UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

(The Nasdaq Global Select Market) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|||

|

☒ |

|

Smaller reporting company |

|

||

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of July 24, 2024, the registrant had

Table of Contents

|

|

Page |

PART I |

4 |

|

Item 1. |

4 |

|

|

4 |

|

|

Condensed Consolidated Statements of Operations and Comprehensive Loss |

5 |

|

6 |

|

|

7 |

|

|

8 |

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 |

Item 3. |

29 |

|

Item 4. |

29 |

|

|

|

|

PART II |

30 |

|

|

|

|

Item 1. |

30 |

|

Item 1A. |

30 |

|

Item 2. |

30 |

|

Item 3. |

31 |

|

Item 4. |

31 |

|

Item 5. |

31 |

|

Item 6. |

32 |

|

|

33 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Quarterly Report”) contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Quarterly Report, including statements regarding our future results of operations or financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will” or “would” or the negative of these words or other similar terms or expressions. These forward-looking statements include, but are not limited to, statements concerning the following:

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Quarterly Report primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in the section titled “Risk Factors” previously disclosed in Part I, Item 1A. in our Annual Report on Form 10-K, as filed with the U.S. Securities and Exchange Commission ("SEC") on February 28, 2024 (the “2023 Annual Report”) and in Part II, Item 1A in this Quarterly Report. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Quarterly Report. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Quarterly Report. And while we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this Quarterly Report relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Quarterly Report to reflect events or circumstances after the date of this Quarterly Report or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments.

We may announce material business and financial information to our investors using our investor relations website (https://ir.mindmed.co/). We therefore encourage investors and others interested in our company to review the information that we make available on our website, in addition to following our filings with the SEC, webcasts, press releases and conference calls. Our website and information included in or linked to our website are not part of this Quarterly Report. Unless otherwise noted or the context indicates otherwise, references in this Quarterly Report to the “Company,” “MindMed,” “we,” “us,” and “our” refer to Mind Medicine (MindMed) Inc. and its consolidated subsidiaries.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

Mind Medicine (MindMed) Inc.

Condensed Consolidated Balance Sheets

(In thousands, except share amounts)

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

||

Assets |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Prepaid and other current assets |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

Goodwill |

|

|

|

|

|

|

||

Intangible assets, net |

|

|

— |

|

|

|

|

|

Other non-current assets |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

|

|

$ |

|

||

Accrued expenses |

|

|

|

|

|

|

||

2022 USD Financing Warrants |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

Credit facility, long-term |

|

|

|

|

|

|

||

Other liabilities, long-term |

|

|

— |

|

|

|

|

|

Total liabilities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

(Note 9) |

|

|

|

|

|

|

||

Shareholders' Equity: |

|

|

|

|

|

|

||

Common shares, |

|

|

|

|

|

|

||

Additional paid-in capital |

|

|

|

|

|

|

||

Accumulated other comprehensive income |

|

|

|

|

|

|

||

Accumulated deficit |

|

|

( |

) |

|

|

( |

) |

Total shareholders' equity |

|

|

|

|

|

|

||

Total liabilities and shareholders' equity |

|

$ |

|

|

$ |

|

||

See accompanying notes to unaudited condensed consolidated financial statements.

4

Mind Medicine (MindMed) Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(In thousands, except share and per share amounts)

|

|

Three Months |

|

|

Six Months |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Research and development |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Loss from operations |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Other income/(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Interest expense |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Foreign exchange gain/(loss), net |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

|

||

Change in fair value of 2022 USD Financing Warrants |

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Gain on extinguishment of contribution payable |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

Total other income/(expense), net |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net loss |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Other comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Gain/(loss) on foreign currency translation |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

Comprehensive loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Net loss per common share, basic |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Net loss per common share, diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Weighted-average common shares, basic |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted-average common shares, diluted |

|

|

|

|

|

|

|

|

|

|

|

|

||||

See accompanying notes to unaudited condensed consolidated financial statements.

5

Mind Medicine (MindMed) Inc.

(Unaudited)

(In thousands, except share amounts)

|

|

Common Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Shares |

|

|

Amount |

|

|

Additional Paid-In Capital |

|

|

Accumulated OCI |

|

|

Accumulated Deficit |

|

|

Total |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Balance, December 31, 2023 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

Issuance of common shares, net of share issuance costs |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Issuance of common shares upon settlement of restricted share unit awards, net of shares withheld for tax |

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

Exercise of 2022 USD Financing Warrants |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Exercise of stock options |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Net loss and comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Balance, June 30, 2024 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Balance, December 31, 2022 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

Issuance of common shares, net of share issuance costs |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Settlement of restricted share unit awards |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Net loss and comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Balance, June 30, 2023 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

|

|

Common Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Shares |

|

|

Amount |

|

|

Additional Paid-In Capital |

|

|

Accumulated OCI |

|

|

Accumulated Deficit |

|

|

Total |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Balance, March 31, 2024 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

Issuance of common shares upon settlement of restricted share unit awards, net of shares withheld for tax |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Exercise of 2022 USD Financing Warrants |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Exercise of stock options |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Net loss and comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Balance June 30, 2024 |

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Balance, March 31, 2023 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

Issuance of common shares, net of share issuance costs |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Settlement of restricted share unit awards |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Net loss and comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Balance, June 30, 2023 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

See accompanying notes to unaudited condensed consolidated financial statements.

