UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Mind Medicine (MindMed) Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

MindMed Releases Investor Presentation Highlighting How the Company is Unlocking the Power of Psychedelics for Patients and Shareholders

Details Why MindMed’s Ideally Qualified Nominees Are the Right Choice to Oversee the Company’s Strategic Execution as it Approaches First Clinical Data Readouts Later this Year

Urges Shareholders to Protect Their Investments and Vote on the WHITE Universal Proxy Card for ALL SIX of the Board’s Nominees

NEW YORK – May 25, 2023 – Mind Medicine (MindMed) Inc. (NASDAQ: MNMD), (NEO: MMED), (the “Company” or “MindMed”) today announced that it has released an investor presentation in connection with its 2023 Annual Meeting of Shareholders. The presentation details how under the guidance of MindMed’s world-class Board of Directors the Company is executing against a well-defined plan to createvalue – with two Phase 2 clinical readouts for lead product candidate MM-120 (LSD D-tartrate) expected in late 2023. MindMed urges all shareholders to vote "FOR" the Company's six highly qualified director nominees using the WHITE universal proxy card at the upcoming Annual Meeting, scheduled for June 15, 2023.

The presentation is available at www.ProtectMindMed.com or on the investor relations section of the Company’s website.

Robert Barrow, Chief Executive Officer and Director of MindMed, stated: “MindMed is at a pivotal inflection point. As we approach our first clinical trial readouts, we are well-positioned to address multiple areas of unmet need for patients and to generate value for our shareholders. All six of our director nominees are proven – with significant experience serving on public company boards and in executive roles in the healthcare industry. If our nominees are elected, our Board will also be 100% refreshed since mid-2021. Most importantly, this group has the right expertise in the areas critical to MindMed’s success: drug development and commercialization; financial management and capital allocation; and corporate governance and compliance.

FCM’s proposals for the Company lack credibility, are based on faulty assumptions and spreadsheet math, and would expose shareholders to significant risk. Electing any of FCM’s candidates could derail our progress at the worst possible time. FCM’s candidates simply do not possess the right experience or backgrounds – especially in comparison to MindMed’s nominees.

In our view, the choice for shareholders is clear. We encourage you to protect your investment in MindMed by voting for all six of the Company’s nominees on the WHITE card today.”

VISIT WWW.PROTECTMINDMED.COM FOR MORE INFORMATION

Due to new U.S. federal rules requiring us to list FCM’s nominees in addition to the Board’s nominees, your WHITE proxy card this year has more names on it than the six directors to be elected. The inclusion of FCM’s nominees on our WHITE proxy card does NOT mean the Board endorses them.

Vote TODAY on the WHITE proxy card FOR all six of the Board’s nominees, WITHHOLD on FCM’s nominees and FOR the other proposals recommended by your Board.

You can help reject FCM’s efforts to take control of the Board by discarding any blue proxy cards and materials you may receive from FCM.

Shareholders will receive proxy materials directly via the preferred method, hard copy or email, specific to each shareholder’s account. If you have any questions, or need assistance voting your shares, please contact the firm assisting us in the solicitation of proxies:

Morrow Sodali LLC

509 Madison Avenue, Suite 1206

New York, NY 10022

Banks and Brokers Call: (203) 658-9400

Shareholders Call Toll Free: (800) 662-5200

Email: MNMD@investor.morrowsodali.com

Shareholders that do not receive proxy materials should contact your broker and request the WHITE voting control number or contact Morrow Sodali.

About MindMed

MindMed is a clinical stage biopharmaceutical company developing novel product candidates to treat brain health disorders. Our mission is to be the global leader in the development and delivery of treatments that unlock new opportunities to improve patient outcomes. We are developing a pipeline of innovative product candidates, with and without acute perceptual effects, targeting neurotransmitter pathways that play key roles in brain health disorders.

MindMed trades on NASDAQ under the symbol MNMD and on the Canadian NEO Exchange under the symbol MMED.

Cautionary Notes and Forward-Looking Statements

Certain statements in this press release related to the Company constitute “forward-looking information” within the meaning of applicable securities laws and are prospective in nature. Forward-looking information is not based on historical facts, but rather on current expectations and projections about future events and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. These statements generally can be identified by the use of forward-looking words such as “will”, “may”, “should”, “could”, “intend”, “estimate”, “plan”, “anticipate”, “expect”, “believe”, “potential” or “continue”, or the negative thereof or similar variations. Undue reliance should not be placed on forward-looking information, which are inherently uncertain, are based on estimates and assumptions, and are subject to known and unknown risks and uncertainties (both general and specific) that contribute to the possibility that the future events or circumstances contemplated by the forward-looking statements will not occur. There can be no assurance that the plans, intentions or expectations upon which forward-looking statements are based will in fact be realized. Forward-looking information in this press release includes, but is not limited to, statements regarding the potential benefits and development of the Company’s product candidates, trials, studies and programs; the strengths and benefits of the Company’s strategic plan; the Company’s business plans and objectives; the ability of MindMed to achieve success consistent with management’s expectations; and the expected impact and results of the Company’s corporate governance practices, including of the Company’s director nominees.

Forward-looking information is based on the opinions and estimates of management of the Company at the date the statements are made, as well as a number of assumptions made by, and information currently available to, the Company concerning, among other things, anticipated performance of its product candidates and programs, business prospects, strategies, regulatory developments, the development of its product candidates into effective products, the ability to produce products if approved, the approval by regulators of any products that are developed, and the non-occurrence of the risks and uncertainties outlined below or other significant events occurring outside of MindMed’s normal course of business. Although management of the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

There are numerous risks and uncertainties that could cause actual results and the Company’s plans and objectives to differ materially from those expressed in the forward-looking information, including history of negative cash flows; limited operating history; incurrence of future losses; availability of additional capital; changes in market conditions; lack of product revenue; compliance with laws and regulations; changes in government policy; difficulty associated with research and development; risks associated with clinical trials or studies; heightened regulatory scrutiny; early stage product development; clinical trial risks; regulatory approval processes; novelty of the psychedelic inspired medicines industry; as well as those risk factors discussed or referred to herein and the risks described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2023 under headings such as “Special Note Regarding Forward-Looking Statements,” and “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other filings and furnishings made by the Company with the securities regulatory authorities in all provinces and territories of Canada which are available under the Company’s profile on SEDAR at www.sedar.com and with the U.S. Securities and Exchange Commission (“SEC”) on EDGAR at www.sec.gov. Except as required by law, the Company undertakes no duty or obligation to update any forward-looking statements contained in this press release as a result of new information, future events, changes in expectations or otherwise.

Additional Information and Where to Find It

MindMed has filed with the SEC and Canadian securities regulatory authorities on May 1, 2023 a definitive proxy statement on Schedule 14A (the “proxy statement”), containing a form of WHITE universal proxy card, with respect to its solicitation

of proxies for the annual general meeting of shareholders of MindMed on June 15, 2023 (the “Annual Meeting”). Details concerning the nominees of MindMed’s Board for election at MindMed’s Annual Meeting are included in the proxy statement. This press release is not a substitute for the proxy statement or other document that MindMed has filed or may file with the SEC and Canadian securities regulatory authorities in connection with any solicitation by MindMed.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND THE ACCOMPANYING WHITE UNIVERSAL PROXY CARD) FILED BY MINDMED AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC AND CANADIAN SECURITIES REGULATORS WHEN THEY BECOME AVAILABLE CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MINDMED AND ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC and Canadian securities regulatory authorities by MindMed free of charge through the website maintained by the SEC at www.sec.gov or through the Company’s profile on SEDAR at www.sedar.com. Copies of the documents filed by MindMed are also available free of charge by accessing MindMed’s website at www.mindmed.co.

Participants in the Solicitation

This press release is neither a solicitation of a proxy or consent nor a substitute for any proxy statement or other filings that may be made with the SEC and Canadian securities regulatory authorities. Nonetheless, MindMed, its directors and executive officers and other members of management and employees may be deemed under U.S. securities laws and Canadian securities laws to be participants in the solicitation of proxies with respect to a solicitation by MindMed. Information about MindMed’s executive officers and directors and other participants in the solicitation, including their respective interests, by security holders or otherwise, is available in the proxy statement. To the extent holdings of MindMed securities reported in the proxy statement for the Annual Meeting have changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC and if applicable, on the System for Electronic Disclosure by Insiders (SEDI) in accordance with insider reporting requirements of Canadian securities laws. These documents are or will be available free of charge at the SEC’s website at www.sec.gov and either through the Company’s profile on SEDAR at www.sedar.com or updated filings on SEDI at www.sedi.ca.

Contacts

For Media:

media@mindmed.co

OR

Longacre Square Partners

Joe Germani / Dan Zacchei

mindmed@longacresquare.com

For Investors:

ir@mindmed.co

OR

Morrow Sodali

Michael Verrechia / Eric Kamback

MNMD@investor.morrowsodali.com

Mindmed Unlocking the Power of Psychedelics for Patients and Shareholders may 2023

Disclaimer Cautionary Notes and Forward-Looking Statements Certain statements in this presentation related to Mind Medicine (MindMed) Inc. (the “Company” or “MindMed”) constitute “forward-looking information” within the meaning of applicable securities laws and are prospective in nature. Forward-looking information is not based on historical facts, but rather on current expectations and projections about future events and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. These statements generally can be identified by the use of forward-looking words such as “will”, “may”, “should”, “could”, “intend”, “estimate”, “plan”, “anticipate”, “expect”, “believe”, “potential” or “continue”, or the negative thereof or similar variations. Undue reliance should not be placed on forward-looking information, which are inherently uncertain, are based on estimates and assumptions, and are subject to known and unknown risks and uncertainties (both general and specific) that contribute to the possibility that the future events or circumstances contemplated by the forward-looking statements will not occur. There can be no assurance that the plans, intentions or expectations upon which forward-looking statements are based will in fact be realized. Forward-looking information in this presentation includes, but is not limited to, statements regarding the potential benefits and development of the Company’s product candidates, trials, studies and programs; the strengths and benefits of the Company’s strategic plan; the Company’s business plans and objectives; the ability of MindMed to achieve success consistent with management’s expectations; and the expected impact and results of the Company’s corporate governance practices, including of the Company Board’s director nominees. Forward-looking information is based on the opinions and estimates of management of the Company at the date the statements are made, as well as a number of assumptions made by, and information currently available to, the Company concerning, among other things, anticipated performance of its product candidates and programs, business prospects, strategies, regulatory developments, the development of its product candidates into effective products, the ability to produce products if approved, the approval by regulators of any products that are developed, and the non-occurrence of the risks and uncertainties outlined below or other significant events occurring outside of MindMed’s normal course of business. Although management of the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect. There are numerous risks and uncertainties that could cause actual results and the Company’s plans and objectives to differ materially from those expressed in the forward-looking information, including history of negative cash flows; limited operating history; incurrence of future losses; availability of additional capital; changes in market conditions; lack of product revenue; compliance with laws and regulations; changes in government policy; difficulty associated with research and development; risks associated with clinical trials or studies; heightened regulatory scrutiny; early stage product development; clinical trial risks; regulatory approval processes; novelty of the psychedelic inspired medicines industry; as well as those risk factors discussed or referred to herein and the risks described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2023 under headings such as “Special Note Regarding Forward-Looking Statements,” and “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other filings and furnishings made by the Company with the securities regulatory authorities in all provinces and territories of Canada which are available under the Company’s profile on SEDAR at www.sedar.com and with the U.S. Securities and Exchange Commission (“SEC”) on EDGAR at www.sec.gov. Except as required by law, the Company undertakes no duty or obligation to update any forward-looking statements contained in this presentation as a result of new information, future events, changes in expectations or otherwise. Additional Information and Where to Find It MindMed has filed with the SEC and Canadian securities regulatory authorities on May 1, 2023 a definitive proxy statement on Schedule 14A (the “proxy statement”), containing a form of WHITE universal proxy card, with respect to its solicitation of proxies for the annual general meeting of shareholders of MindMed on June 15, 2023 (the “Annual Meeting”). Details concerning the nominees of MindMed’s Board for election at MindMed’s Annual Meeting are included in the proxy statement. This presentation is not a substitute for the proxy statement or other document that MindMed has filed or may file with the SEC and Canadian securities regulatory authorities in connection with any solicitation by MindMed. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND THE ACCOMPANYING WHITE UNIVERSAL PROXY CARD) FILED BY MINDMED AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC AND CANADIAN SECURITIES REGULATORS WHEN THEY BECOME AVAILABLE CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MINDMED AND ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC and Canadian securities regulatory authorities by MindMed free of charge through the website maintained by the SEC at www.sec.gov or through the Company’s profile on SEDAR at www.sedar.com. Copies of the documents filed by MindMed are also available free of charge by accessing MindMed’s website at www.mindmed.co. Participants in the Solicitation This presentation is neither a solicitation of a proxy or consent nor a substitute for any proxy statement or other filings that may be made with the SEC and Canadian securities regulatory authorities. Nonetheless, MindMed, its directors and executive officers and other members of management and employees may be deemed under U.S. securities laws and Canadian securities laws to be participants in the solicitation of proxies with respect to a solicitation by MindMed. Information about MindMed’s executive officers and directors and other participants in the solicitation, including their respective interests, by security holders or otherwise, is available in the proxy statement. To the extent holdings of MindMed securities reported in the proxy statement for the Annual Meeting have changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC and if applicable, on the System for Electronic Disclosure by Insiders (SEDI) in accordance with insider reporting requirements of Canadian securities laws. These documents are or will be available free of charge at the SEC’s website at www.sec.gov and either through the Company’s profile on SEDAR at www.sedar.com or updated filings on SEDI at www.sedar.ca.

