “CAD$” are to Canadian dollars.

Mind Medicine (MindMed) Inc. (formerly Broadway Gold Mining Ltd. (“Broadway”)) was incorporated under the laws of the Province of British Columbia. Its wholly owned subsidiary, Mind Medicine, Inc. (“MindMed US”) was incorporated in Delaware. Prior to February 27, 2020, the Company’s operations were conducted through MindMed US.

On February 27, 2020, MindMed completed a reverse takeover transaction with Broadway by way of a plan of arrangement (the “Arrangement”) under the Business Corporations Act (British Columbia) pursuant to the arrangement agreement dated as of October 15, 2019 between Broadway, Madison Metals Inc., Broadway Delaware Subco Inc. and MindMed US (the “Arrangement Agreement”) which resulted in the Company becoming the parent company of MindMed US. MindMed US is deemed to be the acquirer in the reverse takeover transaction. As a result, the consolidated statements of financial position are presented as a continuance of MindMed US and the comparative figures presented are those of MindMed US.

Additional information relating to the Company, including the Company’s most recent Annual Information Form, can be found under the Company’s SEDAR profile at www.sedar.com.

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

This MD&A contains forward-looking statements within the meaning of applicable securities laws. All statements contained herein that are not clearly historical in nature are forward-looking, and the words “anticipate”, “believe”, “expect”, “estimate”, “may”, “will”, “could”, “leading”, “intend”, “contemplate”, “shall” and similar expressions are generally intended to identify forward-looking statements. Forward-looking statements in this MD&A include, but are not limited to, statements with respect to: the duration and effects of COVID-19 and any other pandemics on the Company’s workforce, business, operations and financial condition; expectations of future loss and accumulated deficit levels; projected financial position and estimated cash burn rate; requirements for, and the ability to obtain, future funding on favorable terms or at all; projections for development plans and progress of each of MindMed’s product candidates, particularly with respect to the timely and successful completion of studies and trials and availability of results from such studies and trials; expectations about MindMed’s product candidates’ safety and efficacy; expectations regarding MindMed’s ability to arrange for and scale up the manufacturing of MindMed’s product candidates; expectations regarding the progress, and the successful and timely completion, of the various stages of the regulatory approval process; expectations about the timing of achieving milestones and the cost of MindMed’s development programs; plans to market, sell and distribute product candidates; expectations regarding the acceptance of the Company’s product candidates by the market; MindMed’s ability to retain and access appropriate staff, management and expert advisers; expectations about whether various clinical and regulatory milestones will be achieved; the Company’s ability to strictly comply with federal, state, local and regulatory agencies in the United States and other jurisdictions in which the Company operates, including Australia, Switzerland and the Netherlands; the Company’s expectation that jurisdictions in which the Company operates, including Australia, Switzerland and the Netherlands, have similar regulatory frameworks as the United States; the Company’s expectations of the costs and timing to reach commercial production of drug products; the Company’s ability to secure strategic partnerships with academic research institutions and larger pharmaceutical and biotechnology companies; the Company’s continuation of strategic collaborations; MindMed’s strategy to acquire and develop new product candidates and to enhance the safety and efficacy of existing product candidates; expectations with respect to existing and future corporate alliances and licensing transactions with third parties, and the receipt and timing of any payments to be made by the Company or to the Company in respect of such arrangements; the Company’s strategy with respect to the expansion and protection of its intellectual property.

| 1 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

All forward-looking statements reflect our beliefs and assumptions based on information available at the time the assumption was made. These forward-looking statements are not based on historical facts but rather on management’s expectations regarding future activities, results of operations, performance, future capital and other expenditures (including the amount, nature and sources of funding thereof), competitive advantages, business prospects and opportunities. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, known and unknown, that contribute to the possibility that the predictions, forecasts, projections or other forward-looking statements will not occur. In evaluating forward-looking statements, readers should specifically consider various factors, including the risks outlined under the heading “Risk Factors” in this MD&A. Some of these risks and assumptions include, among others substantial fluctuation of losses from quarter to quarter and year to year due to numerous external risk factors, and anticipation that the Company will continue to incur significant losses in the future; uncertainty as to the Company’s ability to raise additional funding to support operations; the Company’s ability to generate product revenue to maintain its operations without additional funding; fluctuation of foreign exchange rates; the duration of COVID-19 and the extent of its economic and social impact; psychedelic inspired medicines may never be approved by regulator and the risks associated with violating any laws and regulations; the risks associated with the development of the Company’s product candidates which are at early stages of development; the difficulty of researching and developing drugs that target the central nervous system; consequences of the Company’s failure to comply with health and data protection laws and regulations; difficulty in establishing the Company’s reputation and its brand recognition; compliance with environmental, health and safety laws and regulations; unfavourable publicity or consumer perception; unfavourable future clinical research results; heightened scrutiny by the United States and Canadian authorities; inaccurate information posted on social media platforms; the Company’s reliance on the success of its product candidates; reliance on third parties to plan, conduct and monitor MindMed’s preclinical studies and clinical trials; unforeseen disruption in the process of drug development activities; reliance on third party contract manufacturers to deliver quality clinical and preclinical materials; requirements regarding commercial scale and quality manufactured products; the Company’s product candidates may fail to demonstrate safety and efficacy to the satisfaction of regulatory authorities or may not otherwise produce positive results; delays in clinical testing; risks related to filing INDs to commence clinical trials and to continue clinical trials if approved; the risks of delays and inability to complete clinical trials due to difficulties enrolling patients; the Company’s inability to obtain regulatory approval; risks associated with not achieving the Company’s milestones; competition from other biotechnology and pharmaceutical companies; the Company’s reliance on the capabilities and experience of MindMed’s key executives and scientists and the resulting loss of any of these individuals; misconduct or improper activities of the Company’s employees, contractors, consultants and agents; the Company’s ability to fully realize the benefits of its acquisitions; the inability to meet revenue targets of the Company’s investments; negative results from clinical trials; the novelty of psychedelics and the potential resulting lack of information; product liability claims; the Company’s ability to maintain product liability insurance; risks related to the Company’s information technology systems; the outbreak of infectious disease; difficulty of enforcing judgements; the Company’s limited operating history; the Company’s ability to adequately protect its intellectual property and trade secrets; the Company’s ability to source and maintain licenses from third-party owners; changes in patent law; the risk of patent-related litigation; risks related to sharing trade secrets; volatility of biopharmaceutical companies’ securities; the Company’s lack of dividends; risks related to various tax matters; the uncertainty of positive returns on the Company’s securities; risks related to the sales or conversion of the Company’s Subordinate Voting Shares; failure of the Company to maintain its internal controls; liquidity of the Company’s securities; risks related to the public markets; risks related to additional issuances and dilution of the Company’s securities; risks related to the Company’s Foreign Private Issuer status; risks related to the Company’s limited number of shareholders; risks related to the Company’s capital structure; potential declines in trading prices; risks related to published research and reports; the costs associated with maintain public listings; and other factors beyond the Company’s control, all as further and more fully described under the heading “Risk Factors” in this MD&A.

Although the forward-looking statements contained in this MD&A are based upon what our management believes to be reasonable assumptions, we cannot assure readers that actual results will be consistent with these forward-looking statements. Any forward-looking statements represent our estimates only as of the date of this MD&A and should not be relied upon as representing our estimates as of any subsequent date. We undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events, except as may be required by securities legislation.

| 2 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

THE ARRANGEMENT

Name Change, Consolidation and Change in Share Classes

Immediately prior to the closing of the reverse takeover transaction and in connection with the Arrangement, Broadway: (a) consolidated its common shares on an eight-for-one basis (the “Consolidation”), (b) changed its name to “Mind Medicine (MindMed) Inc.” (the “Name Change”), (c) reclassified its post-Consolidation common shares as subordinate voting shares (the “Subordinate Voting Shares”) and (d) created a new class of multiple voting shares (the “Multiple Voting Shares”) ((c) and (d) together, the “Share Capital Amendment”). Broadway’s registered shareholders received replacement share certificates evidencing the Consolidation, Name Change and Share Capital Amendment.