6

Mind Medicine (MindMed) Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In thousands)

|

|

Six Months |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Cash flows from operating activities |

|

|

|

|

|

|

||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

||

Stock-based compensation |

|

|

|

|

|

|

||

Amortization of intangible assets |

|

|

|

|

|

|

||

Change in fair value of 2022 USD Financing Warrants |

|

|

|

|

|

|

||

Gain on extinguishment of contribution payable |

|

|

( |

) |

|

|

— |

|

Unrealized foreign exchange |

|

|

|

|

|

( |

) |

|

Other non-cash adjustments |

|

|

|

|

|

|

||

Changes in operating assets and liabilities: |

|

|

|

|

|

|

||

Prepaid and other current assets |

|

|

( |

) |

|

|

|

|

Other noncurrent assets |

|

|

|

|

|

|

||

Accounts payable |

|

|

( |

) |

|

|

|

|

Accrued expenses |

|

|

( |

) |

|

|

|

|

Other liabilities, long-term |

|

|

( |

) |

|

|

( |

) |

Net cash used in operating activities |

|

|

( |

) |

|

|

( |

) |

Cash flows from financing activities |

|

|

|

|

|

|

||

Proceeds from the March Offering and Private Placement |

|

|

|

|

|

— |

|

|

Payment of issuance costs from the March Offering and Private Placement |

|

|

( |

) |

|

|

— |

|

Proceeds from credit facility |

|

|

|

|

|

— |

|

|

Payment of credit facility issuance costs |

|

|

( |

) |

|

|

— |

|

Proceeds from the 2022 ATM net of issuance costs |

|

|

|

|

|

|

||

Payment of deferred financing fees related to 2024 ATM |

|

|

( |

) |

|

|

— |

|

Proceeds from exercise of 2022 USD Financing Warrants |

|

|

|

|

|

— |

|

|

Proceeds from exercise of options |

|

|

|

|

|

— |

|

|

Withholding taxes paid on vested RSUs |

|

|

( |

) |

|

|

— |

|

Net cash provided by financing activities |

|

|

|

|

|

|

||

Effect of exchange rate changes on cash |

|

|

( |

) |

|

|

|

|

Net increase/(decrease) in cash and cash equivalents |

|

|

|

|

|

( |

) |

|

Cash and cash equivalents, beginning of period |

|

|

|

|

|

|

||

Cash and cash equivalents, end of period |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Supplemental Cash Flow Information |

|

|

|

|

|

|

||

Cash paid for interest |

|

$ |

|

|

$ |

- |

|

|

Supplemental Noncash Disclosures |

|

|

|

|

|

|

||

Conversion of 2022 USD Financing Warrants to common shares upon exercise of warrants |

|

$ |

|

|

$ |

- |

|

|

Unpaid issuance costs for the March Offering and Private Placement |

|

$ |

|

|

$ |

- |

|

|

Deferred financing fees related to 2024 ATM included in accrued expenses |

|

$ |

|

|

$ |

- |

|

|

Reclass of deferred financing fees related to 2022 ATM to additional paid-in capital |

|

$ |

|

|

$ |

- |

|

|

See accompanying notes to unaudited condensed consolidated financial statements.

7

Mind Medicine (MindMed) Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

(In thousands, except share and per share amounts)

Mind Medicine (MindMed) Inc. (the “Company” or “MindMed”) is incorporated under the laws of the Province of British Columbia. Its wholly owned subsidiaries, Mind Medicine, Inc. (“MindMed US”), HealthMode, Inc., MindMed Pty Ltd., and MindMed GmbH are incorporated in Delaware, Delaware, Australia and Switzerland respectively. MindMed US was incorporated on May 30, 2019.

MindMed is a clinical stage biopharmaceutical company developing novel product candidates to treat brain health disorders. The Company’s mission is to be the global leader in the development and delivery of treatments for brain health disorders that unlock new opportunities to improve patient outcomes. The Company is developing a pipeline of innovative product candidates, with and without acute perceptual effects, targeting neurotransmitter pathways that play key roles in brain health disorders. This specifically includes pharmaceutically optimized product candidates derived from the psychedelic and empathogen drug classes, including MM120 and MM402, the Company’s lead product candidates.

As of June 30, 2024, the Company had an accumulated deficit of $

As the Company continues its expansion, it may seek additional financing and/or strategic investments; however, there can be no assurance that any additional financing or strategic investments will be available to the Company on acceptable terms, if at all. If events or circumstances occur such that the Company does not obtain additional funding, it will most likely be required to reduce its plans and/or certain discretionary spending, which could have a material adverse effect on the Company’s ability to achieve its intended business objectives. The accompanying unaudited condensed consolidated financial statements do not include any adjustments that might be necessary if it were unable to continue as a going concern. Management believes that it has sufficient working capital on hand to fund operations through at least the next twelve months from the date of the issuance of these financial statements.

Emerging Growth Company Status

The Company is an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards issued subsequent to the enactment of the JOBS Act until such time as those standards apply to private companies. The Company has elected to use the extended transition period for complying with new or revised accounting standards, and as a result of this election, the unaudited condensed consolidated financial statements may not be comparable to companies that comply with public company Financial Accounting Standards Board (“FASB”) standards’ effective dates. The Company may take advantage of these exemptions up until the last day of the fiscal year following the fifth anniversary of the first sale of its common equity securities under an effective Securities Act of 1933 registration statement or such earlier time that it is no longer an emerging growth company.

In the opinion of management, these unaudited interim condensed consolidated financial statements reflect all adjustments necessary for a fair presentation of our financial position and results of operations and cash flows for the periods presented.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements should be read in conjunction with the audited financial statements and the related notes thereto for the year ended December 31, 2023, which are included in the Company’s 2023 Annual Report on Form 10-K filed with the SEC on February 28, 2024 (the “2023 Annual Report”). The Company’s significant accounting policies are disclosed in the audited financial statements for the periods ended December 31, 2023 and 2022, included in the 2023 Annual Report. Since the date of those financial statements, there have been no changes to the Company's significant accounting policies.

The accompanying unaudited condensed consolidated financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America (“U.S. GAAP”). Any reference in these notes to applicable guidance is meant to refer to the authoritative U.S. GAAP as found in the Accounting Standards Codification and as amended by Accounting

8

Standards Updates of FASB.

The preparation of financial statements in conformity with U.S. GAAP requires management to make a number of estimates and assumptions relating to the reporting of assets and liabilities and the disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of expenses during the reporting periods. Actual results could differ from those estimates under different assumptions or conditions.