MindMed 01 Executive summary 02 MindMed is successfully executing to achieve key milestones and deliver value 03 MindMed has world-class leadership and strong corporate governance practices 04 None of FCM’s nominees would be additive to the Board 05 FCM’s ideas are not viable and would expose shareholders to significant risk 06 FCM has not engaged in good faith 07 Conclusion Table of Contents 3

MindMed at a Glance: A Global Leader in Brain Health MindMed uses industry-leading drug development expertise to unlock the full therapeutic potential of psychedelics and other novel therapeutic targets Advancing Proprietary Drug Candidates Across Psychiatric Indications MM-120 Generalized Anxiety Disorder (GAD) & Attention-Deficit/Hyperactivity Disorder (ADHD) Well-characterized pharmacology Accelerated development potential MM-120 LSD D- tartrate MM-402 Autism Spectrum Disorder (ASD) Enhanced pharmacology Potential to overcome safety liabilities Standard delivery / dosing model MM-402 R(-)MDMA MindMed by the Numbers 2 Clinical readouts expected this year 48 Full-time employees ~$36M Invested in R&D in 2022 4.

Logo Executive Summary MINDMED’S STRATEGY MINDMED’S BOARD FCMExecuting a well-defined plan to create value by developing novel product candidates to treat brain health disorders At a pivotal inflection point – with two Phase 2 clinical readouts for MM-120 expected in 2023 Well-capitalized, with cash on hand of $129 million as of the end of Q1 2023 – sufficient to fund operations beyond key development milestones in 2023 and into the first half of 2025 A diverse set of nominees who have relevant backgrounds and expertise in the areas critical to MindMed’s success: drug development and commercialization; financial management and capital allocation; and corporate governance and compliance Highly respected professionals with significant public company board and executive level experience in the healthcare/biopharma industry New nominee David Gryska – former CFO of two S&P 500 pharma companies – will further strengthen the Board with deep financial and public company director experience FCM has no track record of shareholder value creation, does not manage any institutional capital and is led by a college student who tried to turn MindMed into a meme stock for FCM’s own gain FCM’s ideas lack credibility, are based on faulty assumptions and would expose shareholders to significant risk by creating disruption at a critical time FCM’s myriad false statements and troubling actions call into question its nominees’ fitness for the Board 26 pending U.S. patent applications 3 product candidates in R&D pipeline $129M cash on hand as of end of Q1 2023 100% Board refreshment since September 2021FCM CANDIDATES No credible strategic plan for the Company No significant public healthcare company board or executive officer experience or gender diversity No meaningful experience overseeing clinical trials in psychiatry or psychedelics or commercialization of pharmaceutical products *New independent director nominee 5.

Logo MindMed is at a Pivotal Inflection Point We anticipate the following key milestones in 2023: Topline results from Phase 2b study of MM-120 for the treatment of Generalized Anxiety Disorder Topline results from Phase 2a proof-of-concept trial of repeated low-dose MM-120 in ADHD Preclinical results demonstrating the potential of MM-402 in autism spectrum disorder and initiation of our first sponsored clinical trial of MM-402FCM’s costly and distracting proxy contest comes at the worst possible time for shareholders 6.

Logo We Have Refocused Our Strategic Priorities Since Rob Barrow became CEO in mid-2021, MindMed has: Recruited a seasoned management team with a track record in research, development and commercialization in our sector Continued prudent management of expense and capital allocation activities while advancing our R&D pipeline Completed capital raise to ensure sufficient cash on hand to fund the Company’s operations beyond our key development milestones in 2023 and into the first half of 2025 Maintained efficient staffing to oversee and execute our programs Reallocated internal resources to prioritize key programs We are operating from a position of strength as we enter a critical period for our R&D pipeline 7.

Logo The Board Has Been Proactively and Thoughtfully Refreshed Our Board has the right mix of experience and expertise to execute on our strategic objectives CURRENT DIRECTORS Rob Barrow appointed interim CEO (elected CEO in December) 40% refreshed Board Carol Vallone Andreas Krebs 80% refreshed Board Dr. Suzanne Bruhn Dr. Roger Crystal 100% refreshed Board David Gryska H2 2021 2022 2023 RETIRED DIRECTORS Bruce Linton Perry Dellelce Stephen Hurst Dr. Sarah Vinson Dr. Halperin Wernli As of the 2023 Annual Meeting, the Board will be 100% refreshed since Rob Barrow took on the role of CEO in mid-2021 + Ms. Makes is not standing for election at the 2023 Annual Meeting. *New independent director nominee. 8.

Logo FCM’s Campaign is Ill-Conceived and Value Destructive FCM does not understand the current business, which has changed and grown significantly since Scott Freeman was removed from the Company in 2020 FCM’s nominees lack additive experience and expertise FCM’s ideas are not viable and rest on a reckless suggestion to bypass a Phase 2 study for MM-120 FCM has suspect motives and clear conflicts of interest and has not engaged in good faith with the Company – including rejecting multiple settlement attempts FCM should not be trusted to steward the Company – FCM has no track record, does not manage institutional capital and has conducted itself unprofessionallyFCM’s baseless contention that it is “completely unrealistic” the Phase 2b trial for MM-120 will be completed by the end of this year reads like a short report on MindMed FCM sowed unfounded doubt about the Company’s intellectual property ownership, prioritizing the lawsuit between Scott Freeman and his co-founder over the negative impact on other shareholdersFCM’s attempt to take control of the Board is a costly distraction 9.

Logo FCM’s Questionable Conduct and Track Record jake freeman alright I m intoxicated what questions do you want to ask I am a sucker for whiskey r/Mindmedinvestorsclub if you you want peace, prepare for war Freeman Capital ManagementLLC This is jut beginning. Details to come this week $ MNND MINDMED’S MICKEY MOUSE OFFER TO FCM FCM PLANED RESPONSE Putting the”bail’ in Robert Bailey barrow $MNMD WHAT GIVES BARROW FEELINGS OF POWER MONEY STATUS SELLING RSU FOR “TAX PURPOSE’ FCM does not manage institutional capital and its only other publicly disclosed investment was a meme-stock investment in Bed Bath & Beyond Jake Freeman, the Chief Executive Manager of FCM, is a college student with no credible investment or professional experience FCM’s campaign has been characterized by unprofessional conduct that should concern shareholders FCM’s principals and nominees have demonstrated questionable judgment in allowing Jake Freeman to lead the public and private engagement of this campaign ama WITH fcm mm Holdings, LLC I’m jake freeman, the executive president of FCM MM Holding, LLC I look Forward to answering all your quotations with respect to the proposed plan available at https://mindmed.zone /letter single comment thread See full discussion freemancapitalMngmt The strategic direction of the plan overall was mine along with the strategic plan for this activism jake freeman Despite seeking control of the Board, FCM and its principals have not demonstrated they can be trusted to seriously steward shareholders’ interests FCM Tweet FCM GMEdd.com Discord Server Post, Note: Link Does Not Return to Post FCM Reddit Post FCM Reddit Post. 10.

FCM’s Nominees Are Not Qualified to Serve on the Board Mindmed FCM’s candidates do not possess the necessary skills or expertise to lead MindMed through this pivotal period Scott Freeman President of Scott Freeman Consultant LLC Farzin Farzaneh Co-Founder, CSO of ViroCell Biologics Ltd., a private CDMO Vivek Jain Co-Founder & CEO of LOKO, a video-only dating app Alexander Wodka Retired; Former Executive at Crowe LLP, an accounting firm No public company board or senior executive experience beyond a short stint at MindMed Background in oncology; no relevant experience in psychiatry or MindMed’s drug class No public company board or senior management experience No relevant experience overseeing clinical trials in psychiatry or MindMed’s drug class No experience in areas relevant to MindMed’s business (CEO of a dating app company) No healthcare board or senior management experience No relevant healthcare experience (worked at the same accounting firm as Jake Freeman’s father) No public company board or senior management experience No credible strategic plan for the Company No credible strategic plan for the Company No credible strategic plan for the Company No credible strategic plan for the Company

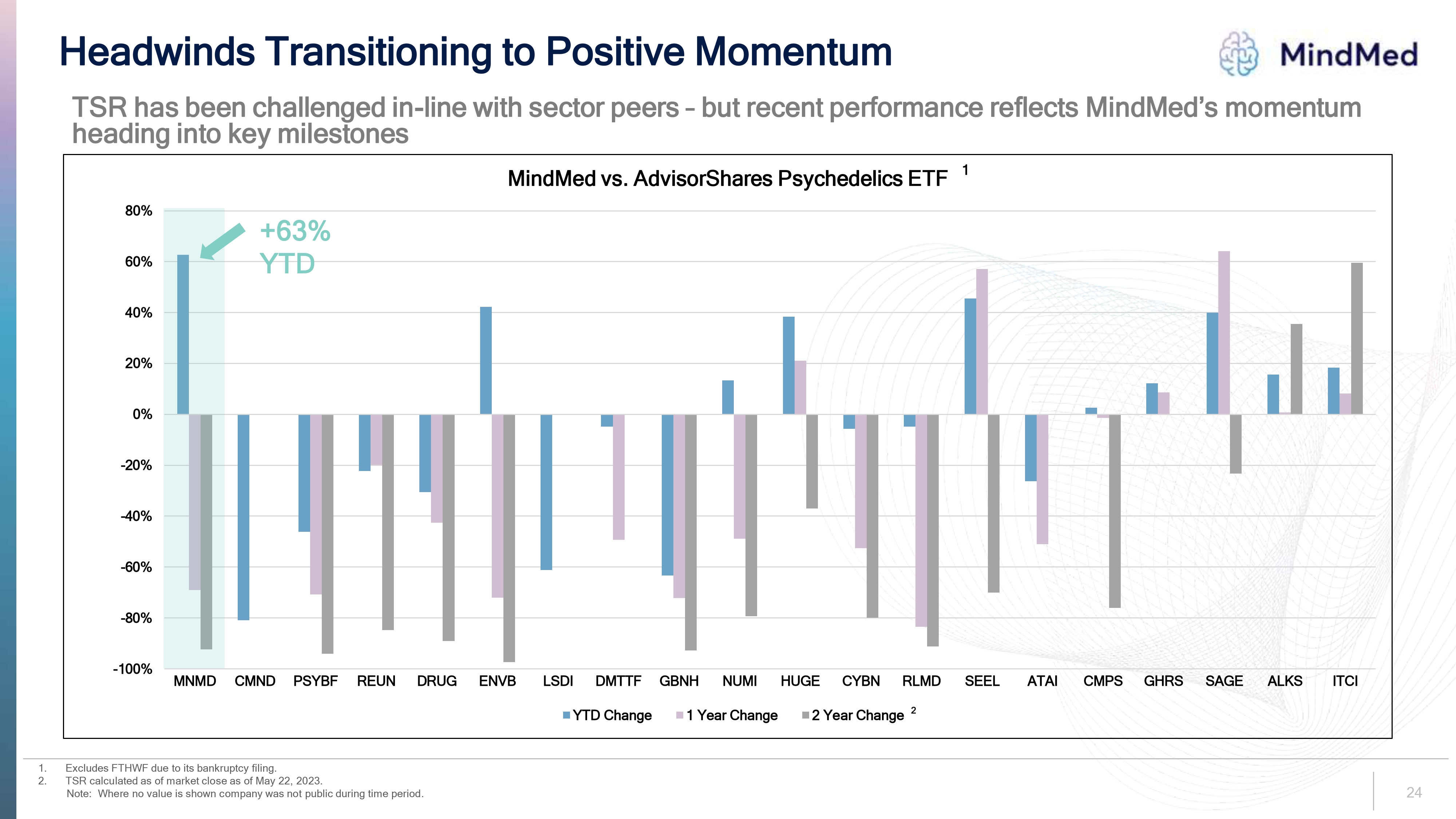

Headwinds Transitioning to Positive Momentum MindMed TSR has been challenged in-line with sector peers – but recent performance reflects MindMed’s momentum heading into key milestones MindMed vs. AdvisorShares Psychedelics ETF 1. Excludes FTHWF due to its bankruptcy filing. 2. TSR calculated as of market close as of May 22, 2023. Note: Where no value is shown company was not public during time period. MNMD CMND PSYBF REUN DRUG ENVB LSDI DMTTF GBNH NUMI HUGE CYBN RLMD SEEL ATAI CMPS GHRS SAGE ALKS ITCI YTD Change 1 Year Change 2 Year Change