Merger of the Company and MindMed US

Further to the terms of the Arrangement, MindMed US merged with Broadway Delaware Subco Inc., a subsidiary of Broadway, under the corporate laws of Delaware. All outstanding Class B common shares of MindMed US (“Class B Shares”), Class C common shares of MindMed US (“Class C Shares”), and Class D common shares of MindMed US (“Class D Shares”) were exchanged for Class A common shares of MindMed US (“Class A Shares”), immediately following which all Class A Shares were exchanged, on a one-for-one basis (the “Exchange Ratio”), for Subordinate Voting Shares or Multiple Voting Shares (in the case of Multiple Voting Shares the exchange was on a one-for-one-hundred basis) of the Company (“Resulting Issuer Shares”) on a post-Consolidation basis. Such Class A Shares were then cancelled pursuant to the Arrangement, and MindMed US issued 1,000 shares of common stock to the Company as consideration for issuing the Resulting Issuer Shares to the (former) Broadway shareholders. Additionally, all convertible securities of Broadway were exchanged for convertible securities of the “Resulting Issuer” (i.e., the Company) on the basis of the Exchange Ratio.

Concurrent financings

Immediately prior to the completion of the Arrangement, MindMed US also completed its brokered and non-brokered private placement financings, in multiple tranches, of Class D Shares at a price of CAD$0.33 per share (the “MindMed US Offering”). See “Description of Share Capital” section for more details of the financing.

STOCK EXCHANGE LISTINGS

Neo Exchange listing

The Subordinate Voting Shares of the Company were listed for trading on the Neo Exchange Inc. (“NEO Exchange”) on March 3, 2020 (“MMED”). The financing warrants issued as part of a bought deal financing which closed on May 26, 2020 also trade on the NEO Exchange (“MMED.WT”), those issued as part of a bought deal financing which closed on October 30, 2020 also trade on the NEO Exchange (“MMED.WS”), those issued as part of a bought deal financing which closed on December 11, 2020 also trade on the NEO Exchange (“MMED.WA”) and those issued as part of a bought deal financing which closed on January 7, 2021 also trade on the NEO Exchange (“MMED.WR”)

NASDAQ listing

The Subordinate Voting Shares of the Company were listed for trading on The Nasdaq Capital Market (“NASDAQ”) on April 27, 2021 (“MNMD”).

BUSINESS

The Company is a clinical stage neuro-pharmaceutical drug development company developing product candidates based on psychedelic substances through rigorous science and clinical trials. The Company’s mission is to discover, develop and deploy psychedelic inspired medicines and therapies intended to treat diseases in the areas of psychiatry, neurology, addiction, pain and, potentially, others such as anxiety disorders, substance use disorders and withdrawal and Adult Attention Deficit Disorder. The Company defines its therapies program to include medicines which have the therapeutic benefits of psychedelics without the hallucinogenic effects. The Company defines its programs to include other substances with hallucinogenic properties, which may be administered in combination with therapy that may be performed in-clinic under the supervision of medical professionals or in a similar therapeutic setting. Through The Company’s drug development platform, the Company seeks to demonstrate the safety and efficacy of psychedelic-based medicines for a continuum of medical conditions, disorders and unmet medical needs. The Company has operations in Switzerland, Australia, the United States and Canada.

| 3 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

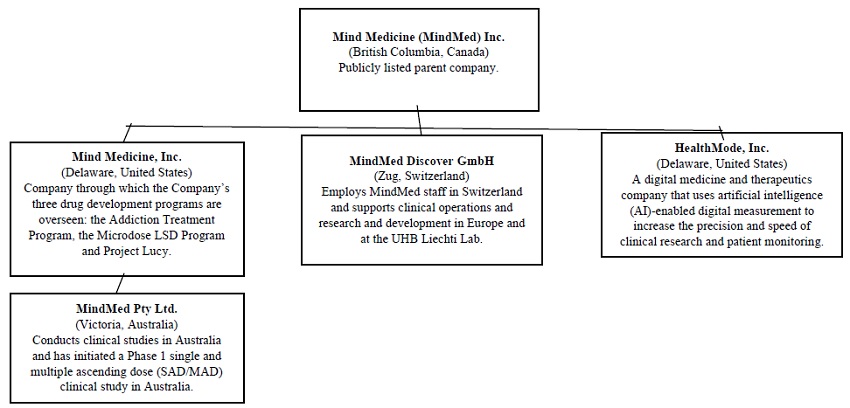

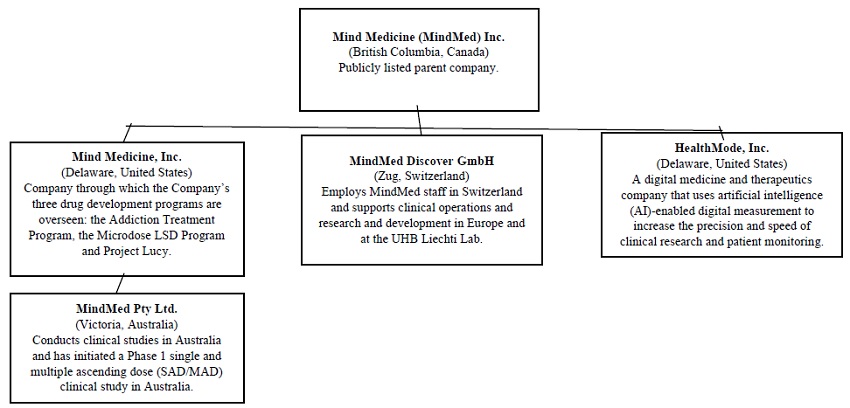

The following diagram presents the inter-corporate relationships among the Company and its subsidiaries as of the date hereof.

MindMed US is the Company’s main operating subsidiary, through which its drug development programs are overseen: Project Layla (18-MC for indications related to substance use disorders, as described below); Project Flow (LSD for Adult Attention Deficit/Hyperactivity Disorder (“ADHD”), as described below); Project Lucy (LSD for anxiety disorders, as described below); Project Angie (LSD for pain, as described below); and R(-)-MDMA to treat social anxiety and functioning in populations including Autism Spectrum Disorder. The Company’s collaboration with the University Hospital Basel’s Liechti Lab (the “UHB Liechti Lab”) and the Company’s other research and development efforts related to psychedelics are additionally supported through the Company’s Swiss subsidiary, MindMed Discover GmbH. Additionally, MindMed Pty Ltd. is conducting a Phase 1 study in normal healthy volunteers to determine the safety, tolerability and pharmacokinetics of single ascending doses (SAD) and multiple ascending doses (MAD) of 18-MC for as part of Project Layla and its program to develop novel therapies for substance use disorders.

In furtherance of the Company’s mission to address unmet medical needs, including in particular the areas of mental health and addiction, the Company is conducting preclinical studies to develop a portfolio of product candidates and assemble a compelling drug development pipeline of psychedelic inspired medicines and therapies for human clinical trials in accordance with the regulations of the FDA and regulatory authorities in other jurisdictions where the Company or its affiliates operate. The Company’s approach to development focuses on therapeutic areas that represent significant unmet medical need. This includes in particular a focus on the development of treatments for psychiatric, substance use, neurological and pain disorders. In the United States, 51.5 million adults suffer from mental illness including a 21% one-year prevalence of anxiety disorders. Economically, this reality is represented by a total annual cost of mental health in the United States of US$148 billion. While treatment options are available, 88% of patients with opioid use disorder relapse upon discontinuation of buprenorphine; 59% of Generalized Anxiety Disorder patients report having residual symptoms; and 13% of the United States population report having uncontrolled pain.