Intercompany balances and transactions, and any unrealized income and expenses arising from intercompany transactions, are eliminated in preparing the unaudited condensed consolidated financial statements.

Foreign Currency

Prior to April 1, 2024, the Company’s functional currency was the Canadian dollar (“CAD”). Translation gains and losses from the application of the U.S. dollar (“USD”) as the reporting currency during the period that the Canadian dollar was the functional currency were included as part of cumulative currency translation adjustment, which is reported as a component of shareholders’ equity as accumulated other comprehensive income.

Following the Company’s voluntary delisting from Cboe Canada in April 2024, the Company reassessed its functional currency and determined that, as of April 1, 2024, its functional currency had changed from the CAD to the USD. The Company analysis included various factors, including: the Company’s cash flows and expenses denominated primarily in USD, and the primary market for the Company’s Common Shares trading in USD. The change in functional currency was accounted for prospectively from April 1, 2024, and the unaudited condensed consolidated financial statements prior to and including the period ended March 31, 2024 were not restated for the change in functional currency.

For periods commencing April 1, 2024, monetary assets and liabilities denominated in currencies other than USD are remeasured at period-end using the period-end exchange rate. Opening balances related to non-monetary assets and liabilities are based on prior period translated amounts, and non-monetary assets acquired, and non-monetary liabilities incurred after April 1, 2024, are translated at the approximate exchange rate prevailing at the date of the transaction. Income and expense accounts are translated at the average rates in effect during the fiscal year. Foreign exchange gains and losses are included in the unaudited condensed consolidated statements of operations and comprehensive loss.

Cash and Cash Equivalents

The Company considers all investments with an original maturity date at the time of purchase of three months or less to be cash and cash equivalents. As of June 30, 2024, the Company’s cash equivalents consisted of U.S. government money market funds at a high-credit quality and federally insured financial institution. The Company’s accounts, at times, may exceed federally insured limits. The Company had cash equivalents of $

Net Loss per Share

For the three month period ended June 30, 2024, the Company determined that the 2022 USD Financing Warrants had a dilutive impact to the calculation of net loss per share. As a result, the Company calculated diluted net loss per common share for the three months ended June 30, 2024 as follows:

|

|

Three Months |

|

|

|

|

2024 |

|

|

Numerator: |

|

|

|

|

Net loss attributable to common shareholders, basic |

|

$ |

( |

) |

Change in fair value of 2022 USD Financing Warrants |

|

|

( |

) |

Net loss attributable to common shareholders, diluted |

|

$ |

( |

) |

|

|

|

|

|

Denominator: |

|

|

|

|

Weighted-average shares used in computing net loss per share attributable |

|

|

|

|

Incremental shares from 2022 USD Financing Warrants |

|

|

|

|

Weighted-average shares used in computing net loss per share attributable |

|

|

|

|

9

The following potentially dilutive securities have been excluded from the calculation of diluted net loss per share due to their anti-dilutive effect:

|

Three Months |

|

|

Six Months |

|

||||||||||

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Options issued and outstanding under stock option plan |

|

|

|

|

|

|

|

|

|

|

|

||||

Restricted Share Units |

|

|

|

|

|

|

|

|

|

|

|

||||

CAD Compensation Warrants |

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

CAD Financing Warrants |

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Conversion Shares |

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

2022 USD Financing Warrants |

|

— |

|

|

|

|

|

|

|

|

|

|

|||

Total |

|

|

|

|

|

|

|

|

|

|

|

||||

Recently Issued Accounting Pronouncements

From time to time, new accounting pronouncements are issued by FASB or other standard setting bodies and adopted by the Company as of the specified effective date. Unless otherwise discussed, the impact of recently issued standards that are not yet effective will not have a material impact on the Company’s financial position, results of operations, or cash flows upon adoption.

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (“ASU 2023-07”). ASU 2023-07 requires disclosure of significant segment expenses that are regularly provided to the chief operating decision maker and included within the segment measure of profit or loss. This guidance will be applied retrospectively and is effective for annual reporting periods in fiscal years beginning after December 15, 2023, and interim reporting periods in fiscal years beginning after December 31, 2024. The Company does not expect implementation of the new guidance to have a material impact on its consolidated financial statements and disclosures.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (“ASU 2023-09"). ASU 2023-09 requires annual disclosures of specific categories in the rate reconciliation, additional information for reconciling items that meet a quantitative threshold and a disaggregation of income taxes paid, net of refunds. ASU 2023-09 also eliminates certain existing disclosure requirements related to uncertain tax positions and unrecognized deferred tax liabilities. ASU 2023-09 is effective for the annual reporting periods in fiscal years beginning after December 31, 2024. Early adoption is permitted. ASU 2023-09 should be applied prospectively. Retrospective adoption is permitted. The Company is currently assessing the impact this standard will have on the Company’s consolidated financial statements.

The following table presents information about the Company’s assets and liabilities measured at fair value on a recurring basis as of June 30, 2024 and December 31, 2023 (in thousands), and the fair value hierarchy of the valuation techniques utilized. The Company classifies its assets and liabilities as either short- or long-term based on maturity and anticipated realization dates.

|

|

June 30, 2024 |

|

|||||||||||||

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

Financial assets: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cash equivalents |

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

||

Financial liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Directors' Deferred Share Unit Liability |

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

||

2022 USD Financing Warrant Liability |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

$ |

|

||

|

|

December 31, 2023 |

|

|||||||||||||

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

Financial assets: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cash equivalents |

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

||

Financial liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Directors' Deferred Share Unit Liability |