Our Nominees Have the Right Skills to Oversee Our Strategy MindMed Robert Barrow Suzanne Bruhn, PhD Roger Crystal, MD David Gryska Andreas Krebs Carol A. Vallone Deep knowledge of MindMed’s operations gained as CEO, and prior to that as Chief Development Officer Extensive experience in clinical pharmacology and drug development across a variety of therapeutic classes, including psychedelics Financial expertise Experience as CEO of several biotech companies Relevant governance experience and industry knowledge gained from serving as a director for numerous public companies in the life sciences industry Extensive experience leading a pharmaceutical company as its CEO Background and training as a medical doctor Strong background in clinical research, product development and commercialization Experience as the CFO and as a director at a number of leading public life sciences and biotechnology companies Extensive audit and compliance experience Financial expertise Financial background and experience as an international pharmaceutical executive Has served on private and public boards and as the head of growthoriented investment firms Deep industry, financial and governance experience as board chair of the country’s #1 psychiatric hospital; board member of leading hospital system Strong experience as CEO raising capital, scaling and successfully selling global companies Relevant experience as chair and director on public and private healthcare company boards

MindMed’s Nominees Have Proven Track Records of Delivering Shareholder Value Mindmed FCM’s Nominees MindMed’s Nominees While serving as a senior executive or director of a public company Sale of Wyeth to Pfizer (NYSE: PFE) for $68B • Sale of Seagen to Pfizer (NYSE: PFE) for $43B • Sale of GW Pharma to Jazz Pharma (Nasdaq: JAZZ) for $7.2B • Sale of Scios to Johnson & Johnson (NYSE: JNJ) for $2.4B • Sale of Raptor Pharma to Horizon Pharma (Nasdaq: HZNP) for $800M • Sale of Aerie Pharma to Alcon (SIX/NYSE: ALC) for $753M • Sale of Opiant to Indivior (LON: INDV) for $145M Proven track record of delivering over $120 billion in value to shareholders While serving as a senior executive or director of a public company $0 of value created for public biotech/pharma shareholders MindMed’s nominees possess value-additive experience and have track records of benefitting public company shareholders

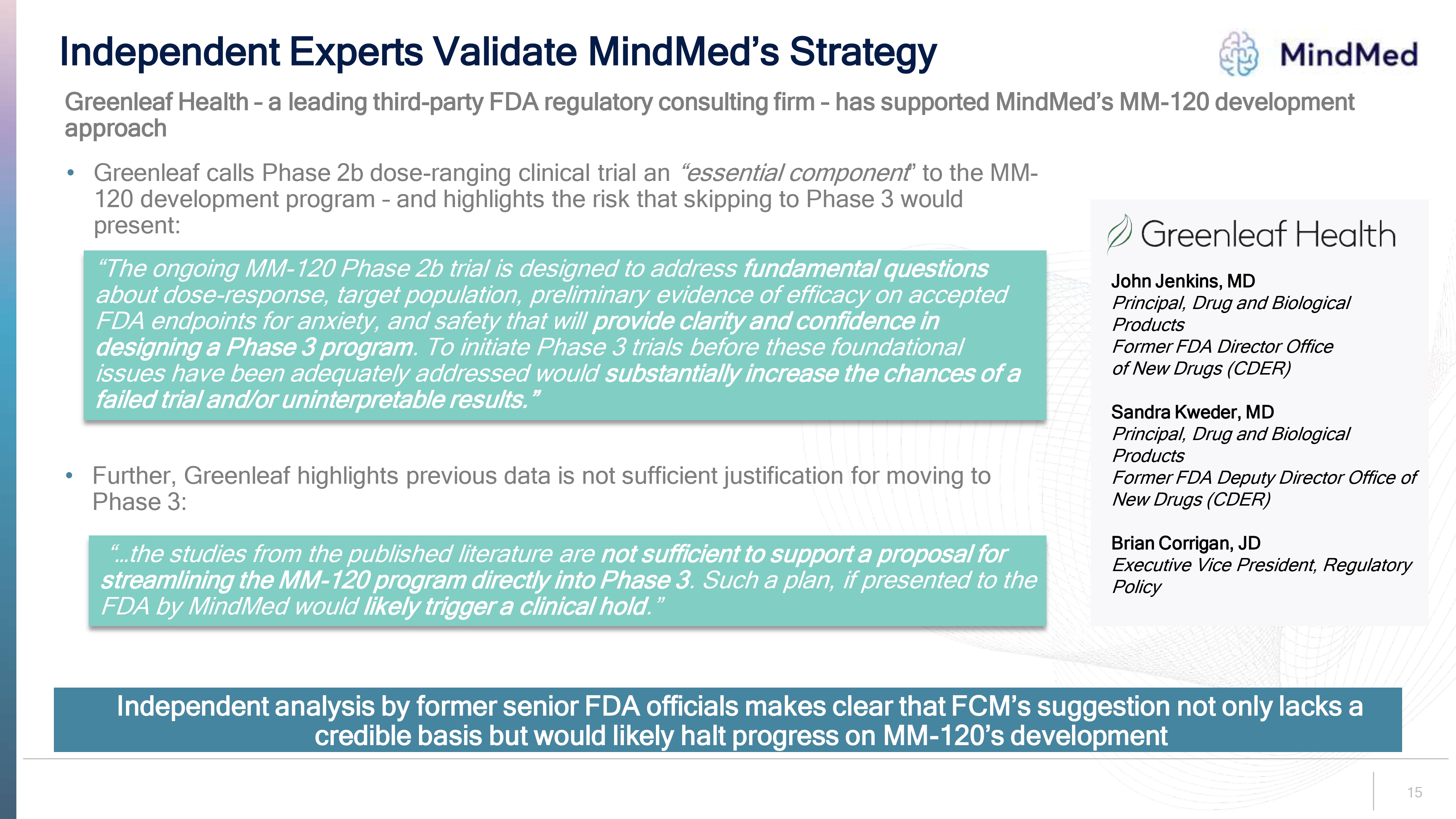

Independent Experts Validate MindMed’s Strategy Mindmed Greenleaf Health – a leading third-party FDA regulatory consulting firm – has supported MindMed’s MM-120 development approach Greenleaf calls Phase 2b dose-ranging clinical trial an “essential component” to the MM120 development program – and highlights the risk that skipping to Phase 3 would present “The ongoing MM-120 Phase 2b trial is designed to address fundamental questions about dose-response, target population, preliminary evidence of efficacy on accepted FDA endpoints for anxiety, and safety that will provide clarity and confidence in designing a Phase 3 program. To initiate Phase 3 trials before these foundational issues have been adequately addressed would substantially increase the chances of a failed trial and/or uninterpretable results.” Further, Greenleaf highlights previous data is not sufficient justification for moving to Phase 3: “…the studies from the published literature are not sufficient to support a proposal for streamlining the MM-120 program directly into Phase 3. Such a plan, if presented to the FDA by MindMed would likely trigger a clinical hold.” Independent analysis by former senior FDA officials makes clear that FCM’s suggestion not only lacks a credible basis but would likely halt progress on MM-120’s development Greenleaf Health John Jenkins, MD Principal, Drug and Biological Products Former FDA Director Office of New Drugs (CDER) Sandra Kweder, MD Principal, Drug and Biological Products Former FDA Deputy Director Office of New Drugs (CDER) Brian Corrigan, JD Executive Vice President, Regulatory Policy

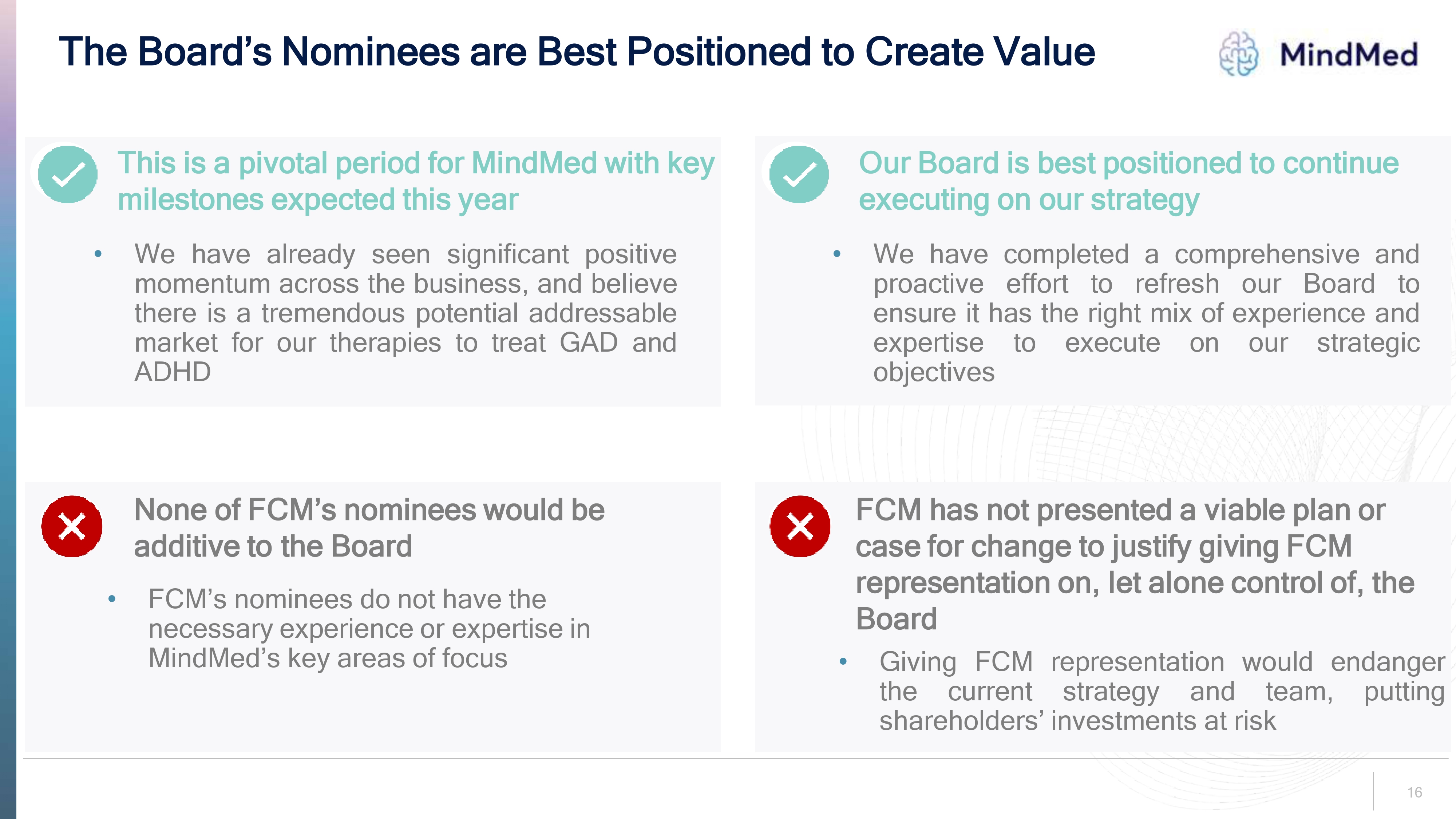

The Board’s Nominees are Best Positioned to Create Value Mindmed This is a pivotal period for MindMed with key milestones expected this year We have already seen significant positive momentum across the business, and believe there is a tremendous potential addressable market for our therapies to treat GAD and ADHD None of FCM’s nominees would be additive to the Board FCM’s nominees do not have the necessary experience or expertise in MindMed’s key areas of focus Our Board is best positioned to continue executing on our strategy We have completed a comprehensive and proactive effort to refresh our Board to ensure it has the right mix of experience and expertise to execute on our strategic objectives FCM has not presented a viable plan or case for change to justify giving FCM representation on, let alone control of, the Board Giving FCM representation would endanger the current strategy and team, putting shareholders’ investments at risk

Mindmed 01 Executive Summary 02 MindMed is successfully executing to achieve key milestones and deliver value 03 MindMed has world-class leadership and strong corporate governance practices 04 None of FCM’s nominees would be additive to the Board 05 FCM’s ideas are not viable and would expose shareholders to significant risk 06 FCM has not engaged in good faith 07 Conclusion