The Company utilizes a discover, develop and deploy process in order to advance psychedelic inspired medicines and therapies. The Company defines discover as being the non-clinical, preclinical, and human clinical trials of psychedelic substances led by academic clinical investigators (i.e., investigator-initiated trials (“IITs”)), discovery of new chemical entities and formulations based on psychedelics, and the advancement of research and development on technologies that seek to demonstrate the safety and efficacy of psychedelic inspired medicines and therapies and/or to facilitate advancement of the Company’s develop and deploy initiatives. The Company defines develop as being drug development programs that are being advanced from the discover mandates, or originating from other sources, and transitioned to be company-sponsored drug development programs seeking to achieve marketing authorization. The Company defines deploy as the commercialization mandates that will aim to partner with insurers, technology companies, care providers and other delivery-focused stakeholders to scale access to the Company’s medicines, if approved for marketing by regulatory authorities.

| 4 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

The Company’s business is premised on a growing body of research supporting the use of psychedelics to treat a myriad of mental health problems. For all product candidates, the Company will continue to proceed through research and development, and with marketing of the product candidates that may ultimately be approved, if any pursuant to the regulations of the FDA and other international regulatory authorities. This entails, among other things, conducting clinical trials utilizing research scientists, using internal and external clinical drug development teams, producing and supplying drugs according to current Good Manufacturing Practices (“GMP”), and conducting all trials and development in accordance with the regulations of the FDA and other international regulatory authorities.

This approach places the Company in an industry in which there are high barriers to entry, due to the need to conduct trials pursuant to applicable regulations, the time and costs required to do so, and the related need to develop and protect intellectual property associated with drug development. Therefore, the Company’s ability to build a compelling drug portfolio and pipeline and to raise the financing necessary for its operations are key to its success.

Processes

Discover

In the Discover projects, the Company conducts research and development (“R&D”) activities originating from internally generated concepts and from external collaborations. The Company is collaborating with the UHB Liechti Lab on various psychedelics and new potential therapeutic programs based on a multi-year, exclusive collaboration agreement with the UHB Liechti Lab on March 1, 2020. The agreement first covered LSD and psilocybin, but has since been expanded to incorporate other compounds and psychedelic substances such as MDMA, DMT and mescaline. These investigator-initiated clinical trials, intellectual property and technologies may ultimately be translated to commercial development programs. The Company is continually evaluating the acquisition of agreements and studies focusing on the medical benefits of other psychedelic substances and new chemical entities similar to known psychedelic substances to advance its R&D efforts.

On November 24, 2020, the Company announced that as part of its Discover projects, it established a digital medicine division known as “Albert”. Albert is in the process of assembling and recruiting a team of technologists, therapists and clinical drug development experts to help the Company research, develop and build an integrated technical platform and comprehensive toolset aimed at delivering psychedelic inspired medicines and therapies combined with digital therapeutics. Digital therapeutics are defined as evidence-based therapeutic interventions for patients to diagnose, prevent, manage or treat a mental disorder or disease or to facilitate the use of certain pharmaceutical products, such as the Company’s drug candidates. The Company will be evaluating the potential to pair digital tools, which may include wearables and the latest in machine learning, with psychedelic assisted therapies in order to give healthcare providers the ability to optimize and better understand the patient journey and therapeutic outcomes from pre-care through after-care. Recent advancements in digital therapeutics have the potential to enable a real time assessment of efficacy in both clinical trials and real-world settings which could lead to a more robust understanding of the value of a treatment and long-term impact on patient outcomes.

Develop

The Company is pursuing a pipeline and discovery strategy that seeks to advance both previously studied “classic psychedelic” molecules and psychedelic-inspired therapies that represent novel advancements on the classic psychedelics. The Company defines first generation or “classic psychedelics” as those that have been known and extensively used historically, including such molecules as DMT, MDMA, psilocybin and LSD. The Company defines second generation or optimized psychedelic-inspired drug candidates as those that have been pharmacologically modified or optimized to overcome limitations of the classic psychedelics. Second generation psychedelic-inspired therapies include closely related prodrugs or analogues, novel dosage forms, novel treatment models, novel administration methods and other improvements on classic psychedelics. The Company defines third generation psychedelic-inspired therapies as new chemical entities, which includes novel structural analogues to classic psychedelics.

| 5 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

Psychedelic therapies represent a novel treatment paradigm that is believed to be primarily mediated by agonist activity at serotonin, dopamine and other cellular receptors in the brain (depending on the specific subclass of psychedelic). Among the serotonergic psychedelics, such as LSD and psilocybin, the mechanism of action is believed to be agonism of the serotonin 5-HT2A receptor which results in increases in global brain connectivity, entropic brain activity and increased single neuron excitability. LSD has also been shown to increase cerebral blood flow and functional connectivity in the brain. LSD and psilocybin have both been shown to demonstrate robust clinical responses in a wide range of conditions and are believed to be rapid acting therapies that also have sustained action for many days or weeks following a single administration.

Currently, the Company’s commercial development pipeline consists of programs relating to 18-MC,LSD and R(-)-MDMA. The Company’s immediate commercial development priorities are to develop treatments for substance use disorders or associated signs, symptoms and conditions, by developing a non-hallucinogenic congener of the psychedelic molecule ibogaine (18-MC), conduct clinical trials of LSD for adult ADHD anxiety disorders, specifically for the treatment of Generalized Anxiety Disorder, and conduct clinical trials of R(-)-MDMA for the treatment of social anxiety and functioning in populations affected by the Autism Spectrum Disorder. The Company is also planning to initiate regulatory discussions with the FDA in 2021 with an aim of advancing LSD for the treatment of certain pain conditions into clinical trials in 2022.

The Company is continuously assessing the opportunity to expand target disease indications and geographic markets for development and deployment of its drug candidates. The four disease areas or therapeutic franchises of primary focus for the development of its drug candidates are: psychiatry, addiction medicine, pain and neurology.

The Company pursues intellectual property and market protection strategies to protect all of its development candidates and innovations, seeking to maximize market protection and exclusivity in anticipation of potential approval of its therapies or technologies. While this intellectual property strategy extends beyond the pursuit of patent applications, such applications are a central component of this strategy. The Company seeks to file patent applications on all of all substantial inventions across its pharmaceutical and digital health pipelines, including pursuing patent applications and other intellectual property for composition of matter claims (e.g. for new chemical entities), methods of use claims (e.g. for new indications), method of manufacturing claims and all other available claims such as those covering combination therapies, artificial intelligence and machine learning algorithms, innovative dosing protocols, unique physiochemical attributes or formulations and forms and methods of administration that may have unique pharmacokinetics. At present, the Company has filed over 30 provisional patent applications which among other claims encompass over 45 compounds (including over 30 of which the Company believes are new chemical entities), 11 of which applications cover LSD and four of which cover 18-MC. In relation to the Company’s multi-generational approach to developing psychedelic-inspired therapies, each generation of psychedelic-inspired drug candidates is represented by a unique intellectual property landscape, with the strongest intellectual property being available for third generation candidates, intellectual property available for novel innovations of second generation candidates and specific intellectual property available for classic psychedelics where gaps in the prior art exist.

Deploy

The Company’s strategy is currently focused on the discovery and development of product candidates based on psychedelic substances, but the Company may ultimately seek to commercialize and deploy its psychedelic inspired medicines and therapies to patients. As a result, the Company has entered into a funding arrangement with NYU Langone Health to establish the NYU Langone Training Program to help the Company understand and prepare for the future deploy phase of its business plan.

Overview of Current Projects

The Company currently has ten significant projects, none of which have yet generated revenue:

| 1. | developing a non-hallucinogenic version of the psychedelic ibogaine to treat select substance use disorder(s), known as “Project Layla”; |

| 6 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

| 2. | developing LSD for the treatment of anxiety disorders, specifically Generalized Anxiety Disorder, known as “Project Lucy”; |

| 3. | developing LSD for the treatment of select pain conditions, known as “Project Angie”; |

| 4. | developing R(-)-MDMA for the treatment of social anxiety and functioning in populations including Autism Spectrum Disorder; |

| 5. | executing a clinical trial of LSD for the treatment of adult ADHD, known as “Project Flow”; |

| 6. | the ongoing collaboration with the UHB Liechti Lab; |

| 7. | the ongoing collaboration with MindShift Compounds AG; |

| 8. | the ongoing collaboration with Nextage Therapeutics Ltd. (“Nextage”); |

| 9. | Albert, which combines digital therapeutics with psychedelic inspired medicines and therapies; and |

| 10. | the NYU Langone Training Program. |

Develop Projects

Project Layla (18-MC for the treatment of indications linked to substance use disorders)

The Company’s lead third generation/new chemical entity (NCE) drug candidate, 18-MC, is a α3β4 nicotinic receptor antagonist that is being developed for the treatment of substance use disorders and associated indications. 18-MC is a non-hallucinogenic analogue, or congener, of the classic psychedelic ibogaine. 18-MC would be the first drug approved that carries out its action by α3β4 antagonist which results in regulation of dopamine levels in the brain. Opioid use results in spikes in brain dopamine levels which amplify the risk of developing addiction. In Opioid Use Disorder (“OUD”), dopamine levels are dysregulated, spiking with each use of opioids and dropping in between uses. Current therapies for OUD, called medication assisted therapy or MAT, primarily have their effects by being partial agonists or antagonists at the same receptors as opioids. While potentially life-saving, agonist therapies result in more regulated but cyclical levels of dopamine in the brain. The novelty of 18-MC is that it is believed to regulate dopamine levels in a way that could stabilize dopamine levels enabling a return to sustained baseline levels.