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

||

2022 USD Financing Warrant Liability |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

$ |

|

||

There were

10

The fair value of the warrant liability is measured at fair value on a recurring basis. The warrants to purchase

|

|

As of June 30, 2024 |

|

As of December 31, 2023 |

Share price |

|

$ |

|

$ |

Expected volatility |

|

|

||

Risk-free rate |

|

|

||

Expected life |

|

|

Goodwill

During the six months ended June 30, 2024, the Company has made

Intangible assets, net

As of December 31, 2023, the Company’s developed technology intangible assets had a gross carrying value of $

Amortization expense included in research and development expense was $

11

At June 30, 2024 and December 31, 2023, accrued expenses consisted of the following (in thousands):

|

|

June 30, |

|

|

December 31, |

|

||

Accrued compensation |

|

$ |

|

|

$ |

|

||

Accrued clinical and manufacturing costs |

|

|

|

|

|

|

||

Professional services |

|

|

|

|

|

|

||

Directors' Deferred Share Unit Liability |

|

|

|

|

|

|

||

Other accruals |

|

|

|

|

|

|

||

Contribution payable |

|

|

- |

|

|

|

|

|

Total accrued expenses |

|

$ |

|

|

$ |

|

||

In June 2024, the Company made a lump sum payment of $

Common Shares

The Company is authorized to issue an unlimited number of Common Shares, which have

At-The-Market Facilities

2022 ATM

On May 4, 2022, the Company filed a shelf registration statement on Form S-3 (the “Registration Statement”). In connection with the filing of the Registration Statement, the Company also entered into a sales agreement (the “Prior Sales Agreement”) with Cantor Fitzgerald & Co. and Oppenheimer & Co. Inc. as sales agents (together, the “Prior Agents”), pursuant to which the Company may issue and sell Common Shares for an aggregate offering price of up to $

2024 ATM

On June 28, 2024, the Company filed a shelf registration statement on Form S-3 (the “2024 Registration Statement”), as well as an accompanying prospectus supplement (“New ATM Prospectus”). In connection with the filing of the 2024 Registration Statement and the New ATM Prospectus, the Company entered into a Sales Agreement (the "Sales Agreement") with Leerink Partners LLC (the “Agent”) pursuant to which the Company may issue and sell from time to time Common Shares for an aggregate offering price of up to $

The March Offering and Private Placement

On March 7, 2024, the Company entered into an underwriting agreement with Leerink Partners LLC and Cantor Fitzgerald & Co., as representatives of the underwriters named therein, in connection with the issuance and sale by the Company in an underwritten offering (the “March Offering”) of

12

The net proceeds to the Company from the March Offering were $

Also on March 7, 2024, the Company entered into a securities purchase agreement with certain investors, pursuant to which the investors agreed to purchase, and the Company agreed to sell

The net proceeds to the Company from the Private Placement were $

The Company intends to use the net proceeds from the March Offering and the Private Placement for (i) the research and development of the Company’s product candidates and (ii) working capital and general corporate purposes.

The March Offering and the Private Placement closed on March 11, 2024.

CAD Financing Warrants and CAD Compensation Warrants

Between 2020 through 2021, in conjunction with equity offerings, the Company issued units at varying prices per unit in CAD, with each unit comprised of one Common Share and one-half of one Common Share financing warrant (each whole warrant, a “CAD Financing Warrant”). The Company also issued compensation warrants to its underwriters (the “CAD Compensation Warrants”). All CAD Financing Warrants and the CAD Compensation Warrants expired as of

2022 USD Financing Warrants

On September 30, 2022, the Company closed an underwritten public offering of

The below table represents the activity associated with the Company's 2022 USD Financing Warrants for the six months ended June 30, 2024:

|

|

2022 USD Financing |

|

|

Balance at December 31, 2023 |

|

|

|

|

Exercised |

|

|

( |

) |

Expired |

|

|

|

|

Balance at June 30, 2024 |

|

|

|

|

Under the guidance in ASC 815-40, the Company's 2022 USD Financing Warrants do not meet the criteria for equity treatment. Therefore, the Company accounts for the 2022 USD Financing Warrants as liabilities and recognized them at fair value upon issuance and adjusts them to fair value at the end of each reporting period. Any change in fair value is recognized on the condensed consolidated statements of operations and comprehensive loss.

The below table summarizes the activity of the outstanding liability for the 2022 USD Financing Warrants for the six months ended June 30, 2024 (in thousands):

|

|

As of June 30, 2024 |

|

|

Balance at December 31, 2023 |

|

$ |

|

|

Warrant exercise |

|

|

( |

) |

Change in fair value of the warrant liability |

|

|

|

|

Balance at June 30, 2024 |

|

$ |

|

|

Stock Incentive Plan

Effective March 7, 2023, the Company amended the definitions of “Fair Market Value” and “Market Value” under the MindMed Stock Option Plan (the “Stock Option Plan”) and the Performance and Restricted Share Unit Plan (the “RSU Plan”), respectively, to be based upon the closing price of the Company's Common Shares as traded on the Nasdaq Stock Market on the last trading day on which Common Shares traded prior to the day on which an equity award is granted (the “Amendments”). This change is only applicable for equity compensation awards granted subsequent to the Amendments. Accordingly, stock options granted after

13

March 7, 2023 ("USD Options") are denominated in USD, and the grant date fair value of restricted share units granted after March 7, 2023 ("USD RSUs") is denominated in USD. The fair value of both USD Options and USD RSUs is based upon the closing price of the Company's Common Shares as traded on the Nasdaq Stock Market.

As of June 30, 2024, in conjunction with the voluntary Cboe Canada delisting on April 1, 2024, all of the Company's Common Shares are only traded on the Nasdaq Stock Market. All equity awards have their exercise prices denominated in USD based upon the USD value on the day on which the equity award was granted.

Stock Options

On February 27, 2020, the Company adopted the Stock Option Plan to advance the interests of the Company by providing employees, contractors and directors of the Company a performance incentive for continued and improved service with the Company. The Stock Option Plan sets out the framework for determining eligibility as well as the terms of any stock-based compensation granted.