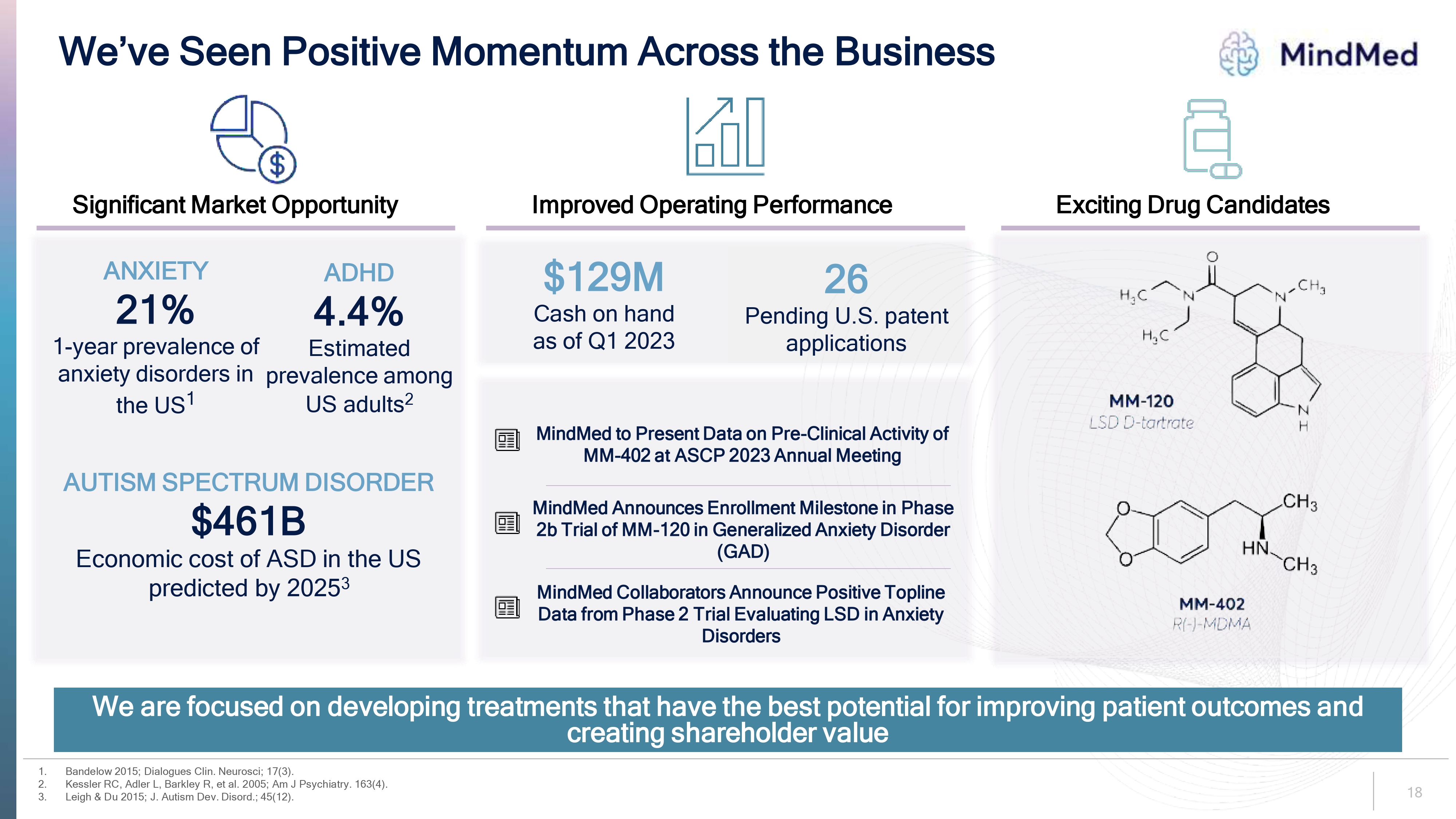

We’ve Seen Positive Momentum Across the Business Mindmed Significant Market Opportunity Improved Operating Performance Exciting Drug Candidates ANXIETY 21% 1-year prevalence of anxiety disorders in the US1 ADHD 4.4% Estimated prevalence among US adults2 AUTISM SPECTRUM DISORDER $461B Economic cost of ASD in the US predicted by 20253 $129M Cash on hand as of Q1 2023 26 Pending U.S. patent applications MindMed to Present Data on Pre-Clinical Activity of MM-402 at ASCP 2023 Annual Meeting MindMed Announces Enrollment Milestone in Phase 2b Trial of MM-120 in Generalized Anxiety Disorder (GAD) MindMed Collaborators Announce Positive Topline Data from Phase 2 Trial Evaluating LSD in Anxiety Disorders We are focused on developing treatments that have the best potential for improving patient outcomes and creating shareholder value 1. Bandelow 2015; Dialogues Clin. Neurosci; 17(3). 2. Kessler RC, Adler L, Barkley R, et al. 2005; Am J Psychiatry. 163(4). 3. Leigh & Du 2015; J. Autism Dev. Disord.; 45(12).

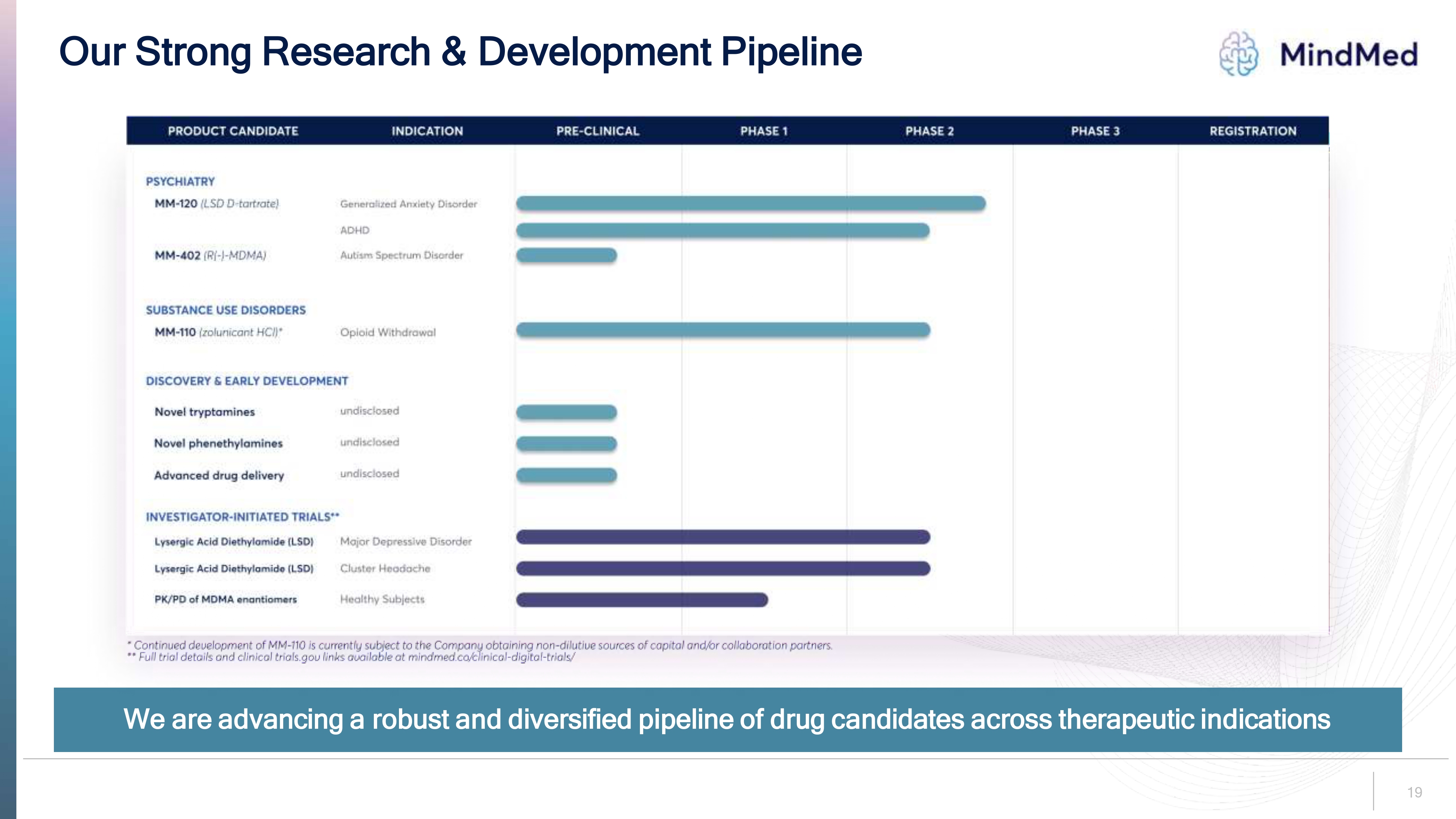

Our Strong Research & Development Pipeline Mindmed Product candidate indication pre-clinical phase-1 phase-2 phase-3 Registration PSYCHIATRY MM-120 (LSD D-TARTRATE) MM-402 (R(-)-MDMA) SUBSTAMCE USE DISORDERS MM-110 (Zolunicant HCI)* DISCOVERY & EARLY DEVELOPMENT Novel tryptamines undisclosed Novel phenethylamines undisclosed Advanced drug delivery undisclosed Generalized Anxiety Disorder ADHD Autism Spectrum Disorder Opioid Withdrawal Investigator Initiated Trials ** Lysergic acid diethylamide (LSD) Major Depressive Disorder Lysergic Acid Diethylamide (LSD) Cluster Headache PK/PD OF MDMA enantiomers Healthy Subjects * Continued Development of mm-110 is currently subject to the company obtaining non-dilutive sources of capital and/or collaboration partners.** Full trial details and clinical trials.gov links available at mindmed.co/clinical-digital-trials/ We are advancing a robust and diversified pipeline of drug candidates across therapeutic indications

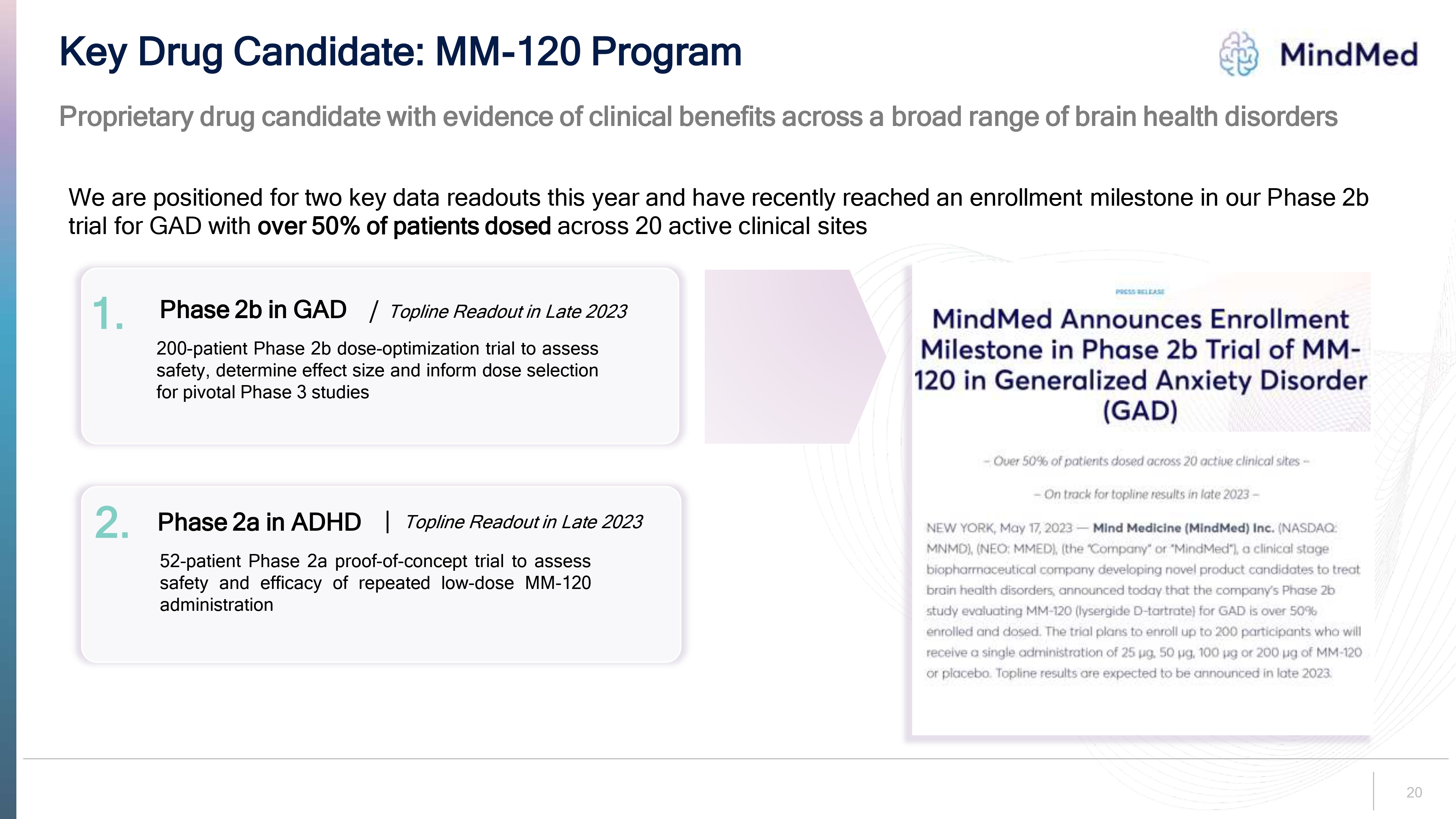

Key Drug Candidate: MM-120 Program Mindmed Proprietary drug candidate with evidence of clinical benefits across a broad range of brain health disorders We are positioned for two key data readouts this year and have recently reached an enrollment milestone in our Phase 2b trial for GAD with over 50% of patients dosed across 20 active clinical sites Phase 2b in GAD Topline Readout in Late 2023 200-patient Phase 2b dose-optimization trial to assess safety, determine effect size and inform dose selection for pivotal Phase 3 studies Phase 2a in ADHD Topline Readout in Late 2023 52-patient Phase 2a proof-of-concept trial to assess safety and efficacy of repeated low-dose MM-120 administration mindmed announces enrollment milestone in phase 2b trial of mm-120 in generalized anxiety disorder (gad)- over 50% of patients dosed across 20 active clinical sites On track for topline results in late 2023 new York, may 17, 2023 – mind medicine (mindmed) inc. (Nasdaq: mnmd), (Neo: mmed), (the “company” or “mindmed”), a clinical stage biopharmaceutical company developing novel product candidates to great brain health disorders, announced today that the company’s phase 2b study evaluating mm-120 (lysergide d-tartrate) for gad is over 50% enrolled and dosed. The trial plans to enroll up to 200 participants who will receive a single administration of 25 ug 50 ug, 100 ug or 200 ug of mm-120 or placebo, Topline Results are expected to be announced in late 2023.