Ibogaine has been historically used and studied as a treatment for opioid addiction, with promising preliminary efficacy, though its use is likely to be significantly limited by its hallucinogenic effects, potential neurotoxicity and well-established risk of sudden death due to cardiovascular failure (specifically, bolus administration of ibogaine can result in a cardiovascular arrhythmia called Torsade de Pointes which can result in sudden death). Unlike ibogaine, 18-MC is not hallucinogenic, does not have the same cardiovascular risk and is not believed to be neurotoxic. In addition to this safety profile, 18-MC administration has been shown to result in approximately the same efficacy in animal models of cocaine, opioid and other substance self-administration in animal models of disease.

Project Layla is focused on opioid withdrawal treatment, the treatment of opioid use disorder and the treatment of other substance use disorders, in respect of which the Company is currently conducting a Phase 1 trial evaluating 18-MC, a non-hallucinogenic synthetic derivative of the psychedelic substance ibogaine. The preliminary data from this trial suggests that, at the doses tested to date, no serious adverse events have been reported in 18-MC. In Study MMED003, a Phase 1 clinical trial being conducted at a single clinical research site in Perth, Australia, a total of 75 subjects have been administered 18-MC at doses ranging from 4 to 325 milligrams twice per day (for one day; 5 subjects per arm) and 2 to 90 milligrams twice per day (for up to 7 days, n=5 per arm). Based on the safety profile observed in this study to date, the study’s safety review committee has determined to continue dose escalation in the study to gather data from subjects administered higher doses of 18-MC for one or seven days. Because early findings from this study indicated that plasma levels of 18-MC were greater than expected, the Company has determined to take additional time to evaluate the data from the Phase 1 trial. Following completion of the Phase 1 trial which is anticipated in late 2021, the Company intends to conduct a Phase 2a proof of concept study, to evaluate 18-MC’s effectiveness in mitigating the symptoms of opioid withdrawal in patients undergoing opioid detoxification and assess the safety and tolerability of 18-MC in this patient population. A meeting with the FDA to discuss the development program for 18-MC was originally scheduled for the second quarter of 2021 but, at the request of the FDA, the meeting request was withdrawn and will be resubmitted following completion of Study MMED003.

| 7 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

Findings from the Phase 2 trial could greatly impact timelines and future capital requirements for Project Layla. In addition, the Company may need to conduct additional Phase 2 trials or additional Phase 1 studies to progress Project Layla, which may impact timelines and required capital. The Company may elect to add additional drug development projects that complement Project Layla and its development programs targeting substance use disorders, including hallucinogenic treatments for substance use disorders, but none have been selected for development at this time.

Project Lucy (LSD for the treatment of anxiety disorders, specifically Generalized Anxiety Disorder)

The Company’s lead classic psychedelic drug candidate, its proprietary form of LSD (“MM-120”), is being developed leveraging extensive preclinical and clinical research dating back to the original discovery of LSD by a scientist at Sandoz named Albert Hoffman. This body of historical evidence includes 29 published clinical studies of LSD, 12 of which have been published since 2008, and encompasses over 1,000 patients that have been administered a form of LSD in clinical trials. Early uses and research of LSD was focused on the treatment of anxiety, depression and alcoholism, though modern evidence from preclinical, clinical and naturalistic studies of LSD have expanded its potential use cases. Modern research has further characterized the pharmacokinetics and pharmacodynamics of LSD, which is being used to inform the clinical development approach for MM-120. Despite this strong historical body of evidence for LSD, it has been largely overlooked by commercial development programs in recent years with more commercial entities focusing on the development of psilocybin. The Company believes this creates a unique opportunity to pursue MM-120, particularly given some of the potential advantages of LSD over psilocybin such as the lack of need for bioactivation as psilocybin must be metabolized in the body to have its pharmacological activity and MM-120’s high potency that translates into a low microgram therapeutic range whereas psilocybin is typically administered at larger doses.

As part of the Company’s decision to add a therapy for anxiety disorders to its clinical development pipeline, the Company established Project Lucy. In December 2020, the Company successfully completed a pre- investigational new drug application (“IND”) meeting with the FDA for the treatment of an anxiety disorder with LSD. The Company intends to submit an IND with the FDA in the second half of 2021, with a Phase 2b clinical trial evaluating experiential doses of LSD in an anxiety disorder. The Company is assembling and using data from its data acquisition from the UHB Liechti Lab to help support its IND filing to the FDA.

As a result of the Company’s data acquisition from the UHB Liechti Lab, the Company received the data and worldwide rights to an ongoing Phase 2 academic trial in respect of LSD for anxiety administered by Professor Dr. Matthias Liechti and a psychedelic therapy expert, Dr. Peter Gasser. Dr. Gasser was appointed as the Clinical Advisor for Project Lucy in August 2020. The data and know-how will help build the Company’s understanding of LSD’s uses for anxiety disorders and its potential as a medication for serious mental health conditions.

On November 2, 2020, the Company announced that, in collaboration with the UHB Liechti Lab, it has completed an academic Phase 1 study measuring LSD dose-dependent induced subjective responses at doses of 25 micrograms up to 200 micrograms of LSD. The academic study provided relevant data to support Project Lucy as the Company identifies optimal dose levels of LSD to test in its intended Phase 2 LSD anxiety trial.

Project Flow (LSD for the treatment of adult ADHD)

As part of Project Flow, the Company is preparing a clinical trial of LSD for adult ADHD. A Phase 2a proof of concept trial for the low dose LSD program has received regulatory approvals from the Netherlands and Switzerland. The Company has selected two principal investigators and signed clinical trial agreements with the UHB Liechti Lab and Maastricht University. After the Company’s clinical team assesses the results from the Phase 2a proof of concept clinical trial, the Company will determine the best future strategy for additional clinical trials based on these findings and future milestones for Project Flow. The Company anticipates that the trial will run over two years commencing in the fourth quarter of 2021.

Project Angie (LSD for the treatment of pain)

Beyond the most common uses of psychedelics for the treatment of psychiatric conditions (such as depression or anxiety), mounting mechanistic and clinical evidence supports other potential clinical applications such as in the treatment of pain. Psychedelics like LSD are believed to have a novel mechanism of action among pain therapies, targeting the descending pain pathways as opposed to existing therapies (opioids, nonsteroidal anti-inflammatory drugs (NSAIDs), aesthetics and N-Methyl-D-aspartic acid (NMDA) antagonists, which target the ascending pain pathways). Even doses at the low end of LSD’s therapeutic range (i.e. a 20-microgram dose) have been shown to increase pain tolerance and decrease perceived pain when tested in experimental models of acute pain.

| 8 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

The Company is in the initial planning stages to conduct clinical trials of LSD for the treatment of pain. The Company is currently preparing to submit a pre-IND meeting request to FDA in the second half of 2021. Clinical studies under Project Angie are not anticipated to commence until 2022 and are subject to the outcome of the proposed pre-IND meeting.

Discover Projects

UHB Liechti Lab Initiatives

R&D Collaboration & Exclusive License to Clinical Trials of LSD, MDMA, DMT, Psilocybin, Mescaline

On April 1, 2020, the Company announced that it had signed a multi-year, exclusive collaboration with the UHB Liechti Lab, the world-leading psychedelics pharmacology and clinical research group based in Basel, Switzerland. Pursuant to the agreement, the Company acquired exclusive worldwide rights to data, compounds, and patent rights associated with the UHB Liechti Lab’s research with LSD and other psychedelic compounds, including data from preclinical studies and completed or ongoing LSD and MDMA clinical trials. The Company has commenced work with the UHB Liechti Lab to file patent applications for the data and clinical trials it has generated over a 10-year period and from current ongoing trials.