The following table summarizes the Company’s stock option activity:

|

|

Number of Options |

|

|

Weighted Average Exercise Price |

|

|

Weighted Average Remaining Contractual Life (Years) |

|

|

Aggregate Intrinsic |

|

||||

Options outstanding at December 31, 2023 |

|

|

|

|

$ |

|

|

|

— |

|

|

$ |

— |

|

||

Issued |

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

||

Exercised |

|

|

( |

) |

|

|

|

|

|

— |

|

|

|

— |

|

|

Forfeited |

|

|

( |

) |

|

|

|

|

|

— |

|

|

|

— |

|

|

Expired |

|

|

( |

) |

|

|

|

|

|

— |

|

|

|

— |

|

|

Options outstanding at June 30, 2024 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

||||

Options vested and exercisable at June 30, 2024 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

||||

The expense recognized related to options was $

Restricted Share Units

The Company adopted the RSU Plan to advance the interests of the Company by providing employees, contractors and directors of the Company a performance incentive for continued and improved service with the Company. The RSU Plan sets out the framework for determining eligibility as well as the terms of any stock-based compensation granted. The RSU Plan was approved by the shareholders as part of the Arrangement. The fair value has been estimated based on the closing price of the Common Shares on the day prior to the grant.

|

|

Number of RSUs |

|

|

Weighted Average Grant Date Fair Value |

|

||

Balance at December 31, 2023 |

|

|

|

|

$ |

|

||

Granted |

|

|

|

|

|

|

||

Vested and issued |

|

|

( |

) |

|

|

|

|

Cancelled |

|

|

( |

) |

|

|

|

|

Balance at June 30, 2024 |

|

|

|

|

$ |

|

||

The expense recognized related to RSUs was $

14

Directors' Deferred Share Unit Plan

On April 16, 2021, the Company adopted the MindMed Director's Deferred Share Unit Plan (the "DDSU Plan"). The DDSU Plan sets out a framework to grant non-executive directors deferred share units (“DDSUs”) which are cash settled awards. Effective June 8, 2023, the Company amended the definition of “Fair Market Value” under the DDSU Plan to be based upon the volume weighted average trading price of the Company’s Common Shares as traded on the Nasdaq Stock Market for the five business days on which Common Shares are traded on Nasdaq immediately preceding the applicable date. This change is only applicable for DDSUs granted subsequent to June 8, 2023. Accordingly, DDSUs granted after June 8, 2023 are denominated in USD. The DDSU Plan states that the fair market value of one DDSU shall be equal to the volume weighted average trading price of a Common Share on the Nasdaq Stock Market for the five business days immediately preceding the valuation date. The DDSUs generally vest ratably over twelve months after grant and are settled within 90 days of the date the director ceases service to the Company.

For the six months ended June 30, 2024, stock-based compensation expense of $

Employee Share Purchase Plan

On April 16, 2024, the Company’s Board of Directors approved the Mind Medicine (MindMed) Inc. Employee Share Purchase Plan (the “ESPP”), subject to its approval by the Company’s shareholders. On June 10, 2024, the Company's shareholders approved the ESPP at the Company’s 2024 Annual General and Special Meeting of Shareholders. A total of

Stock-based Compensation Expense

Stock-based compensation expense for all equity arrangements for the three and six months ended June 30, 2024 and 2023 was as follows (in thousands):

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Research and development |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total share-based compensation expense |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

As of June 30, 2024, there was approximately $

As of June 30, 2024, the Company had obligations to make future payments, representing significant research and development contracts and other commitments that are known and committed in the amount of approximately $

The Company enters into research, development and license agreements in the ordinary course of business where the Company receives research services and rights to proprietary technologies. Milestone and royalty payments that may become due under various agreements are dependent on, among other factors, clinical trials, regulatory approvals and ultimately the successful development of a new drug, the outcome and timing of which are uncertain.

15

The Company periodically enters into research and license agreements with third parties that include indemnification provisions customary in the industry. These guarantees generally require the Company to compensate the other party for certain damages and costs incurred as a result of claims arising from research and development activities undertaken by or on behalf of the Company. In some cases, the maximum potential amount of future payments that could be required under these indemnification provisions could be unlimited. These indemnification provisions generally survive termination of the underlying agreement. The nature of the indemnification obligations prevents the Company from making a reasonable estimate of the maximum potential amount it could be required to pay. Historically, the Company has not made any indemnification payments under such agreements and no amount has been accrued in the unaudited condensed consolidated financial statements with respect to these indemnification obligations.

10. CREDIT FACILITY

On August 11, 2023 (the “Closing Date”), the Company and certain of its subsidiaries party thereto, as co-borrowers (together with the Company, the “Borrowers”) entered into a Loan and Security Agreement (the “Loan Agreement”) with K2 HealthVentures LLC (“K2HV”), as administrative agent and Canadian collateral agent for lenders thereunder (K2HV, together with any other lender from time to time, the "Lenders"), and Ankura Trust Company, LLC, as collateral trustee for the Lenders. The Loan Agreement provides for up to an aggregate principal amount of $

The Term Loan matures on

The Lenders may elect at any time following the Closing Date and prior to the full repayment of the Term Loan to convert any portion of the principal amount of the term loans then outstanding, up to an aggregate principal amount of $

The Loan Agreement contains customary representations and warranties and affirmative and negative covenants, including covenants that limit or restrict the Company's ability to, among other things: dispose of assets; make changes to the Company's business, management, ownership or business locations; merge or consolidate; incur additional indebtedness, encumbrances or liens; pay dividends or other distributions or repurchase equity; make investments; and enter into certain transactions with affiliates, in each case subject to certain exceptions. The Company is in compliance with the Loan Agreement as of June 30, 2024.