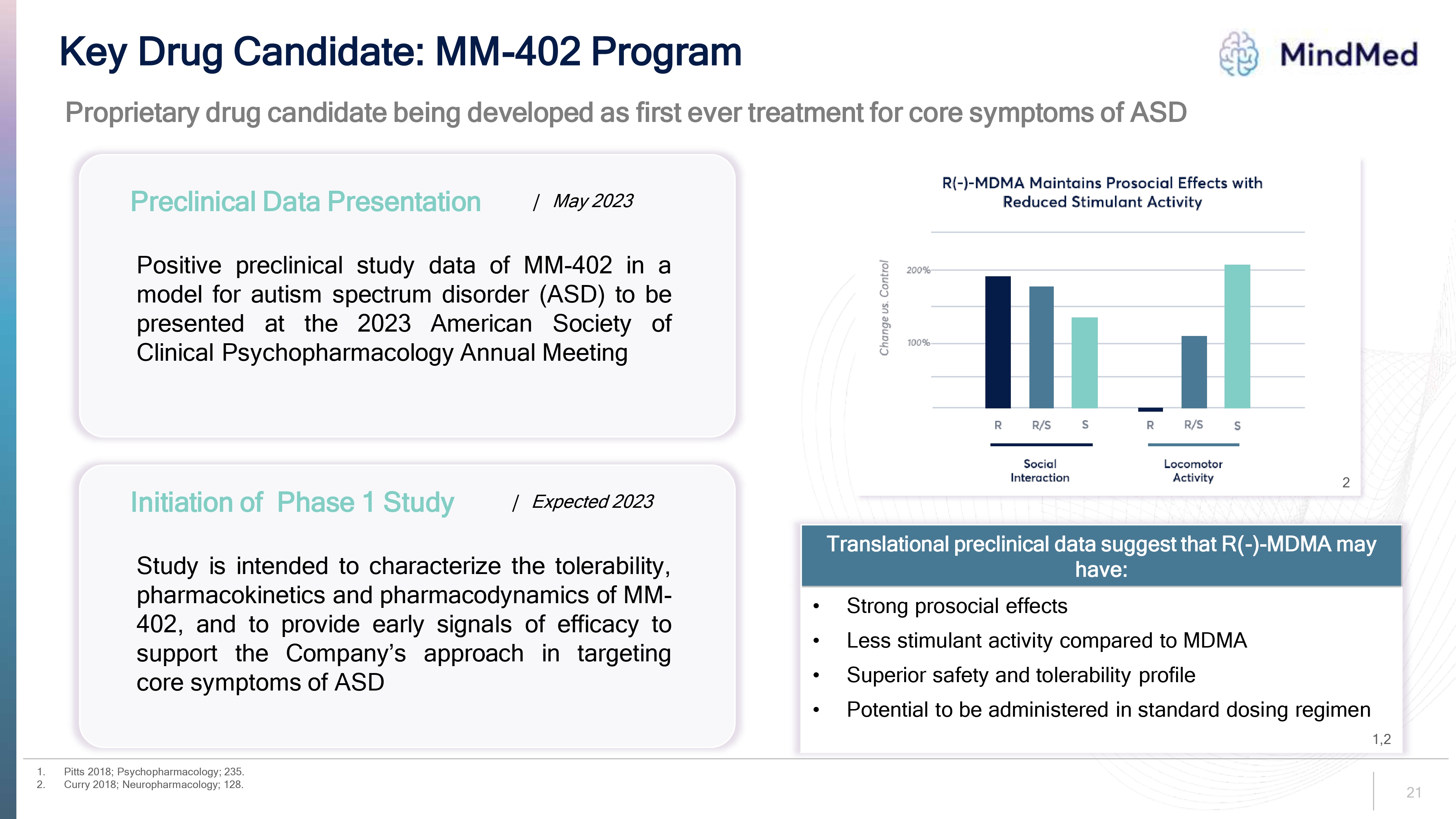

Key Drug Candidate: MM-402 Program MindMed Proprietary drug candidate being developed as first ever treatment for core symptoms of ASD Preclinical Data Presentation | May 2023 Positive preclinical study data of MM-402 in a model for autism spectrum disorder (ASD) to be presented at the 2023 American Society of Clinical Psychopharmacology Annual Meeting Change us. Control 200% 100% R(-)-MDMA Maintains Prosocial Effects with Reduced Stimulant ActivityR R/S S R R/S S Social Interaction Locomotor Activity Initiation of Phase 1 Study | Expected 2023 Study is intended to characterize the tolerability, pharmacokinetics and pharmacodynamics of MM-402, and to provide early signals of efficacy to support the Company's approach in targeting core symptoms of ASD 2 Translational preclinical data suggest that R(-)-MDMA may have: Strong prosocial effects Less stimulant activity compared to MDMA Superior safety and tolerability profile Potential to be administered in standard dosing regimen 1. Pitts 2018; Psychopharmacology; 235. 2. Curry 2018; Neuropharmacology; 128. 1,2 21

Digital Medicine Designed to Enhance the Value of Our Therapeutic Offerings MindMed Our drug development strategy is closely complemented by a platform of digital medicine programs that we are developing to facilitate adoption, use and access to our product candidates Pre-Treatment During Treatment Post-Treatment • Patient education, engagement, preparation Deep digital diagnosis Support for treatment selection 14:55 Dashboard Welcome Here's your first baseline assessment available for you, if you want to give it a try! BASELINE ASSESSMENTS (ONE-TIME Hamilton Anxiety Scale (HAM-A) > 2-minutes Today Alcohol Use Disorder Identification Test 10-minutes Today Pittsburgh Sleep Quality Index Tap anywhere to dismiss E Dashboard Video Diary Journal Profile • In-session monitoring ⚫ Clinician decision support • Predictive models that link interventions and outcomes Recording in progress • Real world monitoring of trends Engagement in health maintenance • Al models to inform psychotherapies 14:55 Self Report Self Report Video Diary Short decription of the video diary feature Journal Short decription of the video diary feature Session in progress Application is currently recording an ongoin session, you can close the app and it will run in the background. MY PAST REPORTS Video Diary Journal HIDE A 9.11.2021 Today B Dashboard Self Report Settings 22

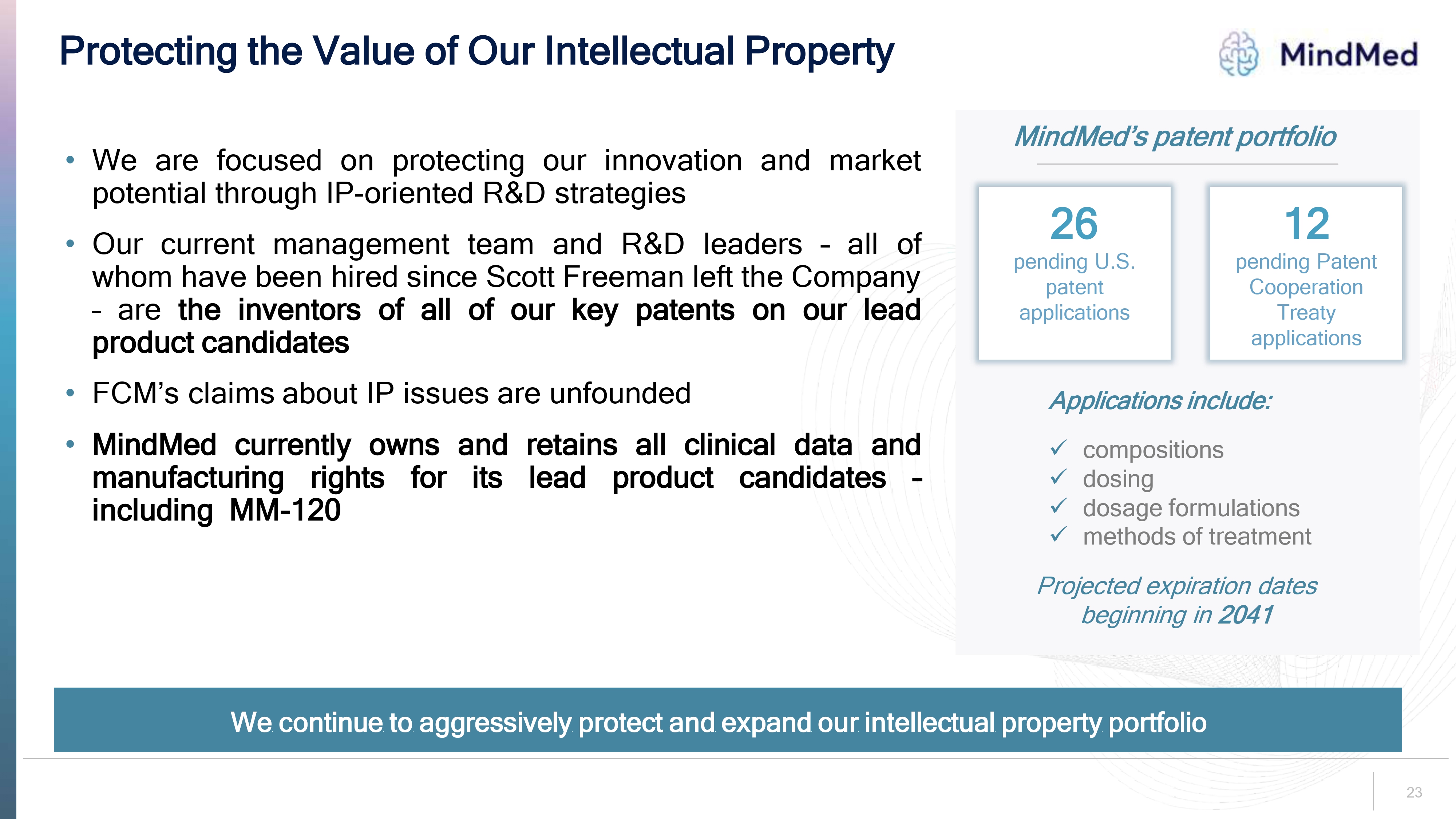

Protecting the Value of Our Intellectual Property • We are focused on protecting our innovation and market potential through IP-oriented R&D strategies — Our current management team and R&D leaders all of whom have been hired since Scott Freeman left the Company are the inventors of all of our key patents on our lead product candidates FCM's claims about IP issues are unfounded • MindMed currently owns and retains all clinical data and manufacturing rights for its lead product candidates - including MM-120 MindMed MindMed's patent portfolio 26 pending U.S. patent applications 12 pending Patent Cooperation Treaty applications Applications include: ✓ compositions ✓ dosing ✓ dosage formulations ✓ methods of treatment Projected expiration dates beginning in 2041 We continue to aggressively protect and expand our intellectual property portfolio 23

1. 2. Headwinds Transitioning to Positive Momentum MindMed TSR has been challenged in-line with sector peers - but recent performance reflects MindMed's momentum heading into key milestones 80% +63% 60% YTD 40% 20% 0% -20% -40% -60% -80% MindMed vs. AdvisorShares Psychedelics ETF1 -100% MNMD CMND PSYBF REUN DRUG ENVB LSDI DMTTF GBNH NUMI HUGE CYBN RLMD SEEL ΑΤΑΙ CMPS GHRS SAGE ALKS ITCI Excludes FTHWF due to its bankruptcy filing. TSR calculated as of market close as of May 22, 2023. Note: Where no value is shown company was not public during time period. ■YTD Change ☐ 1 Year Change ■2 Year Change 2 24

Third Party Analysts Support Our Value Creation Opportunities ff We continue to see shares undervaluing the opportunity for a novel mechanism to treat GAD even with conservative assumptions around patent life and market uptake, and look to additional derisking events this year." - Brian Abrahams, MD, Leonid Timashev, PhD, Joe Kim, PhD, RBC Capital Markets, March 9, 2023 Despite competition from several emerging psychedelic biotechs, we believe MNMD is a well-capitalized leader poised to disrupt the large, growing mental health market." ff - Francois Brisebois, Oppenheimer, August 25, 2022 We are reiterating our Buy rating and $21 price target on MindMed following the release of clinical data with LSD in major depressive disorder." - Elemer Piros, PhD, EF Hutton, April 14, 2023 RBCMindMed RBC Royal Bank OPPENHEIMER EFHutton 25