The Company will support ongoing and planned R&D clinical trials and commercial development trials under the direction of Professor Dr. Liechti. Professor Dr. Liechti will have primary responsibility for the development of the selected compounds, and the Company will provide research funding and milestone payments in return for the exclusive license to existing and future data and intellectual property generated from clinical trials. UHB Liechti Lab will receive royalties and development revenue on any products marketed through the collaboration.

MDMA Research

The Company added the psychedelic compound MDMA to its discover portfolio with research being led by Professor Dr. Liechti. After starting the UHB Liechti Lab, over the past ten years Professor Dr. Liechti has led multiple clinical trials of the safety and pharmacodynamics of MDMA. The cumulative data from the work done in the UHB Liechti Lab will enable the Company to design clinical trials and form a strategy for MDMA or its derivatives as potential future development programs in its portfolio.

The Company committed to fund future R&D of new psychedelic therapies being pursued by the UHB Liechti Lab with the intention to create next-generation psychedelic inspired medicines that incorporate MDMA as a component of these therapies. The UHB Liechti Lab and the Company plan to explore combination treatments of LSD and MDMA to optimize the subjective effect profiles and potentially join the benefits of both psychedelics in various treatment paradigms. A combined MDMA and LSD randomized placebo-controlled Phase 1 trial was initiated in early 2021.

DMT Research

The Company will also fund the UHB Liechti Lab to perform research on DMT, the principally active ingredient in ayahuasca. The Company is providing funding for a Phase 1 clinical trial testing various intravenous dosing regimens of DMT that began in July 2021. In order to potentially induce a stable DMT experience lasting one to two hours, various intravenous dosing regimens, including a starting dose and then a maintenance dose, will be evaluated in the Phase 1 clinical trial. Through this Phase 1 clinical trial, the Company and the UHB Liechti Lab are exploring how DMT can achieve experiential effects similar to ayahuasca by testing a more controlled intravenous dosing method. The Phase 1 study is a randomized, double blind, placebo-controlled, five-period crossover trial in 30 healthy volunteers who will undergo five sessions with different DMT doses.

The human safety data and associated know-how gathered in this Phase 1 clinical trial will better enable the Company’s clinical team to design future potential drug development programs based on DMT sessions. Currently, no study has definitively determined the elimination half-life of DMT and other pharmacokinetic parameters and there is limited known data on dosing regimens of pure DMT. This Phase 1 study is expected to provide a well-controlled study setting to illuminate these shortcomings in the current clinical understanding of DMT and is anticipated to pave the way for future Phase 2a proof of concept efficacy studies in various indications.

| 9 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

Neutralizer Technology Research

In collaboration with the UHB Liechti Lab, the Company filed a provisional patent application for neutralizer technology intended to shorten and stop the hallucinogenic effects of using LSD during a therapy session. This innovative approach may help reduce the acute effects of a psychedelic drug and help shorten the hallucinogenic effects when required by a patient or medical professional. The Company is seeking to develop research findings that may one day inform therapists and other medical professionals on how to better control the effects of dosing LSD in a clinical setting to potentially improve the patient experience and outcomes. This could pave the way for greater therapeutic applications of LSD and shorter-acting psychedelic therapy treatments.

The Company is working in collaboration with the UHB Liechti Lab on a Phase 1 double-blind, placebo-controlled, random-order two-period crossover design clinical trial evaluating the effect of ketanserin on the acute response to LSD in healthy subjects after LSD administration. The study is being conducted at the UHB Liechti Lab and is expected to be completed in Q4 2021. This study is intended to support the provisional patent application.

Personalized Medicine Technology Research

The Company, in collaboration with UHB Liechti Lab, is also in the process of researching and developing technologies and analytics that will seek to personalize psychedelic therapy experiences. One such research effort aims to optimize the dosing of MDMA, LSD and other psychedelics based on individual characteristics including age, gender, pharmacogenetics, personality traits, moods, metabolic markers and therapeutic drug monitoring. Through its clinical research, the UHB Liechti Lab is seeking to identify ways to predict and optimize the amount of a psychedelic dose and dosing regimen for therapy. To assemble a patient’s personalized dosing regimen and therapy session, the Company and the UHB Liechti Lab’s analytics method is being developed to aggregate multiple data and criteria of patients in a pre-dose screening and analysis process. Three provisional patent applications have been filed covering MDMA dose optimization and LSD dose response. The Company has received exclusive global rights from the UHB Liechti Lab to commercialize the outcome of these provisional patent applications. Further, biomarkers such as brain-derived neurotrophic factor (“BDNF”) are assessed and evaluated to potentially be used as predictors of markers of positive effects on neuroplasticity and therapeutic response.

LSD for Treatment of Cluster Headache Research

The Company is supporting and collaborating on a Phase 2 clinical trial evaluating LSD for the treatment of cluster headaches at the UHB Liechti Lab. Cluster headaches are a relatively uncommon primary headache disorder that is one of the trigeminal autonomic cephalgias; they are considered to be among the most severe forms of pain. The Phase 2 trial began recruiting patients in the first quarter of 2019 and has commenced treating patients with LSD. The intention of this trial is to evaluate the administration of LSD to target cluster headache patients. As part of this collaboration with the UHB Liechti Lab, the Company acquired the exclusive global rights to all data and intellectual property generated in this Phase 2 trial of LSD for cluster headaches.

LSD for Treatment of Major Depression Disorder Research

The Company is supporting and collaborating on a Phase 2 clinical trial evaluating LSD for depression at the UHB Liechti Lab. This study will evaluate the potential benefits of LSD-assisted psychotherapy in patients suffering from major depressive disorder. This is a randomised, double-blind, active-placebo-controlled trial using either two moderate to high doses of LSD (100 micrograms and 100 micrograms or 100 micrograms and 200 micrograms) as intervention and two low doses of LSD (25 micrograms and 25 micrograms) as active-placebo control. The study is planned to include 60 patients over the age of 25 with major depressive disorder (according to the Diagnostic and Statistical Manual of Mental Disorders (“DSM”)). The main outcome measurements are expected to be changes in depressive symptomatology (Inventory of Depressive Symptomatology, Self-Report and Beck Depression Inventory), anxiety (State-Trait Anxiety Inventory), and general psychopathology (Symptom Checklist-90) compared with active-placebo-assisted psychotherapy. This investigator-initiated study started in early 2020 and is planned to be completed in 2023.

| 10 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

Maastricht University Initiatives

On January 12, 2021, the Company announced an LSD study evaluating the potential benefits of LSD on cognitive performance, sleep quality, mood, neuroplasticity markers, emotion regulation, quality of life and immune system response. The study will be conducted in collaboration with Dr. Kim Kuypers of Maastricht University in the Netherlands, a global, leading authority on the use of psychedelics. In order to advance the scientific understanding of low doses of LSD for clinical purposes, the randomized placebo-controlled study will specifically measure the effects of low doses of LSD on neuroplasticity markers such as BDNF plasma levels. Leveraging Albert, the Company is integrating innovative digital tracking devices and software into the study to better assess LSD’s effects on various digital clinical markers on the human body. The study is planned to start in Q4 2021.

MindShift Compounds AG Initiatives

The Company entered into an agreement with MindShift Compounds AG, to develop and patent next-generation psychedelic compounds with psychedelic or empathogenic properties. The first initial compounds have already been synthesized by MindShift Compounds AG and the Company filed related provisional patent applications. The Company plans to begin first-in-human Phase 1 clinical trials as early as the first quarter of 2022 through its existing clinical trial platform for psychedelic and empathogenic compounds in Switzerland. These initiatives are intended to expand the Company’s current clinical pipeline with additional compounds with similar and potentially improved therapeutic properties. The Company acquired the exclusive global rights related to intellectual property derived from the medicinal chemistry/synthesis, drug discovery and product development efforts through its collaboration with MindShift Compounds AG.