The Company recorded $

Future expected repayments of principal amount due on the credit facility as of June 30, 2024 are as follows (in thousands):

Remainder of 2024 |

|

$ |

- |

|

2025 |

|

|

- |

|

2026 |

|

|

|

|

2027 |

|

|

|

|

Total principal repayments |

|

$ |

|

|

Unamortized debt issuance costs |

|

|

( |

) |

Total credit facility, non-current, net |

|

$ |

|

As of June 30, 2024, the Company estimated the fair value of the credit facility to be $

16

million of principal is converted into Conversion Shares.

11. SUBSEQUENT EVENTS

On August 9, 2024, the Company entered into an underwriting agreement with Leerink Partners LLC and Evercore Group L.L.C., as representatives of the several underwriters named therein, in connection with an underwritten public offering (the “August Offering”) of (i)

The net proceeds to the Company from the August Offering are expected to be approximately $

The Company intends to use the net proceeds from the August Offering to fund the research and development of its product candidates and for working capital and general corporate purposes.

The Pre-Funded Warrants are exercisable at any time after the date of issuance. The exercise price and the number of Pre-Funded Warrant Shares are subject to appropriate adjustment in the event of certain share dividends and distributions, share splits, share combinations, reclassifications or similar events affecting the Common Shares as well as upon any distribution of assets, including cash, securities or other property, to the Company’s shareholders. The Pre-Funded Warrants will not expire and are exercisable in cash or by means of a cashless exercise. A holder of Pre-Funded Warrants may not exercise such Pre-Funded Warrants if the aggregate number of Common Shares beneficially owned by such holder, together with its affiliates, would exceed more than

17

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion should be read in conjunction with the unaudited condensed consolidated financial statements and notes thereto included elsewhere in this Quarterly Report. This Quarterly Report, including the following sections, contains forward-looking statements. These statements are subject to risks and uncertainties that could cause actual results and events to differ materially from those expressed or implied by such forward-looking statements. For a detailed discussion of these risks and uncertainties, see Item 1A “Risk Factors” in our 2023 Annual Report and this Quarterly Report. See also “Special Note Regarding Forward-Looking Statements.” We caution the reader not to place undue reliance on these forward-looking statements, which reflect management’s analysis only as of the date of this Quarterly Report. We undertake no obligation to update forward-looking statements, which reflect events or circumstances occurring after the date of this Quarterly Report.

Our U.S. GAAP accounting policies are referred to in Note 2 of the Unaudited Condensed Consolidated Financial Statements in this Quarterly Report as well as the Consolidated Financial Statements included in our 2023 Annual Report. All amounts are in U.S. dollars, unless otherwise indicated.

Overview

We are a clinical stage biopharmaceutical company developing novel product candidates to treat brain health disorders. Our mission is to be the global leader in the development and delivery of treatments for brain health disorders that unlock new opportunities to improve patient outcomes. We are developing a pipeline of innovative product candidates, with and without acute perceptual effects, targeting neurotransmitter pathways that play key roles in brain health disorders. This specifically includes pharmaceutically optimized product candidates derived from the psychedelic and empathogen drug classes including MM120 and MM402, our lead product candidates.

Our lead product candidate, MM120, is a proprietary, pharmaceutically optimized form of lysergide D-tartrate that we are developing for the treatment of generalized anxiety disorder (“GAD”). We have also evaluated MM120 in a subperceptual repeat administration dosing regimen for the treatment of attention deficit hyperactivity disorder (“ADHD”). In December 2023, we announced positive topline results from our Phase 2b clinical trial of MM120 for the treatment of GAD. The trial met its primary endpoint, with MM120 demonstrating statistically significant and clinically meaningful dose-dependent improvements on the Hamilton Anxiety rating scale compared to placebo at Week 4. In January 2024, we announced that our Phase 2a trial of a sub-perceptual dose of MM120 in ADHD did not meet its primary endpoint. In conjunction with the findings from our clinical trial of MM120 in GAD, we believe that these results support the critical role of perceptual effects of MM120 in mediating a clinical response. In March 2024, we announced that the FDA granted breakthrough designation to our MM120 program for the treatment of GAD. We also announced in March 2024 that our Phase 2b trial of MM120 in GAD met its key secondary endpoint, and 12-week topline data demonstrated clinically and statistically significant durability of activity observed through Week 12.

On June 20, 2024, we announced the completion of our End-of-Phase 2 meeting with the FDA, supporting the advancement of MM120 into pivotal trials for the treatment of adults with GAD. Our Phase 3 clinical program for MM120 ODT is expected to consist of two clinical trials: the Voyage Study (MM120-300) and the Panorama Study (MM120-301). Both studies are comprised of two parts: Part A, which is a 12-week, randomized, double-blind, placebo-controlled, parallel group study assessing the efficacy and safety of MM120 ODT versus placebo; and Part B, which is a 40-week extension study during which participants will be eligible for open-label treatment with MM120, subject to certain conditions for re-treatment eligibility. The Voyage Study is anticipated to enroll approximately 200 participants (randomized 1:1 to receive MM120 ODT 100 µg or placebo) and the Panorama Study is anticipated to enroll approximately 240 participants (randomized 5:2:5 to receive MM120 ODT 100 µg, MM120 ODT 50 µg or placebo). We expect both studies will utilize an adaptive study design with a blinded interim sample size re-estimation, allowing for an increase in sample size by up to 50% in each study in the case of certain parameters. We expect the primary endpoint for each study is the change from baseline in Hamilton Anxiety Rating Scale (HAM-A) score at Week 12 between MM120 ODT 100 µg and placebo. We expect to initiate the Voyage Study in the second half of 2024 with an anticipated topline readout (Part A results) in the first half of 2026 and we expect to initiate the Panorama Study in the first half of 2025 with an anticipated topline readout (Part A results) in the second half of 2026. Both studies are subject to ongoing regulatory review and discussions, which could result in changes to study design, including of the Phase 3 clinical trials.