Analyst Support for MM-120 Strategy and Expected Timelines Therefore, we are cautiously optimistic that '120 will not only achieve the primary outcome with a dose response that can be discerned but also demonstrate long-term clinical benefit as well... As such, we find it ill-advised for dose ranging to take place in P3 as we believe it would be a mismanaged use of capital to conduct a P3 trial with non-optimized doses, resulting in a much larger sample size, potential delays and higher cost. Recall that the P2b study for '120 is purposed to provide insight into the therapeutic window of '120 and establish dose-specific magnitude and durability of response, way beyond the anecdotal information that exists on the activity of LSD." – Charles C. Duncan, PhD and Pete Stavropoulos, PhD Cantor Fitzgerald, May 18, 2023 We continue to see good progress towards two ph.ll readouts by year- end and a reasonable likelihood of success for MM-120 in LSD given the totality of evidence across mood disorders, which can drive share appreciation." – Brian Abrahams, MD, RBC Capital Markets, May 17, 2023 MindMed CANTOR دم Pilzgerald RBC Royal Bank RBC 26

01 Executive Summary MindMed 02 MindMed is successfully executing to achieve key milestones and deliver value 03 MindMed has world-class leadership and strong corporate governance practices 04 None of FCM's nominees would be additive to the Board 05 FCM's ideas are not viable and would expose shareholders to significant risk 06 07 Conclusion FCM has not engaged in good faith 27

Our Nominees Have the Right Skills to Oversee Our Strategy MindMed Robert Barrow Usona Institute OLATEC MindMed Deep knowledge of MindMed's operations gained as CEO, and prior to that as Chief Development Officer ✓ Extensive experience in clinical pharmacology and drug development across a variety of therapeutic classes, including psychedelics Financial expertise Suzanne Bruhn, PhD Tiaki Proclara THERAPEUTICS BIOSCIENCES Promedior Shire PLIANT TRAVERETM THERAPEUTICS Human Genetic Therapies(vigil) NEURO raptor aeglea pharmaceuticals corp. ✓ Experience as CEO of several biotech companies ✓ Relevant governance experience and industry knowledge gained from serving as a director for numerous public companies in the life sciences industry Roger Crystal, MD ☛opiant NHS ImaginAb Imperial College HealthcareNHS TrustG GE Healthcare ✓ Extensive experience leading a pharmaceutical company as its CEO Background and training as a medical doctor Strong background in clinical research, product development and commercialization David Gryska* Incyte Myrexis Celgene scios Seagen® FORTE BIOSCIENCES CARDIAC PATHWAYS CORPORATION GW pharmaceuticals Experience as the CFO and as a director at a number of leading public life sciences and biotechnology companies ✓Extensive audit and compliance experience Financial expertise Andreas Krebs LONGFIELD INVEST Wyeth Heidelberg PHARMA Focused Cancer TherapiesMERZFinancial background and experience as an international pharmaceutical executive Has served on private and public boards and as the head of growth- oriented investment firms Carol A. Vallone M McLean 1811 HARVARD MEDICAL SCHOOL AFFILIATE CRESCO LABS' Arosa Mass General Brigham Berkshire Partners →Ria Health Longitude CAPITAL Deep industry, financial and governance experience as board chair of the country's #1 psychiatric hospital; board member of leading hospital system Strong experience as CEO raising capital, scaling and successfully selling global companies Relevant experience as chair and director on public and private healthcare company boards *New independent director nominee. 28

MindMed Has a World-Class Leadership Team MindMed Robert Barrow Chief Executive Officer and Board Director Usona Miri Halperin Wernli, PhD Executive President Daniel Karlin, MD, MA Chief Medical Officer MSD }}}} HealthMode Institute Roche Pfizer OLATEC Tufts UNIVERSITY ACTELION Schond Greenway, MBA Chief Financial Officer avalo THERAPEUTICS Mark Sullivan, JD Chief Legal Officer and Corporate Secretary sesen bio Francois Lilienthal, MD, MBA Chief Commercial Officer MERCK Carrie Liao, CPA Chief Accounting Officer ORIC Pharmaceuticals Halozyme mxmodal Johnson Johnson mannkind BARCLAYS troutmanTM pepper Ill Bristol Myers Squibb GenMarkDX Morgan Stanley Our management team has decades of successful leadership, product development and commercialization in pharma and biopharma 29

Our R&D Team Has Significant Drug Development Experience VELETRI VELETRI Tracleer 125 mg Filmtabletten Bosentan 56 Fimtableten Zum Ennemen Delstrigo doravirine/lamivudine/ tenofovir disoproxil fumarate 100 mg/300 mg/300 mg tablets Pifeltro doravirine 100 mg tablets ACTELION ZAVESCA (miglustat) capsules BREZTRI AEROSPHERER (budesonide 160 mcg, glycopyrrolate 9 mcg and formoterol fumarate 4.8 mcg) Inhalation Aerosol Tivicay (dolutegravir) tablets 10 mg 25 mg | 50 mg 300 mg tablets Viread tenofovir disoproxil fumarate NOG 0004-880-01 FUZEONM (enfuvirtide) for injection Single Use Vial Ro For SC the offer Recoration 90 mg Balance by Substrate Reduction Professionals Patiente NOC 73463-10-01 Cosela (trilaciclib) for injection 300 m/vial For Intravenous Inf After Reconstituti and Dilution 27896433-3300 ZEPATIER Rozerem (elbasvir and grazoprevir) tablets NOC 58768-150-15 Visudyne verteporfin for injection 15 mg 58768-150-15 Visudyng verteporte for inject Ventavis® (iloprost) SOLUTION INHALATION NOXAFIL posaconazole ramelteon 8-mg tablets Stalevo (carbidopa, levodopa and entacapone) tablets CNS Agents → Ulotaront (SEP-363856, 1) TAAR1 EC50 = 38 nM Trintellix PERSERIS vortioxetine 5mg 10mg-20mg tablets (risperidone) for extended-release injectable suspension 90 mg. 120 mg MindMed Fintepla (fenfluramine) 2.2 mg/mL oral solution Selincro nalmefene The us geading The first and only oral BEVESPI AEROSPHERE 7.2/5 micrograms pressured inhalation, suspension BEVESPI glycopyrronium/formoterol BEVESPI fumarate dihydrate Inhalation use 120 actuations (f inhaler) AstraZend 7.2/5 mog Apsiu dhydrate warate ISENTRESS REYATAZ raltegravir film-coated tablets 400 mg One Single-Dose Discord Unused P Cosela for injection 300/vi Uptravi selexipag tablets 200-1600 mcg ZOSTAVAX® SCUTANS NECTION RESCRIPTION ONLY MEDICINE (atazanavir) capsules VICTRELIS boceprevir, MSD/ PREZISTA (darunavir) tablets Systane ZADITOR eifenfumarate oplein sollten 0.05% ANTIHISTAMINE EYE DROPS Dovato dolutegravir 50 mg/ lamivudine 300 mg tablets P Lamictal lamotrigine tablets SublocadeR (buprenorphine extended-release) injection for subcutaneous use C 100mg-300mg Suboxone® Sublingual (buprenorphine and naloxone) Film 2 mg/0.5 mg 4 mg/1 mg⚫ 8 mg/2 mg 12 mg/3 mg Latuda (lurasidone HCl) tablets TEMBEXA brincidofovir 10 mg/mL. oral suspension || 100 mg tablets Our team's relevant experience overseeing the approval of drug candidates positions MindMed for success 30

Strong Corporate Governance Policies Logo Best Practices Refreshed Board The Right Perspectives New Independent board chair in 2021 Majority Voting Policy for uncontested director elections Annually elected directors Robust Code of Conduct and Ethics Regular, proactive communications with shareholders Prohibit directors and employees from hedging or pledging Company shares Voluntarily provide enhanced compensation disclosures in proxy 1. Immediately following the 2023 Annual Meeting 2. For current directors standing for re-election at the 2023 Annual Meeting Member of Comp Committee and Nom and Corp Gov Committee Board Chair, Chair of Comp Committee, Member of Audit Committee Member of Comp Committee and Nom and Corp Gov Committee *New independent director nominee. Robert Barrow Chief Executive Officer Suzanne Bruhn, PhD Member of Comp Committee and Nom and Corp Gov Committee Roger Crystal, MD Member of Comp Committee and Nom and Corp Gov Committee David Gryska* Incoming Chair of Audit Committee Andreas Krebs Vice Board Chair, Chair of Nom and Corp Gov Committee, Member of Audit Committee Carol A. Vallone Board Chair, Chair of Comp Committee, Member of Audit Committee Average Tenure: 15 months2 The Right Perspectives 5 of 6 Independent Directors 33% Directors are Women1 100% Director Healthcare Experience 31

Our Compensation Program is Aligned with Shareholders’ Interests Logo MindMed’s approach to executive compensation links pay to performance 87% and 85% of Mr. Barrow’s and our other NEOs’ respective 2022 total direct compensation was “at-risk,”with payout and value directly tied to Company performance, in the form of annual incentive and equity awards granted Our executive compensation levels for the past two years generally fall within reasonable market ranges based on peer data provided by our independent compensation consultant In 2022, we re-designed our non-employee director compensation policy to pay cash and equity compensation on a go-forward basis that approximated the median of market data provided by our independent compensation consultant for similarly situated companies 2022 Realizable Pay* Reflects Impact of Actual Stock Performance CEO 2022 realizable pay is nearly 80% less than reported pay Compensation ($Ms) 0 1 2 3 4 5 6 $5.23 $1.22 $2.42 $0.67 Fixed Compensation Reported Pay Realizable Pay Reported Pay Realizable Pay CEO Other NEOs (Average) Base Salary Performance Bonus Equity Grants Other Annual Bonus Award / At-Risk Compensation CEO 2022 Total Direct Compensation Mix 13% 5% 82% Long-Term Equity Award / At-Risk Compensation 87% At-Risk Fixed Compensation 15% 5% 80% Other NEOs 2022 Total Direct Compensation Mix Long-Term Equity Award / At-Risk Compensation 85% At-Risk *“Realizable pay” for these purposes means base salary and performance bonus earned and other compensation as reported in the Summary Compensation Table for 2022, but for equity awards granted during 2022, reflects the “intrinsic” value at the end of the year which is the value the award could deliver as of such time (ignoring vesting requirements) based on the stock price at the end of the year of $0.74 USD) **“Total Direct Compensation” reflects 2022 cash compensation, consisting of annual base salaries and performance bonus earned, and 2022 equity awards granted, based on such equity incentives’ grant date fair value as reported in the “Summary Compensation Table,” for each of our named executive officers. Base Salary performance Bonus Equity Grants Other 32

01Executive Summary 02 MindMed is successfully executing to achieve key milestones and deliver value 03 MindMed has world-class leadership and strong corporate governance practices 04 None of FCM’s nominees would be additive to the Board 05 FCM’s ideas are not viable and would expose shareholders to significant risk 06 FCM has not engaged in good faith 07Conclusion 33

34 FCM’s Nominees Are Not Qualified to Serve on the Board FCM’s candidates do not possess the necessary skills or expertise to lead MindMed through this pivotal period Scott Freeman Farzin Farzaneh Vivek Jain Alexander Wodka Co Founder, CSO of ViroCell Biologics Ltd., a private CDMO President of Scott Freeman Consultant LLC Co Founder & CEO of LOKO, a video only dating app Retired; Former Executive at Crowe LLP, an accounting firm x No public company board or senior executive experience beyond a short stint at MindMed x Background in oncology; no relevant experience in psychiatry or MindMed s drug class x No public company board or senior management experience x No relevant experience overseeing clinical trials in psychiatry or MindMed s drug class x No experience in areas relevant to MindMed s business (CEO of a dating app company) x No healthcare board or senior management experience x No relevant healthcare experience (worked at the same accounting firm as Jake Freeman s father) x No public company board or senior management experience x No credible strategic plan for the Company x No credible strategic plan for the Company x No credible strategic plan for the Company x No credible strategic plan for the Company

35 MindMed vs. FCM: A Stark Contrast in Experience MindMed s nominees possess value additive experience and have track records of proven positive impact on therapeutic success MindMed Nominees T rack record of developing, commercializing and managing tens of billions of dollars in revenues across indications, including CNS and psychiatry FCM Nominees 0 1 0 0 FCM s slate has cumulatively brought one cancer drug to market a completely different drug class from MindMed

36 MindMed vs. FCM: A Stark Contrast in Experience MindMed s nominees possess value additive experience and have track records of proven positive impact on therapeutic success MindMed Nominees Track record of developing, commercializing and managing tens of billions of dollars in revenues across indications, including CNS and psychiatry FCM Nominees 0 1 0 0 FCM s slate has cumulatively brought one cancer drug to market a completely different drug class from MindMed

37 Shareholders Should Not Entrust FCM and Scott Freeman with MindMed s Development Pipeline For years, Scott Freeman did nothing to address FDA concerns with MM 110 and as a result, clinical trial design flaws adopted under his leadership led to the reallocation of resources away from the program OCT $6.7 million NIH grant to fund 18 MC preclinical work Savant HWP co founded by Scott Freeman and Stephen Hurst 2013 FEB Savant submits 18 MC IND AUG FDA issues Advisement Letter (containing restrictions on dose/exposure for 18 MC) JUL Savant enters into Foundational Agreement and Contribution Agreement (transferring 18 MC to MindMed*) JUN Rob Barrow appointed interim CEO FEB Scott Freeman named President & CMO of MindMed APR Phase 1 study of 18 MC starts in Australia AUG Phase 1 study completed 2020 2019 2018 2017 2016 2015 2014 2013 2012 AUG Scott Freeman leaves MindMed 2022 SUMMER FDA feedback received 18 MC development under Scott Freeman ( 2012 2020 MM 110 development (2021 2022) Scott Freeman’s only experience with a CNS drug candidate was unsuccessful * 18 MC was renamed MM 110 upon acquisition by MindMed MM 110 program deprioritized DEC 2021