Nextage Initiatives

The Company launched an exclusive collaboration with Nextage, an Israeli innovative drug development company, to optimize the delivery of certain psychedelic drug candidates, leveraging Nextage's proprietary Brain Targeting Liposome System (BTLS) delivery technology. Utilizing this technology, the Company and Nextage are collaborating to develop a proprietary formulation of ibogaine derivatives, seeking to minimize the systemic exposure while maintaining effective concentrations in the brain, with the objective of improving the benefit-risk profile of their delivery.

Deploy Projects

Albert and HealthMode

The Company established a digital medicine division known as “Albert”. Albert aims to have a team of technologists, therapists, and clinical drug development experts to help the Company research, develop and build an integrated technical platform and comprehensive toolset aimed at delivering psychedelic inspired medicines and therapies combined with digital therapeutics. Digital therapeutics are defined as evidence-based therapeutic interventions for patients to prevent, manage, or treat a mental disorder or disease. The potential to pair digital tools, which may include wearables and the latest in machine learning, with psychedelic assisted therapies, can give healthcare providers the ability to optimize and better understand the patient journey and therapeutic outcomes from pre-care through after-care. Recent advancements in digital therapeutics have the potential to enable a real time assessment of efficacy in both clinical trials and real-world settings, which can lead to a more robust understanding of the value of a treatment and long-term impact on patient outcomes.

In February 2021, the Company completed the acquisition of HealthMode, Inc. (“HealthMode”) to build out the Albert division. HealthMode is a digital medicine and therapeutics company that uses artificial intelligence (“AI”) enabled digital measurement to increase the precision and speed of clinical research and patient monitoring. With the acquisition, the Company has gained access to HealthMode’s intellectual property, platforms for clinical drug trials and its entire 24 person digital medicine team. The Company will incorporate HealthMode’s machine learning engineering, product development and operations employees based in Silicon Valley, New York City, Bratislava and Prague into Albert.

The Company’s digital projects are oriented around developing product candidates that will be applied to two primary clinical periods: activities during a treatment session (referred to as “intrasession”) and activities between treatment sessions (referred to as “intersession”). Each product candidate consists of a platform that contains a number of separate underlying components, some of which the Company anticipates will be within the scope of the Food, Drug & Cosmetic Act’s definition of medical devices and others will not be regulated as medical devices. For the medical device products, the Company will engage with the FDA and other international regulatory authorities to receive guidance along the development pathway, culminating with a potential submission for regulatory clearance or approval. The Company expects that each medical device product candidate in development will be, for the purpose of FDA regulations, Investigational Device Exemption (IDE) exempt, non-significant risk, Class I or Class II Software as Medical Device (SaMD).

| 11 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

The intersession monitoring platform may include components that support patient education, engagement, preparation and assistance; deep digital diagnosis that allows greater granularity to complement DSM diagnoses; support for treatment selection: modality dose and timing; real world monitoring of trends for relapse prediction and re-treatment decisions; engagement in health maintenance behaviors; and AI models to inform psychotherapeutic intervention. The intrasession monitoring platform may include components that provide in-session monitoring for safety, efficacy and additional interventions; clinician decision support for drug and non-drug therapeutic sessions; and predictive models linking interventions and treatment outcomes.

In the intersession monitoring platform, the Company has current products that are being used in clinical studies for the detection and prediction of transdiagnostic agitation, opioid withdrawal for people with opioid use disorders, monitoring of acute and chronic pain and tracking symptoms and medication in Parkinson’s disease. The Company also has products for measurement of anxiety disorders, substance use disorders and pain measurement that are either currently collecting clinical data (from existing data sources) or are intended to start doing so by the end of 2021. Earlier in the digital pipeline, the Company has intrasession products that could potentially monitor anxiety and affective disorders and provide decision support among other subject monitoring.

NYU Langone Health Psychedelic Medicine Clinical Training Program

The Company entered into a funding arrangement with NYU Langone Health to establish the NYU Langone Training Program to assist the Company understand and prepare for the future deploy phase of its business plan. The Company committed US$5 million over a five-year period to found and launch a clinical training program focused on psychedelic assisted therapies and psychedelic inspired medicines at NYU Langone Health, one of the United States’ premier academic medical centers.

The NYU Langone Training Program is the first step in a larger initiative to establish a Center for Psychedelic Medicine at NYU Langone Health. The NYU Langone training program is intended to train additional clinical researchers in psychedelic medicines. In addition, the Company hopes to work with NYU Langone and other academic institutions as it prepares for the future deploy phase of its business plan that will inevitably require training large numbers of medical personnel including psychiatrists to administer psychedelic assisted therapies at scale in the United States. NYU Langone Health will have full and free discretion in using the funds for the development and conduct of the training program and operations of the Center for Psychedelic Medicine. The launch of the Center for Psychedelic Medicine at NYU Langone Health is still subject to additional funding from other parties. It is not anticipated that the Company will generate future revenue from this project.

BUSINESS COMBINATION

On February 26, 2021, the Company acquired 100% of the issued and outstanding shares of HealthMode for aggregate consideration of $27,634,000, consisting of cash of CAD $285,788 ($225,000), a prior advance of $250,000, equity consideration of 81,497 multiple voting shares of MindMed (equivalent to 8,149,700 subordinate voting shares), and 33,619 stock options, which are convertible into Subordinate Voting Shares of the Company.

In the completion of this transaction, MindMed Mergerco Inc. (“Mergerco”), a wholly owned Delaware subsidiary of the Company merged with and into HealthMode. As a result, the separate corporate existence of Mergerco ceased and HealthMode continued its corporate existence as the surviving Company in the Merger and as a wholly-owned subsidiary of the Company.

| 12 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

HealthMode’s primary operations consist of developing technologies using AI-enabled digital measurement to increase the precision and speed of clinical research and patient monitoring.

| (i) | Outlined below is a summary of the purchase consideration and fair value of assets acquired and liabilities assumed |

| Details of the consideration transferred are: | ||||

| Cash paid (CAD $285,788 converted to USD @ 1.2685 CAD/USD) | $ | 225,000 | ||

| Cash advances paid | 250,000 | |||

| Fair value of shares issued (FV of a Company share = USD $3.32 based on closing share price as at the transaction date) | 27,048,000 | |||

| Value of options issued (33,619 options at FV of USD $3.30 /share option (using Black-Scholes model) | 111,000 | |||

| Total | $ | 27,634,000 |

The fair value of the shares issued as consideration was determined as follows:

The estimated fair values of the assets acquired, and liabilities assumed in the acquisition of HealthMode for the purposes of the provisional purchase price allocation are as follows:

| Cash | $ | 178,000 | ||

| Prepaid and other current assets | 74,000 | |||

| Property and equipment | 1,000 | |||

| Intangible assets (acquired technology) | 25,000,000 | |||

| Goodwill | 9,992,000 | |||

| Total assets | $ | 35,260,000 | ||

| Accounts payable and accrued liabilities | 876,000 | |||

| Deferred tax liability | 6,750,000 | |||

| Total liabilities | $ | 7,626,000 | ||

| Net assets acquired | $ | 27,634,000 |

| 13 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

The intangible assets consist of the following:

| Useful Life | ||||||

| Frontend Systems Developed | $ | 5,000,000 | 2 years | |||

| Backend Systems Developed | 5,000,000 | 2 years | ||||

| Value of models/data/work product | 5,000,000 | 2 years | ||||

| HM Pooply Product | 5,000,000 | 2 years | ||||

| HM Cough Product | 5,000,000 | 2 years | ||||

| $ | 25,000,000 | |||||

The application of IFRS requires management to determine the fair value of the net assets acquired and liabilities assumed (with certain exceptions). As the acquisition closed on February 26, 2021, management has not completed its assessment of the fair value of assets acquired and liabilities assumed. As management completes its assessment of the fair value of net assets acquired and liabilities assumed, there could be adjustments to the values outlined above, however such adjustments are not expected to be material. This period such revisions may be made is not to 12 months from the date of the acquisition.

The goodwill is the attributable value of the assembled workforce, and the related expertise and developed business function. Further, the acquisition is expected to allow the Company to streamline its product development processes. None of the goodwill is expected to be deductible for tax purposes.

| (ii) | Acquisition-related costs |

Acquisition-related costs of $296,000 were incurred by the Company and are included in general and administrative expenses. These costs primarily consist of diligence and legal costs.