In addition to our Phase 3 clinical program for GAD, we are developing MM120 for the treatment of Major Depressive Disorder (“MDD”). In the first quarter of 2024, we held a pre-IND meeting with FDA to discuss the initiation of our MM120 MDD program and the study design for our planned Emerge Study (MM120-310), which like our pivotal studies in GAD is comprised of two parts: Part A, which is a 12-week, randomized, double-blind, placebo-controlled, parallel group study assessing the efficacy and safety of MM120 ODT versus placebo; and Part B, which is a 40-week extension study during which participants will be eligible for open-label treatment with MM120, subject to certain conditions for re-treatment eligibility. The Emerge Study is anticipated to enroll at least 140 participants (randomized 1:1 to receive MM120 ODT 100 µg or placebo). The primary endpoint is the change from baseline in Montgomery Åsberg Depression Rating Scale (MADRS) score at Week 6 between MM120 ODT 100 µg and placebo. We expect to initiate the Emerge Study in the first half of 2025 with an anticipated topline readout (Part A results) in the second half of 2026.

18

In addition to the findings from our Phase 2b trial on comorbid depressive symptoms in GAD patients, additional evidence for the potential of lysergide in the treatment of MDD is available from a double-blind, investigator-initiated trial of lysergide in participants with MDD conducted by our collaborators at University Hospital Basel (“UHB”). In this trial, 61 participants were randomized to receive one of two treatment regimens of lysergide. Each regimen consisted of two treatment sessions separated by four weeks. In the high-dose regimen, participants received 100 µg in their first dosing session and either 100 µg or 200 µg in their second dosing session. In the control regimen, participants received 25 µg in each dosing session. The high-dose regimen (n=28) demonstrated statistically and clinically significant improvements on the primary endpoint, which was the change in clinician-rated Inventory of Depressive Symptomatology – Clinical Rating (“IDS-C”) scores six weeks after the first treatment session compared to the control regimen (n=27). Participants in the high-dose regimen demonstrated a least square mean change from baseline in IDS-C scores of -12.9 points compared to -3.6 points in the control regimen (p=0.05). The statistically significant benefit measured by IDS-C was maintained up to 16 weeks after the first session of the high-dose regimen compared to the control-dose regimen (p=0.01). According to the results reported by UHB, lysergide was generally well-tolerated in the trial, as indicated by adverse events, vital signs, and laboratory values. UHB reported four serious adverse events (“SAEs”) during the trial, three of which were determined to be “possibly related” to the treatment. These SAEs were two hospitalizations due to worsening depression in the control regimen and one in the high-dose regimen. UHB noted that a participant in the control regimen who withdrew from the trial after such participant’s first session died of suicide seven months later. No treatment association was suspected and this was not reported as an SAE because it occurred after the participant withdrew from the trial. Secondary outcome measures for the trial included improvements in the self-rated version of the Inventory of Depressive Symptomatology – Self Report (IDS-SR), Beck Depression Inventory (BDI), and State-Trait Anxiety Inventory (STAI-G), along with other psychiatric symptom assessments. Participants were followed for up to 16 weeks following the first treatment session.

Our second lead product candidate, MM402, also referred to as R(-)-MDMA, is our proprietary form of the R-enantiomer of 3,4-methylenedioxymethamphetamine (“MDMA”), which we are developing for the treatment of autism spectrum disorder (“ASD”). MDMA is a synthetic molecule that is often referred to as an empathogen because it is reported to increase feelings of connectedness and compassion. Preclinical studies of R(-)-MDMA demonstrated its acute pro-social and empathogenic effects, while its diminished dopaminergic activity suggests that it has the potential to exhibit less stimulant activity, neurotoxicity, hyperthermia and abuse liability compared to racemic MDMA or the S(+)-enantiomer. In the third quarter of 2022, UHB began conducting a Phase 1 investigator-initiated trial (“IIT”) of R(-)-MDMA, S(+)-MDMA and R/S-MDMA in healthy volunteers to compare the tolerability, pharmacokinetics and acute subjective, physiological and endocrine effects of the three molecules. On June 6, 2024, UHB presented topline data from the trial at the Interdisciplinary Conference on Psychedelic Research in The Netherlands. The presentation noted that the trial indicates that R(-)-MDMA, S(+)-MDMA and R/S-MDMA induced overall similar qualitative subjective and adverse effects when dosed equivalently. The presentation also noted that S(+)-MDMA may have slightly greater stimulant like properties than R/S-MDMA and R(-)-MDMA. The pharmacokinetic findings from the trial indicate that R(-)-MDMA, but not S(+)-MDMA, inhibits the Cytochrome P450 2D6 enzyme (CYP2D6), which is the primary metabolic pathway for MDMA inactivation, and thereby its own inactivation and that of S(+)-MDMA when administered as R/S-MDMA. In addition, we have initiated our first clinical trial of MM402, a single-ascending dose trial in adult healthy volunteers in the fourth quarter of 2023. This Phase 1 clinical trial is intended to characterize the tolerability, pharmacokinetics and pharmacodynamics of MM402.

Beyond our clinical stage product candidates, we are pursuing a number of programs, primarily through external collaborations, through which we seek to expand our drug development pipeline and broaden the potential applications of our lead product candidates. These research and development programs include non-clinical, pre-clinical and human clinical trials and IITs of additional product candidates and research compounds with our collaborators. Our external research programs include a broad multi-year exclusive research partnership with UHB in Switzerland. We also have an ongoing partnership agreement with MindShift Compounds AG to develop next-generation compounds utilizing the molecular backbone of classical psychedelics and empathogens. Our research partnerships and IITs facilitate the advancement of our early-stage pipeline and support the potential identification of product candidates for additional company-sponsored drug development programs.

Our drug development program is complemented by digital medicine projects to develop products intended to help facilitate the adoption and scalability of our product candidates, if and when they are approved. Our digital medicine projects and product roadmaps strategies, and investments are based on the projected development and commercialization strategies of our product candidates, with timelines and investments for each project contingent on the progression of the related drug program.