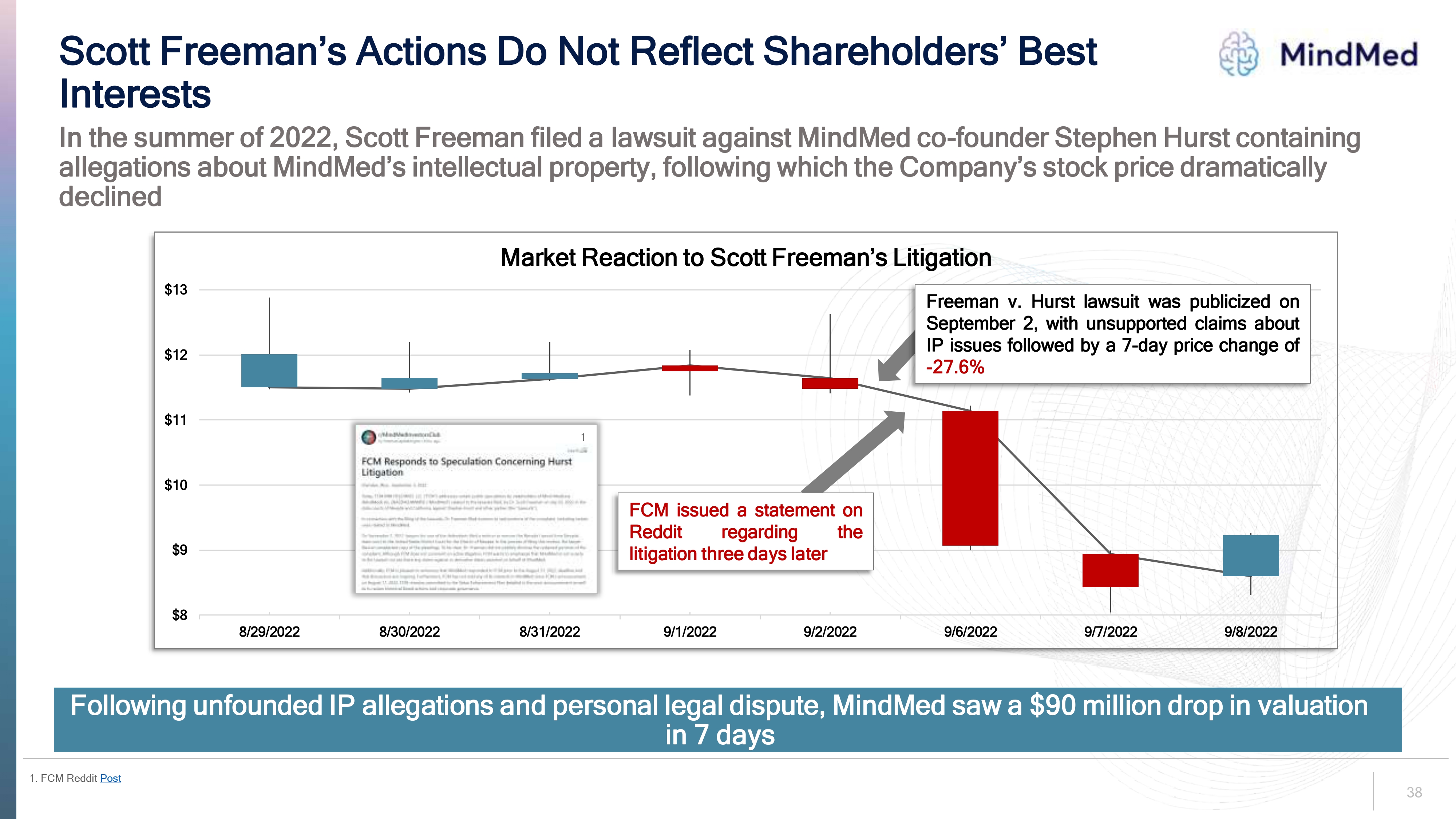

38 $8 $9 $10 $11 $12 $13 8/29/2022 8/30/2022 8/31/2022 9/1/2022 9/2/2022 9/6/2022 9/7/2022 9/8/2022 Market Reaction to Scott Freeman s Litigation Scott Freeman’s Actions Do Not Reflect Shareholders’ Best Interests Following unfounded IP allegations and personal legal dispute, MindMed saw a $90 million drop in valuation in 7 days In the summer of 2022 , Scott Freeman filed a lawsuit against MindMed co founder Stephen Hurst containing allegations about MindMed s intellectual property, following which the Company s stock price dramatically declined Freeman v Hurst lawsuit was publicized on September 2 with unsupported claims about IP issues followed by a 7 day price change of 27 6 FCM issued a statement on Reddit regarding the litigation three days later 1 . FCM Reddit Post 1

39 01Executive Summary 02 MindMed is successfully executing to achieve key milestones and deliver value 03 MindMed has world class leadership and strong corporate governance practices 04 None of FCM s nominees would be additive to the Board 05 FCM’s ideas are not viable and would expose shareholders to significant risk 06 FCM has not engaged in good faith 07 Conclusion

40 FCM s Proposed Path Forward is a Fantasy The ideas FCM has raised demonstrate an ignorance of the FDA drug approval process applicable to major market psychiatric disorders and of the capital allocation and financing needs of a company at MindMed’s growth stage We believe implementing its ideas would destroy value for shareholders

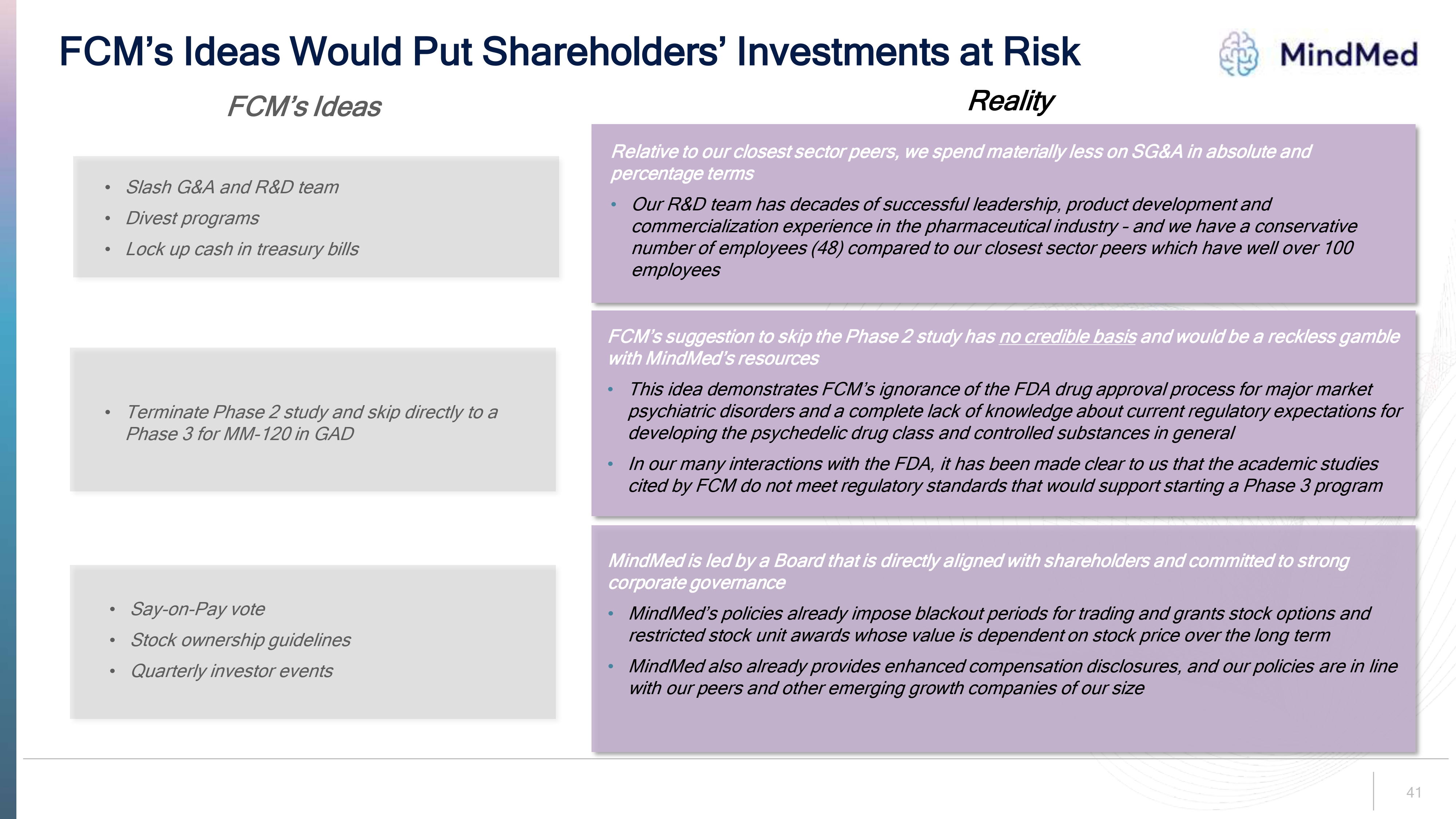

FCM’s Ideas Would Put Shareholders’ Investments at Risk logo MindMed FCM’s Ideas Reality Slash G& Aand R&D team Divest programs Lock up cash in treasury bills Relative to our closest sector peers, we spend materially less on SG&A in absolute and percentage terms Our R&D team has decades of successful leadership, product development and commercialization experience in the pharmaceutical industry – and we have a conservative number of employees (48) compared to our closest sector peers which have well over 100 employees Terminate Phase 2 study and skip directly to a Phase 3 for MM-120 in GAD FCM’s suggestion to skip the Phase 2 study has no credible basis and would be a reckless gamble with MindMed’s resources This idea demonstrates FCM’s ignorance of the FDA drug approval process for major market psychiatric disorders and a complete lack of knowledge about current regulatory expectations for developing the psychedelic drug class and controlled substances in general In our many interactions with the FDA, it has been made clear to us that the academic studies cited by FCM do not meet regulatory standards that would support starting a Phase 3 program Say-on-Pay vote Stock ownership guidelines Quarterly investor events MindMed is led by a Board that is directly aligned with shareholders and committed to strong corporate governance MindMed’s policies already impose blackout periods for trading and grants stock options and restricted stock unit awards whose value is dependent on stock price over the long term MindMed also already provides enhanced compensation disclosures, and our policies are in line with our peers and other emerging growth companies of our size 41

FCM Core Idea – Skip to Phase 3 Trial for MM-120 logo MindMed FCM’s unrealistic idea calls for moving directly to Phase 3 trial ofMM-120 “Initiate the long overdue Phase III clinical trial for MM-120 (LSD) in 2023 based on the two Phase II clinical trials in Generalized Anxiety Disorder(GAD) already completedby MindMed’s collaborator, Dr.Matthias Liechti.” Demonstrates a deep misunderstanding of clinical trials and working with controlled substances There is no credible basis for the claim that the Phase 2 study could be skipped • Without our Phase 2b dose optimization study, we would not be able to make critical clinical determinations including (1) making informed decisions about the sample size or statistical power for our Phase 3 studies (2) determining an appropriate dose (3) demonstrating a clinical response in a pure GAD population or (4) demonstrating clinical response on a clinical outcome measure that is accepted by FDA in GADstudies1 • FCM’s stubborn focus on this unrealistic proposal shows that its principals and director nominees lack any meaningful experience or expertise with either the complex regulatory regime governing our clinical programs or the basics of the drug development process fora new molecular entity in a new drug class for psychiatric disorders • FCM also appears unaware that Phase 3 studies cannot be done without extensive preclinical studies and manufacturing efforts, which take years 1. Prior studies included a mix of psychiatric disorders and only a subset had GAD. Additionally, these studies did not use the only currently accepted outcome measure for GAD (the Hamilton Anxiety scale or HAM-A). Our ongoing Phase 2b clinical trial includes only patients with a primary GAD diagnosis and its primary endpoint is the change in HAM A at four weeks post dosing. Of note, Dr Liechti’s randomized Phase 2 study in GAD was conducted with a different formulation (i.e., NOT MM 120) and did not assess changes on the only outcome measure accepted by FDA. 42