LEGAL PROCEEDINGS

To our knowledge, there have not been any legal or arbitration proceedings, including those relating to bankruptcy, receivership or similar proceedings, those involving any third party, and governmental proceedings pending or known to be contemplated, which may have, or have had in the recent past, significant effect on our financial position or profitability.

Also, to our knowledge, there have been no material proceedings in which any director, any member of senior management, or any of our affiliates is either a party adverse to us or has a material interest adverse to us.

RESULTS OF OPERATIONS

For the Third Quarter of 2021

Overview

Since inception, we have incurred losses while advancing the research and development of our products and processes. Comprehensive loss for the three months ended September 30, 2021 was $24,300,000. The loss was due primarily to general and administrative expenses of $4,975,000, research and development costs of $7,071,000 and share-based payments of $7,966,000.

During the period ended September 30, 2021, MindMed continued to enhance the resources it requires to build its pipeline of opportunities. This included adding personnel and contract resources and ramping up the nonclinical aspects of our activities. During the period, the company also completed the transition from Co-founder CEOs to new senior management and enhanced the board of directors by adding new board members.

| 14 |

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

Research and Development

To date, our resources were focused primarily on the development of our 18-MC and LSD programs and the commencement of related clinical activities. We have commenced clinical studies and have funded data and study acquisitions and have begun to acquire materials required to supply our studies.

Since inception to September 30, 2021, the Company has expended approximately $34,932,000 on research and development, including consulting and licensing fees, manufacturing costs, clinical research and regulatory data and study acquisition costs, as follows:

| Costs | Q3-21(1)

(US$) | Q2-21(1)

(US$) | Q1-21(1)

(US$) | Q4-20(1)

(US$) | Q3-20(1)

(US$) | Q2-20(1)

(US$) | Q1-20(1)

(US$) | Incep’n to Dec. 19(1) (US$) | Total(1)

(US$) | |||||||||||||||||||||||||||

| Payroll, consulting and benefits | 1,931 | 2,496 | 1,269 | 842 | 1,011 | 627 | 672 | 801 | 9,649 | |||||||||||||||||||||||||||

| Licensing fees | 400 | - | 400 | - | 200 | - | 500 | 727 | 2,227 | |||||||||||||||||||||||||||

| Manufacturing costs | 964 | 589 | 1,096 | 2,161 | 782 | 691 | 207 | 333 | 6,823 | |||||||||||||||||||||||||||

| Clinical research and regulatory expenses | 1,993 | 924 | 1,815 | 1,323 | 1,858 | 930 | 5 | 115 | 8,963 | |||||||||||||||||||||||||||

| Data and study acquisition cost | 1,181 | - | 698 | 346 | 1,219 | 690 | 584 | - | 4,718 | |||||||||||||||||||||||||||

| Other | 602 | 657 | 481 | 240 | 272 | 83 | 143 | 73 | 2,552 | |||||||||||||||||||||||||||

| Total | 7,071 | 4,667 | 5,759 | 4,912 | 5,342 | 3,021 | 2,111 | 2,049 | 34,932 | |||||||||||||||||||||||||||

Note:

| (1) | All dollar amounts are in thousands. |

The table below describes the next stage of each of the Company’s material projects, as well as the anticipated timing and costs required to complete such stage.

| Project | Stage of Project | Expected Timing to Complete Stage | Expected

Costs (US$) | Total (US$) | ||||||||||

| Discover | UHB Liechti Lab clinical trials | Phase 1 IIT, LSD and MDMA | late 2022 | Nil | 10,346 | (3) | ||||||||

| Phase 1 IIT, DMT regimen | mid 2022 | 530 | ||||||||||||

| Phase 1 IIT, LSD and ketanserin | early 2022 | 110 | ||||||||||||

15

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

| Phase 1 IIT, LSD bioequivalence | early 2023 | 110 | ||||||||||

| Phase 1 IIT, Mescaline Dose Response | mid 2023 | 760 | ||||||||||

| Phase 1 IIT, Novel MDMA | early 2024 | 710 | ||||||||||

| Phase 1 IIT, SERT- psilocybin | complete | Nil | ||||||||||

| Phase 2 IIT evaluating LSD for the treatment of cluster headaches | late 2023 | 200 | ||||||||||

| Phase 2 IIT evaluating LSD for the treatment of Major Depressive Disorder | Early 2024 | 54 | - | |||||||||

| Phase 2 IIT evaluating LSD for the treatment of anxiety disorders | Early 2022 | 56 | - | |||||||||

| MindShift Compounds AG Collaboration | Drug discovery efforts to identify and synthesize novel psychedelic-related molecules | Ongoing | 1,580 | 2,000 | ||||||||

| Nextage Therapeutics Collaboration | Formulation development and optimization of ibogaine derivatives in brain target liposome delivery system | Early 2022 | 500 | - | ||||||||

| Albert | Beginning stages of assembling a team of technologists, therapists, and clinical drug development experts | Ongoing(4) | To be determined(4) | 15,701 |

| Develop | Project Layla | Phase 1 trial evaluating 18-MC | late 2021 | 4,000 | 7,870 | (3) | ||||||||

| Phase 2a proof of concept study evaluating 18-MC | late 2023 | 5,600 | ||||||||||||

| Project Lucy | Phase 2b clinical trial evaluating experiential doses of LSD in an anxiety disorder | late 2023 | 18,000 | 16,782 | ||||||||||

| Project Flow | Phase 2a proof of concept trial for the repeat low dose LSD in adult ADHD | late 2023 | 3,500 | 3,084 | (3) |

16

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

| University Maastricht, LSD microdosing study | Phase 1 IIT, LSD microdosing | mid 2022 | 460 | 550 | ||||||||||

| Deploy | NYU Langone Health | Investment to found and launch a clinical training program focused on psychedelic assisted therapies and psychedelic inspired medicines | 5 years | 5,000 | N/A(5) |

Notes:

| (1) | All dollar amounts are in thousands. |

| (2) | The “Total Proceeds Allocated” column in the table above sets out the aggregate amounts allocated to each project in the prospectuses related to the Company’s offerings completed on May 26, 2020 (the “May Offering”), October 30, 2020 (the “October Offering”), December 11, 2020 (the “December Offering”) and the January 7, 2021 (the “January Offering”). While the Company anticipates that the amounts described in the “Expected Costs to Complete Stage” column above will be used to complete the next stage of each project, the nature, timing and costs related to future stages of each project are difficult to predict, and as such the amounts above are subject to change. The amounts allocated to each project in the applicable prospectus has been converted to United States dollars based on (i) the May 30, 2020 Bank of Canada exchange rate of US$1.00 = C$1.3785 in respect of the May Offering; (ii) the October 30, 2020 Bank of Canada exchange rate of US$1.00 = C$1.3318 in respect of the October Offering; (iii) the December 11, 2020 Bank of Canada exchange rate of US$1.00 = C$1.2769 in respect of the December Offering and (iv) the January 7, 2021 Bank of Canada exchange rate of US$1.00 = CAD$1.2707 in respect of the January Offering. |

| (3) | In the prospectuses related to the May Offering, the October Offering, the December Offering and the January Offering, the Company has also allocated an aggregate of $16,038 towards the chemistry, manufacturing and control of substances such as LSD and 18-MC, among others. |

| (4) | The Company continues to evaluate its full budget and strategy for Albert and will make announcements related thereto through is regular continuous and timely disclosure once this process is complete and certain key hires and personnel are in place. The Company anticipates that in 2021 it will undertake a product ideation phase with a digital therapeutic development budget of approximately $7 million to hire additional personnel and leadership for the division and advance digital therapeutic projects. |

| (5) | The Company has not specifically allocated proceeds from the Prior Offerings towards the NYU Langone Health program. The Company expects that the costs of such program attributable to the Company will be funded from amounts the Company has previously allocated towards general or other working capital purposes in respect of the Prior Offerings. |

The allocation of capital towards the Company’s ongoing projects and programs is largely dependent on the success, or difficulties encountered, in any particular portion of the process and therefore the time involved in completing it; in turn the time and costs associated with completing each step are highly dependent on the incremental results of each step and the results of other programs, and the Company’s need to be flexible to rapidly reallocate capital to projects whose results show the greatest potential. As such, it is difficult for the Company to anticipate the timing and costs associated with taking the projects to their next planned stage, and the Company cannot make assurances that the foregoing estimates will prove to be accurate, as actual results and future events could differ materially from those anticipated. Accordingly, investors are cautioned not to put undue reliance on the foregoing estimates.