Our business is premised on a growing body of research supporting the use of novel psychoactive compounds to treat a myriad of brain health disorders. For all product candidates, we intend to proceed through research and development, and with marketing of the product candidates that may ultimately be approved pursuant to the regulations of the FDA and the legislation in other jurisdictions. This entails, among other things, conducting clinical trials with research scientists, using internal and external clinical drug development teams, producing and supplying drugs according to current Good Manufacturing Practices, and conducting all trials and development in accordance with the regulations of the FDA, and other legislation in other jurisdictions.

19

We were incorporated under the laws of the Province of British Columbia. Our wholly owned subsidiary, Mind Medicine, Inc. (“MindMed US”) was incorporated in Delaware. Prior to February 27, 2020, our operations were conducted through MindMed US.

Since inception, we have incurred losses while advancing the research and development of our products and processes. Our net losses were $5.9 million and $60.3 million for the three and six months ended June 30, 2024, respectively, and $29.1 million and $53.9 million for the three and six months ended June 30, 2023, respectively. As of June 30, 2024, we had an accumulated deficit of $350.5 million and cash and cash equivalents of $243.1 million.

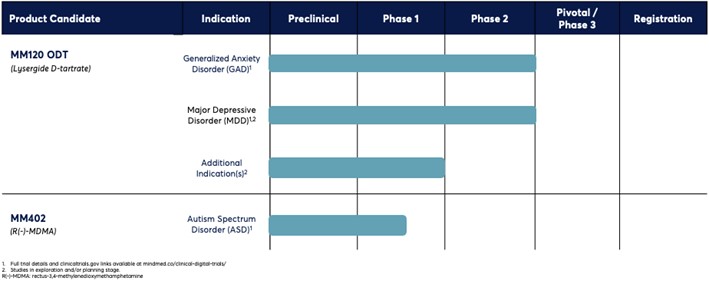

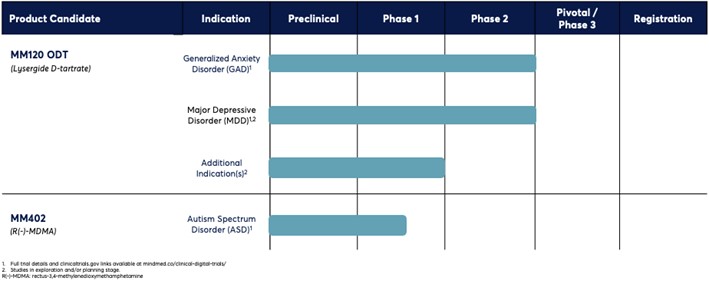

Our Product Candidate Pipeline

The following table summarizes the status of our portfolio of product candidates:

Recent Developments

Underwritten Public Offering

On August 9, 2024, we entered into an underwriting agreement with Leerink Partners LLC and Evercore Group L.L.C., as representatives of the several underwriters named therein, in connection with an underwritten public offering (the “August Offering”) of (i) 9,285,511 common shares (the “Shares”), no par value per share (“Common Shares”), and (ii) to certain investors, pre-funded warrants (the “Pre-Funded Warrants”) to purchase 1,428,775 Common Shares (the “Pre-Funded Warrant Shares”). The offering price for the Shares was $7.00 per share, less underwriting discounts and commissions. The offering price for the Pre-Funded Warrants was $6.999 per Pre-Funded Warrant, which represents the per share public offering price for the Shares less a $0.001 per share exercise price for each such Pre-Funded Warrant.

The net proceeds from the August Offering are expected to be approximately $70.0 million, after deducting underwriting discounts and commissions and other estimated offering expenses payable by us. The August Offering closed on August 12, 2024.

We intend to use the net proceeds from the August Offering to fund the research and development of our product candidates and for working capital and general corporate purposes.

The Pre-Funded Warrants are exercisable at any time after the date of issuance. The exercise price and the number of Pre-Funded Warrant Shares are subject to appropriate adjustment in the event of certain share dividends and distributions, share splits, share combinations, reclassifications or similar events affecting the Common Shares as well as upon any distribution of assets, including cash, securities or other property, to our shareholders. The Pre-Funded Warrants will not expire and are exercisable in cash or by means of a cashless exercise. A holder of Pre-Funded Warrants may not exercise such Pre-Funded Warrants if the aggregate number of Common Shares beneficially owned by such holder, together with its affiliates, would exceed more than 4.99% or 9.99% (at the initial election of the holder) of the number of Common Shares outstanding following such exercise, as such percentage ownership is determined in accordance with the terms of the Pre-Funded Warrants. A holder of Pre-Funded Warrants may increase or decrease this percentage not in excess of 19.99% by providing at least 61 days’ prior notice to us.

20

At-the-Market Offering

On June 28, 2024, we entered into a Sales Agreement (the “Sales Agreement”) with Leerink Partners LLC (the “Agent”) to create an at-the-market equity program under which the Company from time to time may offer and sell our Common Shares of the Company (the “ATM Shares”), through or to the Agent. We filed a prospectus supplement on June 28, 2024 allowing for up to $150.0 million of Common Shares to be sold under the Sales Agreement.

Subject to the terms and conditions of the Sales Agreement, the Agent will use its commercially reasonable efforts to sell the ATM Shares from time to time, based upon our instructions. We have provided the Agent with customary indemnification rights, and the Agent will be entitled to a commission of up to 3.0% of the aggregate gross proceeds from each sale of the ATM Shares effectuated through or to the Agent.

Sales of the ATM Shares, if any, under the Sales Agreement may be made in transactions that are deemed to be “at the market offerings” as defined in Rule 415 under the Securities Act. We have no obligation to sell any of the ATM Shares and may at any time suspend offers under the Sales Agreement or terminate the Sales Agreement.

Voluntary CBOE Canada Delisting

Effective April 10, 2024, we voluntarily delisted our common shares from Cboe Canada. Our common shares will continue to trade on Nasdaq under the symbol “MNMD”.

Components of Operating Results

Operating Expenses

Research and Development