Independent Experts Validate MindMed’s Strategy logo MindMed Greenleaf Health – a leading third-party FDA regulatory consulting firm – has supported MindMed’s MM-120 development approach Greenleaf calls Phase 2b dose-ranging clinical trial an “essential component” to the MM-120 development program – and highlights the risk that skipping to Phase 3 would present: “The ongoing MM-120 Phase 2b trial is designed to address fundamental questions about dose-response, target population, preliminary evidence of efficacy on accepted FDA endpoints for anxiety, and safety that will provide clarity and confidence in designing a Phase 3 program. To initiate Phase 3 trials before these foundational issues have been adequately addressed would substantially increase the chances of a failed trial and/or uninterpretable results.” logo Greenleaf healthJohn Jenkins, MD Principal, Drug and Biological Products Former FDA Director Office of New Drugs (CDER) Sandra Kweder, MD Principal, Drug and Biological Products Former FDA Deputy Director Office of New Drugs (CDER) Brian Corrigan, JD Executive Vice President, Regulatory Policy Further, Greenleaf highlights previous data is not sufficient justification for moving to Phase 3: “the studies from the published literature are not sufficient to support a proposal for streamlining the MM-120 program directly into Phase 3. Such a plan, if presented to the FDA by MindMed would likely trigger a clinical hold.” Independent analysis by former senior FDA officials makes clear that FCM’s suggestion not only lacks a credible basis but would likely halt progress on MM-120’s development 43

UHB Principal Investigator Agrees with MindMed logo MindMed Dr. Matthias Liechti, MindMed’s collaborator at University Hospital Basel – whose investigator-initiated trial FCM itself suggested could be leveraged to skip to Phase 3 – agrees our current plan is the best path forward logo logo I fully support the decision to run another dose-finding study for several reasons. First, the LSD-assist study was an investigator-initiated study and conducted largely in one private practice. Second, the formulation in the LSD-assist (lysergide) is different from MM-120 (lysergide D-tartrate). I agree that the dose-finding study by MindMed is an important and critical step for a solid development plan as it is very important to select the best dose before conducting large phase 3 studies. A dose ranging study also helps increase investigator experience in administering psychedelics as they were unlikely to have been familiar with managing the tolerability and setting aspects for this class of drug. MindMed made the right choice to replicate and expand our findings first before making the final dosing decisions. - Dr. Matthias Liechti logo FCM’s plan to skip to a Phase 3 trial is unrealistic and would lead to value destruction for shareholders 44

FCM Ideas – Slash R&D and Administrative Staffing logo MindMed FCM calls for a “significant” reduction of the R&D Team “Streamline redundant general and administrative employees and the current large R&D teams. FCM believes that the current administrative employees and R&D teams can be reduced significantly…”Reflects a lack of understanding of MindMed’s business and the associated needs for successfully developing drug candidates MindMed has significantly progressed over the past two years and has built an efficient, world-class R&D organization Our R&D team has decades of successful leadership, product development and commercialization experience in the pharmaceutical industry – and we have a conservative number of employees (48) compared to our closest sector peers, which have well over 100 employees We have a total headcount of 48 employees, with the vast majority (69%) dedicated to R&D activities Our headcount is conservative in comparison to peer companies and enables us to efficiently execute our drug development programs MindMed Headcount vs. Similarly Situated Sector Peers1 logo COMPASS 200 150 100 0 logo MindMed 48 MNMD 181 CMPS 119 ATAI G&A R&D FT Employees 45

FCM Ideas –Adopt Additional Compensation Policies logo MindMed FCM calls for blackouts on director and management share sales and utilization of PSUs Adopt director ownership policies, blackouts on director and management share sales until after key milestones are reached and utilize performance-based awards such as performance(preferred) stock-units Overlooks that many of these of policies are already in place or are not applicable to MindMed Current members of executive management and directors have not sold any shares of stock except to satisfy required tax withholding obligations The Company’s policies already impose blackout periods during which insiders are prohibited from trading Director ownership policies are uncommon (only 1 of 20 proxy peer companies maintain such a policy) MindMed’s stock options and restricted stock unit awards are already performance-based; these awards provide value over time directly dependent on share price and, for stock options, only if the share priced appreciates over the long-term Equity awards that vest based on specific performance goals are uncommon (only 3 of the proxy peer companies maintain such a policy); the Company’s Compensation Committee will continue to consider and evaluate granting these types of awards in the future 46

MindMed 01 Executive Summary 02 MindMed is successfully executing to achieve key milestones and deliver value 03 MindMed has world-class leadership and strong corporate governance practices 04 None of FCM’s nominees would be additive to the Board 05 FCM’s ideas are not viable and would expose shareholders to significant risk 06 FCM has not engaged in good faith 07 Conclusion 47

FCM Has Not Engaged in Good Faith logo MindMed Private Engagement AUG 2021 Scott Freeman sent a request to MindMed for a Board seat MAY 6 The Board invited Scott Freeman to submit his resume to be included in the list of possible candidates. MindMed received no response from Scott Freeman AUG 11 FCM issued a public letter to shareholders Despite publicly purporting to represent a group holding over 5% of MindMed’s total outstanding shares, FCM did not file a 13D AUG 22 MEETING #1 FCM discussed with MindMed the FCM Plan but FCM failed to provide meaningful responses when Board members posed follow-up questions and raised concerns of the plan SEPT 8 MEETING #2 MindMed asked FCM for additional details about the FCM Plan, which FCM failed to provide. FCM stated its requirement that Scott Freeman and another individual to be identified by FCM be added to the Board SEPT 13 FCM’s Reddit stated that it is adding to its MindMed position SEPT 22 FCM issued a statement via Reddit which FCM notes was not distributed over the newswire given its “inability to get up at 5am” SEPT 23 MindMed met with FCM during which the company offered a cooperation agreement. Scott Freeman indicated FCM’s resistance to the proposal, noting it did not give FCM sufficient control over strategy and operations. FCM indicated it would consider the proposal and respond SEPT 28 FCM issued public letter to Ms. Vallone 2021 Scott Freeman reiterated entitlement to Board seat, on basis of being one of the largest single shareholders MAY 4 2022 FCM MindMed Co-Founder Dr. Scott Freeman Proposes Value Enhancement Plan About FCM FCM is managed by Dr. Scott Freeman and represents an investment of 5.6% of MindMed's shares outstanding. MindMed received no response from FCM, but that same day, FCM’s Twitter account posted the following, which the Company took to indicate FCM’s rejection FCM MindMed Board is Trippin’… Freeman Capital Mngmt A non-trival portion of today’s volume.We plan to likely continue to add to our position in a non-trival way over the next few days Freeman Capital Mngmt FCM also bought more today! For some reason that may or may not pertain to my inability to get up at 5am, we did not release a press release this morning I wanted to share with you the content – slightlymodified for adaption Reddit. 48

FCM Has Not Engaged in Good Faith (cont.) MindMed OCT 3 Mr. Freeman issued a public letter addressed to Mr. Barrow challenging Mr. Barrow to a “public debate” OCT 13 FCM issued a public letter to Company shareholders addressing Mr. Barrow’s interview with Psychedelic Invest OCT 21–NOV 21 FCM issued a series of public and private letters to the MindMed Board, demanding the termination of Rob Barrow, among other things FCM also posts on Reddit and Twitter OCT 26 FCM sent a letter to Ms. Vallone demanding an investigation of certain allegations set forth in such letter and the resignation of Mr. Barrow NOV 3 FCM issued letter stating that FCM has filed a complaint with the SEC and called for the immediate termination of Mr. Barrow, another MindMed employee and Ms. Brigid Makes, a member of the Board NOV 14 FCM issued a public letter containing allegations of wrongdoing, demanding the Company engage independent counsel to investigate DEC 1 MindMed delivered a letter to FCM demanding that the recipients cease and desist from unlawful conduct, including making or publishing false statements about the Board members MARCH 7 The Board held a meeting and considered the independent review of FCM’s allegations conducted by outside counsel. After discussion, the Board concluded that the FCM Allegations are not supported by credible evidence and that no further action is warranted MARCH 30 Scott Freeman, on behalf of FCM, delivered to MindMed a notice of FCM’s intent to nominate and solicit proxies in favor of four director nominees for election to the Board APR 6 MEETING #4 Mr. Freeman indicated FCM would be willing to settle in exchange for the Company replacing three existing directors with three of FCM’s proposed nominees to the Board, including Scott Freeman Mr. Freeman also indicated that FCM was not currently a record holder of MindMed shares APR 13 FCM rejects the proposal 2022 Freeman Capital Management LLC Capital Freeman Putting the bail in Robert Bailey Barrow SMNMD WHAT GIVES BARROW FEELINGS OF POWER MONEY STATUS SELLING RSU FOR TAX PURPOSES Robert Barrow and MindMed 11:06 PM Oct 25, 2022 r/MindMedInvestorsClub by FreemanCapitalMngmt 7 mo. Ago Barrow Needs to be Recused: FCM Sent a Letter to the Board of Director FreemanCapitalMngmt 21 min. ago Yes, Jake Freeman Exists I look forward to thin-skinned Barrow being laughed out of count if he tries. Oh please barrow beg of thee, let’s get discovery-I’m sure you’d love that so much. Hahahahaha -2 reply share report save follow 2023 MEETING #5After careful review and discussion of FCM’s nominees, the Board had determined that they did not have experience and expertise that would be additive to the Board relative to the Board’s intended slate of directors and that the Board had rejected FCM’s settlement proposal. MindMed suggested a counter-settlement APR 11 49

Our Attempts at a Constructive Solution Have Been Rejected MindMed MindMed’s Offer (Sept 23) Mutually-agreed upon independent director to be nominated for election at the Annual Meeting MindMed management holding a confidential discussion with representatives of FCM to provide FCM with further insights into the Company’s strategy and to address matters raised by FCM FCM’s Counteroffer (Sept 23) FCM sends notice of intent to nominate four directors to the Board (March 30) FCM’s Settlement Proposal (April 6) Company required to replace three existing directors with three of FCM’s proposed nominees to the Board, including Scott Freeman, resulting in FCM designating half of the Board MindMed’s Offer (April 11) Expand the Board to seven members and add a new independent director to be mutually agreed with FCM Enter into a confidentiality agreement with FCM to facilitate discussing the Company’s strategy in more detail and endeavor to incorporate FCM’s feedback, subject to FCM entering into a customary cooperation agreement FCM’s Counteroffer None Freeman Capital Management LLC @capital_freeman After todays meeting with #mnmd No DEAL Release the memes 3:42 Sep 23, 2022 Freeman Capital Management LLC @capital_freeman this is just the beginning Details to come this week. $MNMD MINDMED’S MICKEY MOUSE OFFER TO FCM FCM’S PLANNED RESPONSE 2:57 PM Sep 26, 2022 FCM is proposing a control slate – which is massively disproportionate to its share ownership 50

FCM’s Questionable Conduct and Track Recordlogo FCM does not manage institutional capital and its only other publicly disclosed investment was a meme-stock investment in Bed Bath & Beyond Jake Freeman, the Chief Executive Manager of FCM, is a college student with no credible investment or professional experienceFCM’s campaign has been characterized by unprofessional conduct that should concern shareholdersFCM’s principals and nominees have demonstrated questionable judgment in allowing Jake Freeman to lead the public and private engagement of this campaign Jake Freeman Despite seeking control of the Board, FCM and its principals have not demonstrated they can be trusted to seriously steward shareholders’ interests FCM GMEdd.com Discord Server Post, Note: Link Does Not Return to PostFCM Reddit Post FCM Twitter Post FCM Reddit Post 51

01 Executive Summary logo 02 MindMed is successfully executing to achieve key milestones and deliver value 03 MindMed has world-class leadership and strong corporate governance practices 04 None of FCM’s nominees would be additive to the Board 05 FCM’s ideas are not viable and would expose shareholders to significant risk 06 FCM has not engaged in good faith 07 Conclusion 52

Conclusion - MindMed’s Nominees Are the Right Choice for Shareholders logo MindMed’s strategy is working We are executing a carefully constructed plan and are approaching our first clinical trial data readouts later this year We are well-capitalized and well-positioned to be a leader in the emerging clinical psychedelics industry while addressing multiple areas of massive unmet need in GAD and ADHD While our share price performance has been impacted by industry-wide headwinds, our 63% YTD TSR is ahead of peers and reflects our positive momentum We have the right leadership Our current Board and management team have built the Company as it stands today from the ground up – bringing in individuals with extensive research, development, commercialization, psychiatric and technology expertise Our Board nominees are proven – they have significant experience serving on public company boards and at an executive level in the healthcare/biopharma industry Our management and R&D teams are ideally qualified to help achieve our objectives and reflect the professionalization of MindMed FCM’s nominees are the wrong choice FCM’s nominees do not – individually or collectively – possess relevant expertise or industry backgrounds that would be additive, especially in comparison to the Board’s proposed slate of directors Since Scott Freeman was removed from the Company in 2020, MindMed has significantly evolved and become a completely different company The ideas FCM has proposed lack credibility, are based on faulty assumptions and would expose shareholders to significant risk by creating disruption at a critical time Protect MindMed: Support the Company’s continued progress – not FCM’s attempt to set the Company back 53

Vote the WHITE Universal Proxy Card to Protect MindMed logo PROTECT YOUR INVESTMENT IN MINDMED LOGO Vote MindMed’s WHITE universal proxy card to vote “FOR” MindMed’s six highly qualified nominees, FOR the other proposals recommended by MindMed and WITHHOLD on FCM’s nominees www.ProtectMindMed.com INVESTOR CONTACT MORROW SODALI Michael Verrechia / Eric Kamback MNMD@investor.morrowsodali.com MEDIA CONTACT LONGACRE SQUARE PARTNERS Dan Zacchei / Joe Germani mindmed@longacresquare.com 54

Logo Appendix