Additionally, identifying the timing and costs of such projects beyond their immediate next steps go to the core differentiating factors with respect to the Company and its competitors. The disclosure of prospective costs and timing other than as already disclosed by the Company would negatively impact shareholder value and undermine the Company’s proprietary technology. In keeping with pharmaceutical industry practice, it is the Company’s policy to disclose these details in conjunction with our financial statements, and to publicly disclose published patent applications, published scientific papers, scientific symposia and the attainment of key milestones only. In addition, the premature disclosure of proprietary data would have a material and adverse effect on the Company’s patent and other intellectual property rights and could result in the breach of confidentiality obligations.

17

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

General and Administrative

Components of general and administrative expenses were as follows:

Q3-21(1) (US$) | Q2-21(1) (US$) | Q1-21(1) (US$) | Q4-20(1) (US$) | Q3-20(1) (US$) | Q2-20(1) (US$) | Q1-20(1) (US$) | May 30

to (US$) | |||||||||||||||||||||||||

| Payroll, consulting fees and benefits | 1,534 | 2,608 | 2,829 | 937 | 717 | 308 | 741 | 1,174 | ||||||||||||||||||||||||

| Legal fees | 1,011 | 1,187 | 1,165 | 408 | 144 | 231 | 31 | 1,045 | ||||||||||||||||||||||||

| Accounting and audit | 168 | 228 | 134 | 75 | 98 | 65 | 63 | 312 | ||||||||||||||||||||||||

| Marketing and IR | 199 | 294 | 770 | 782 | 550 | 686 | 312 | 185 | ||||||||||||||||||||||||

| Insurance | 825 | 645 | 651 | 309 | 51 | 50 | 37 | 4 | ||||||||||||||||||||||||

| Public company costs | 532 | 408 | - | - | - | - | - | - | ||||||||||||||||||||||||

| Other | 581 | 908 | 584 | 476 | 41 | 213 | 365 | 385 | ||||||||||||||||||||||||

| Total | 4,975 | 6,666 | 6,133 | 2,987 | 1,601 | 1,553 | 1,549 | 3,105 | ||||||||||||||||||||||||

Note:

| (1) | All dollar amounts are in thousands. |

During the three months ended September 30, 2021, general and administrative expenses decreased primarily due to the absence of one time payroll costs associated with transitioning executive officers in the prior two quarters. The Company continues to grow its management team in anticipation of pursuing and executing on opportunities identified. In addition, there has been additional focus on building the Company’s capabilities to scale for anticipated growth.

Share-based payments

Share-based compensation of $7,966,000 for the quarter resulted from stock options provision ($3,738,000), from RSU and DSU provisions ($4,176,000) and from share-based compensation related to an arrangement for a director to purchase Class D Shares of the Company ($52,000) through a loan advanced by MindMed US to the director pursuant to an agreement dated September 16, 2019 with MindMed US and the director. Pursuant to the agreement, if the director ceases to be a member of the board of directors of MindMed US and all affiliates of MindMed US, other than as a result of his disqualification under applicable corporate law or his resignation, the loan shall be automatically deemed to be repaid and satisfied in full and the Class D Shares (which have since been exchanged for Subordinate Voting Shares) would be tendered back to the Company without any payment being made. The loan has been accounted for as an option plan since the Company does not have full recourse to the outstanding loan balance. The director ceased to be a director of MindMed US and all affiliates of MindMed US as at September 29, 2021 and as of September 30, 2021, in accordance with the terms of the agreement, the loan term is complete and the loan is considered to have been repaid.

Finance income and costs and foreign exchange gains and losses

During the quarter ended September 30, 2021, we recorded a net foreign currency loss of $34,000 and a loss on foreign currency translation of $1,156,000. The net foreign currency loss in the current period reflected a weakening of the Canadian dollar versus the U.S. dollar while holding a portion of the cash received from financing in Canadian currency. The majority of the cash held has been converted to US dollars.

18

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

Prior use of Proceeds

MindMed US Offering

The table below describes the differences between the Company’s anticipated use of the net proceeds from the MindMed US Offering completed by MindMed US in three tranches between December 2019 and February 2020, as disclosed in the management information circular (the “Circular”) of the Company (then called Broadway Gold Mining Ltd.) dated December 29, 2019, and the Company’s actual use of the net proceeds for the MindMed US Offering as of September 30, 2021:

| Component | Original

(C$) | Revised (C$) | Revised

Planned Use of Proceeds(1)(3) (US$) | Actual

Use of (US$) | Difference

in (US$) | |||||||||||||||

| Research and development | 11,500 | 19,521 | 14,579 | 12,559 | 2,020 | |||||||||||||||

| General and administration costs | 4,600 | 7,808 | 5,832 | 7,830 | (1,999 | ) | ||||||||||||||

| Working capital | 482 | 819 | 611 | 632 | (21 | ) | ||||||||||||||

| Total | 16,582 | 28,148 | 21,022 | 21,022 | Nil | |||||||||||||||

Notes:

| (1) | All dollar amounts are in thousands. |

| (2) | At the time of the Circular, the Company anticipated that the proceeds of the MindMed US Offering would be $16,582. Upon closing of the MindMed US Offering, the actual proceeds were $28,808. As a result of holding a portion of the remaining cash in Canadian dollars, there was an unrealized foreign exchange loss of $660, reducing the proceeds of $28,808 to $28,148 in the above table. The planned use of proceeds as disclosed in the Circular has been revised on a pro rata basis in the above table to account for the increased actual proceeds realized from the MindMed US Offering. |

| (3) | Revised use of proceeds converted to United States dollars based on the February 27, 2020 Bank of Canada exchange rate of US$1.00 = C$1.339. |

The actual use of proceeds from the MindMed US Offering differed in certain respects from the anticipated use of proceeds at the time of the Circular. These differences were caused by a number of factors, including that the actual proceeds received from the MindMed US Offering were approximately 70% higher than originally anticipated. Had the anticipated proceeds from the MindMed US Offering at the time of Circular been as high as the actual proceeds, the Company’s estimation of the allocation of proceeds to be put towards research and development versus general and administration costs would likely have been different at the time, as the original planned use of proceeds was not necessarily meant to scale on a one-to-one basis with additional proceeds. Additionally, since the time of the MindMed US Offering and before December 31, 2020, the Company completed the May Offering, the October Offering and the December Offering. The costs related to such offerings also resulted in increased general and administration costs than were anticipated at the time of the Circular.

19

MIND MEDICINE (MINDMED) INC.

Management’s Discussion and Analysis

May 2020 Offering

The table below describes the differences between the Company’s anticipated use of the net proceeds from the May 2020 Offering as disclosed in the final prospectus of the Company dated May 21, 2020, and the Company’s actual use of the net proceeds for the May Offering as of September 30, 2021:

| Component | Planned Use of Proceeds(1) (C$) | Planned Use of Proceeds(1)(2)(US$) | Actual Use of Proceeds(1) (US$) | Difference in Amounts(1) (US$) | ||||||||||||

Funding the Company’s collaboration with University Hospital Basel’s Liechti Laboratory, including: | 7,200 | 5,223 | 4,868 | 330 | ||||||||||||

| License fees | 1,000 | 725 | 725 | Nil | ||||||||||||

| Financial support for studies | 3,000 | 2,176 | 1,846 | 330 | ||||||||||||

| Clinical trials | 2,500 | 1,814 | 1,814 | Nil | ||||||||||||

| Project management and support | 700 | 508 | 508 | Nil | ||||||||||||

Other general corporate and working capital, including: | 3,110 | 2,256 | 2,256 | Nil | ||||||||||||

| Management and contract personnel costs | 2,200 | 1,596 | 1,596 | Nil | ||||||||||||